June 20, 2024 | 2:00 pm

Table of Contents

The Bureau of Internal Revenue (BIR) has implemented a new withholding tax rule that impacts

online sellers. This ruling affects how online sellers receive their earnings for goods and

services sold and paid through online platforms and facilities.

A one percent withholding tax will be applied to the gross remittances made by e-market

operators and digital financial services providers (DFSPs) to online sellers.

This BIR new ruling on online sellers officially took effect on January 11, 2024, and

supports the agency's efforts toward a more efficient and fair tax administration. This

initiative also helps the government take advantage of the country's growing e-commerce and

online business industries.

With this new withholding tax rule, all businesses involved with online marketplaces and

digital financial services must understand the regulation to ensure smooth operations and

compliance with the BIR.

Read on to learn how this withholding tax works and how it could affect you as in online

seller.

What is the BIR withholding tax rule for online sellers?

Last December 21, 2023, BIR issued Revenue Regulations No. 16-2023 (RR

No. 16-2023),

imposing a one percent withholding tax (WHT) on half of the gross remittances that

e-marketplace operators and digital financial services providers (DFSPs) pay to online

sellers or partner merchants.

Gross remittances refer to the money an e-marketplace operator or DFSP receives from buyers

through a platform or a payment facility, such as e-wallets or banks, which is then paid to

online sellers.

Meanwhile, sales returns or discounts, shipping costs, value-added tax (VAT), and any fees

related to platform usage are excluded from gross remittances.

In addition to online sellers, the withholding tax rule applies to other businesses using

DFSPs or offering online payment methods, including websites and even physical stores that

allow digital money transmissions (i.e., e-wallets and online banking).

Is the withholding tax rule a new tax for online businesses?

Contrary to what entrepreneurs might think, this withholding tax is not a new or additional

tax burden to sellers. Instead, WHT is just a way for the BIR to

collect your existing

income taxes in advance, including income from online sales.

In the current tax scheme, businesses designated by BIR as Top Withholding Agents (TWA)

already collect WHT on all regular suppliers' purchases. Simply put, the recent RR No.

16-2023 merely ensures the inclusion of online businesses and the usage of digital platforms

in the same withholding tax system.

Businesses should also know that the tax withheld from the business is creditable against

their income tax liability. In short, WHT is a way for you to pay your income tax dues bit

by bit through every sale instead of paying a large sum of taxes every quarter-end.

Since WHT is essentially just an advanced tax collection, online sellers do not need to

increase their prices to cover it. However, some sellers may mistakenly perceive WHT as an

additional cost and pass this burden on to their customers by raising prices.

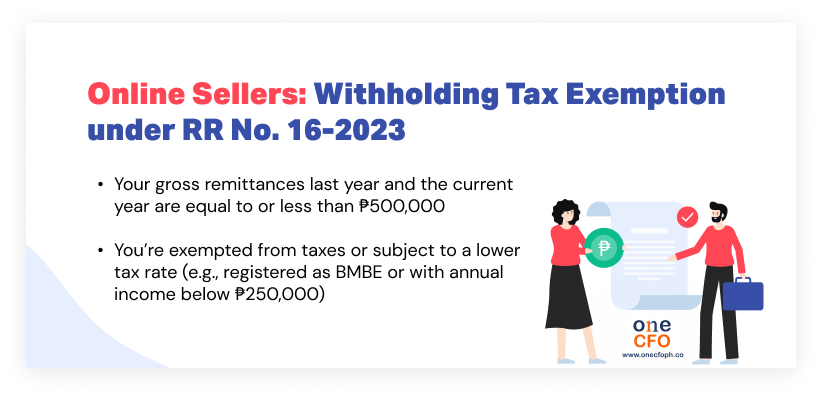

Who is exempt from paying withholding tax?

Your digital or online business may still be exempted from this withholding tax rule under the following conditions:

How does the 1% withholding tax work for online transactions?

When the gross remittances to your online business exceed the ₱500,000 limit, the

e-marketplace operator or DFSP now must withhold a one percent tax on half of the gross

remittances.

The computation of withholding taxes depends on whether the business is subject to VAT or is

exempt. Here are examples of how to compute withholding taxes:

