February 4, 2025 | 6:49 pm

Table of Contents

Staying compliant with ever-changing tax regulations is crucial to avoid penalties and

ensure long-term success. A small business tax health check thoroughly reviews key financial

items to ensure compliance and minimize tax liabilities.

Conducting a tax health check helps your business avoid risks like overpayments, missing

requirements, or penalties for non-compliance. Fractional CFO experts review your company’s

financial documentation and compliance requirements, ensuring there’s no stone left

unturned.

This article explores the 13 key items typically reviewed during a tax health check and

provides valuable insights for small business owners.

What is a tax health check?

A tax health check is a comprehensive and proactive review of the business’s compliance with

tax regulations. Fractional CFO experts scrutinize your tax and accounting records to

identify errors, discrepancies, or potential liabilities.

Why You Need a Tax Health Check:

How does a tax health check work?

Fractional CFO experts review specific items relevant to your business during a tax health check. Here’s a checklist to help you understand what is typically covered during a tax health check:

Item #1 Financial statements

Financial reports or statements are

not only crucial in assessing your financial health but

also in ensuring tax compliance.

Experts review your income statement, balance sheet, and cash flow statement for the year

and verify that all your transactions are recorded accurately. They also review your books

or documentation and reconcile bank accounts to ensure no

discrepancies or

missing entries.

Even if there’s no tax health check coming up, it’s still a good practice for you to review

your financial statements monthly or quarterly. Doing so helps you quickly spot errors and

prevents issues during audits.

Note that accurate financial statements stem from proper bookkeeping. So, avoid these common

bookkeeping mistakes for a smooth tax health check:

Item #2 Corporate income tax

If your business is a corporation, including a one-person

corporation (OPC), the next thing

experts review is your compliance with the corporate income tax regulations.

First, they verify that you’ve been paying your corporate income taxes, up to 25% of your

taxable income, correctly and on time. Furthermore, they ensure that you already made

adjustments for any allowable deduction or tax-exempt income applicable to your business

before finalizing the financial statements.

Lastly, if your operating expenses exceed your gross income, they check that you’ve declared

the excess a net operating loss. Your business

can carry over this loss and deduct this from

your gross income over the next three years.

Item #3. Withholding taxes

The idea behind withholding taxes is essentially businesses acting as

tax agents or

collectors for the government.

Here are the different types of withholding taxes you should be aware of:

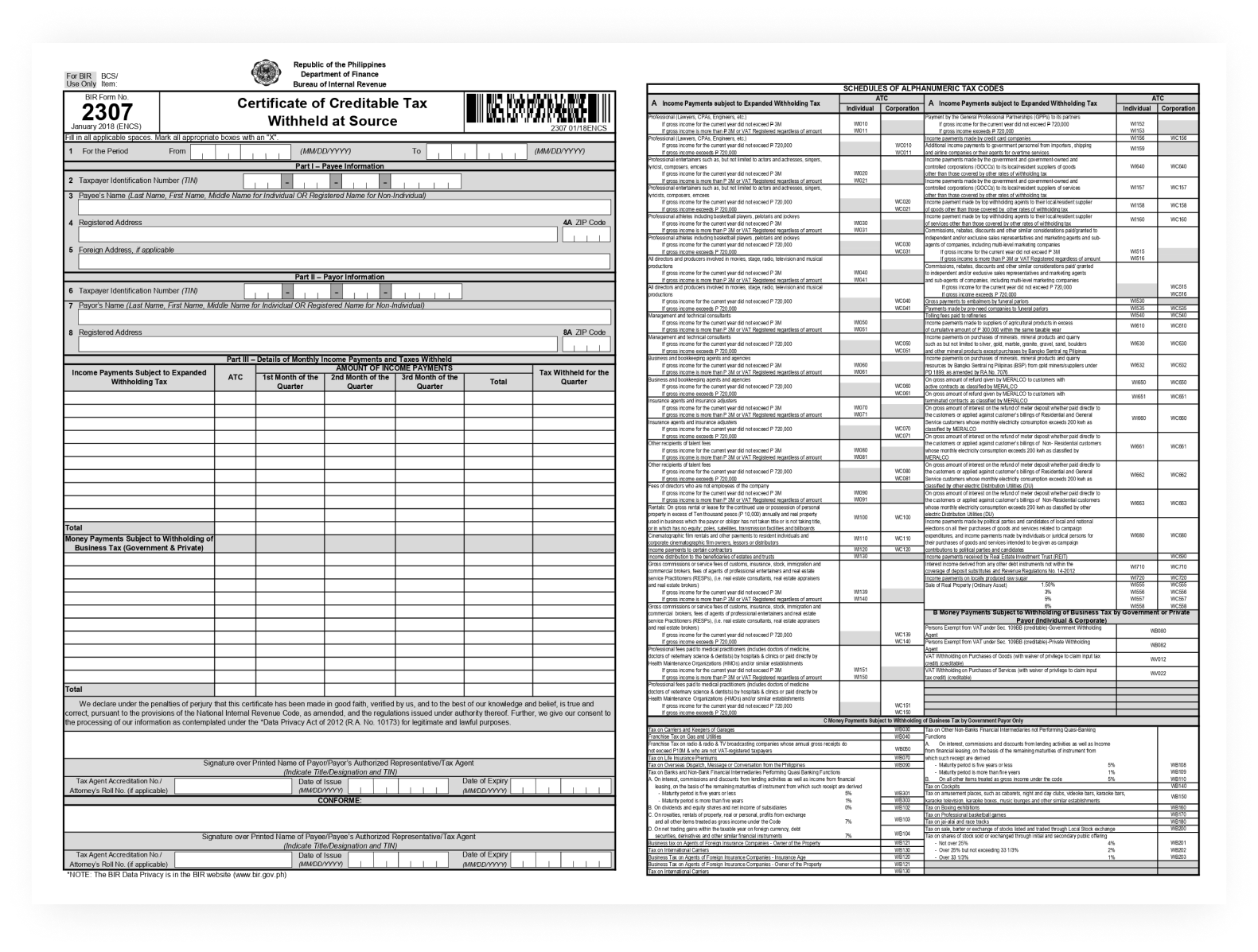

When withholding taxes, experts ensure you apply the correct rates and remit them to the BIR. They also verify if you’ve issued a Certificate of Creditable Tax Withheld at Source or BIR Form 2307 to your suppliers or service providers as proof that you collected their withholding taxes.

Similarly, if another business withheld taxes from you, experts check that you secured the

corresponding BIR Form 2307 to deduct the withheld amount from your total taxable due.

Online sellers must also secure their BIR Form 2307 in line with the new regulation

affecting them. In this new regulation, e-marketplace operators, like Shopee and Lazada, and

digital financial services providers (DSFPs), like GCash and Maya, must collect withholding

taxes from the payments they remit to online sellers.

Read more about the new regulation affecting online sellers, particularly the implications

of withholding tax on online transactions:

Item #4 VAT or percentage tax

If you’re a VAT-registered business, experts verify that you correctly recorded and reported

all input VAT, which is the VAT you paid, and output VAT, which is the VAT you collected.

They also take the time to review the VAT breakdown and other information in your invoices

and official receipts to ensure they align with your VAT returns.

For non-VAT corporations, experts ensure that you apply the correct 3% percentage tax rate

on your gross sales or receipts.

Like other tax types, paying your taxes on time is crucial to avoid penalties.

Item #5 Documentation of expenses

If you want to claim deductible expenses to lower income tax, proper

documentation is highly

important.

Supporting documents such as invoices, receipts, and other supporting documents go through a

test check to reconcile them with the expenses recorded in your books.

In addition, non-deductibles, like retirement

expenses are identified and separated.

To further guide you on proper documentation of expenses and sales, check out this video:

Item #6 Tax incentives and special programs compliance

Businesses registered with the Philippine Economic Zone Authority (PEZA) or Board of

Investments (BOI) can enjoy additional tax incentives, such as income tax holidays, tax

credits on materials, additional tax deductions, and more.

If your business is not yet registered with PEZA, experts can help you check their

eligibility requirements to see if you qualify for

the incentives they offer.

Once registered, tax experts assist you in complying with each government office’s renewal

or reporting obligations to enjoy their

benefits continuously.

Item #7 Ensuring transfer pricing accuracy

Businesses might sometimes engage with a related party within the same corporate group, such

as affiliates or subsidiaries, including cross-border and domestic transactions.

During a tax health check, fractional CFO experts ensure that you follow the arm’s length principle (APL)

implemented by the BIR to prevent the risk of transfer pricing being too

high or too low.

Arm’s length principle essentially means that transfer prices should align with market

standards, similar to what independent or unrelated parties agree upon. Practicing this

principle ensures that related parties do not manipulate prices to avoid or minimize paying

taxes.

For example, a company in the Philippines selling to an overseas subsidiary might be tempted

to set transfer prices below the fair market value to report lower profits and,

consequently, pay lower taxes. By following the APL, these kinds of practices can be

avoided.

Additionally, experts ensure that you complete the transfer pricing requirements,

including

BIR Form No. 1709, transfer pricing documentation, and other supporting documents.

Item #8 Local government requirements

In addition to the taxes imposed by the BIR, local government units collect taxes

and fees

such as business permits, real property taxes, and community taxes. Tax experts ensure your

business has paid these taxes on time to avoid late penalty fees.

As a business, you should also consider the necessary documentation to renew your business permit and other permits

that may be required for your line of business.

Most permits need to be renewed annually, so preparing the required documents in advance is

essential. Some examples are sanitary permits, building permits, fire safety inspection

certificates, and more.

Item #9 Reconcile documentary stamp tax (DST) liabilities

Certain transactions in the country, including loan agreements, leases, and share transfers,

are subject to documentary stamp tax (DST), much

like a fee you pay for “stamping” or making

these transactions official.

Experts review all your business contracts and legal documents to identify which are subject

to DST. For applicable transactions, they ensure that you or the other party involved has

paid the DST and filed the appropriate BIR Form No. 2000 form.

Item #10 Employee benefits and compensation

Businesses must withhold taxes on their employees’ compensation. Tax experts review your

payroll and confirm that you collected the right amount of withholding taxes and

contributions to benefits like SSS, Pag-IBIG, and PhilHealth.

Another thing businesses should note is that bonuses, including 13th-month pay, up to

₱90,000 are income tax-free.

However, if the total amount exceeds this threshold, any excess

is subject to income tax and should be withheld.

Businesses are also liable for fringe benefits tax for all

non-taxable benefits they give to

managerial and supervisory employees. Examples are benefits for housing, vehicles, travel,

and more. Tax compliance for these benefits, including calculation and payment, is

thoroughly reviewed through a tax health check.

Item #11 Year-end audits

Another way to properly review your business’s financial and tax compliance is by conducting

an internal year-end audit. This audit will help pinpoint any inconsistencies in your

financial documents, tax returns, and other critical processes that relate to taxation.

Conducting this audit ensures you can spot and correct errors before external auditors or

the BIR conduct their assessments.

Here is a guide on how to prepare for a year-end audit:

Furthermore, for SMEs with previous audit reports, a tax health check ensures all

recommendations have been fully addressed. This is crucial, especially with the upcoming tax

season, since any unresolved findings can be scrutinized further by the BIR and result in

hefty penalties.

If you still have audit findings pending implementation, be sure to watch this informative

video. Fractional CFOs in this video guide you through practical steps for leveraging audit

reports for your business growth.

Item #12 Pending BIR assessments

If your business has any pending BIR assessments or audit findings, tax experts help fix and

address them immediately. Prolonging or delaying these findings can result in escalations

and possibly hefty fines from the agency.

Through a tax health check, findings are individually reviewed, supporting evidence for your

case is gathered, and disputes are resolved.

In addition, small businesses can have provisions for outstanding tax exposures to lessen

the impact on year-end financials.

Item #13 Year-end Filings and Reports

To prepare your business for a fresh start of the year, tax health checks ensure you

complete all required year-end filings.

Some of these requirements are:

Tax experts also review all information in your reports before submitting them to avoid discrepancies and ensure you submit them on or before the deadline.

Tax Health Check: A Must-Have for Small Business Success

A Tax Health Check is crucial in ensuring your small business is tax compliant. It helps

identify and address potential tax issues, minimize risks, and optimize your tax strategy

for long-term success.

However, conducting a comprehensive review of all these tax areas isn’t a task you can do

alone – you need experienced tax experts to guide you and ensure you don’t miss anything.

Fortunately, OneCFO is just right here!

At OneCFO, we understand the unique challenges faced by small businesses. Our fractional

CFOs leverage their expertise to provide a thorough tax health check, going beyond a simple

checklist.

We'll not only identify potential tax savings and minimize liabilities, but also ensure

you're fully compliant with regulations. With OneCFO, you can rest assured that all risks

are spotted, issues resolved, and your tax stress is a thing of the past.

Visit us at onecfoph.co or email us at [email protected] to

discover how our fractional CFO

expertise can help you start your tax health check and set your business on the path to

long-term success.

Read our disclaimer here.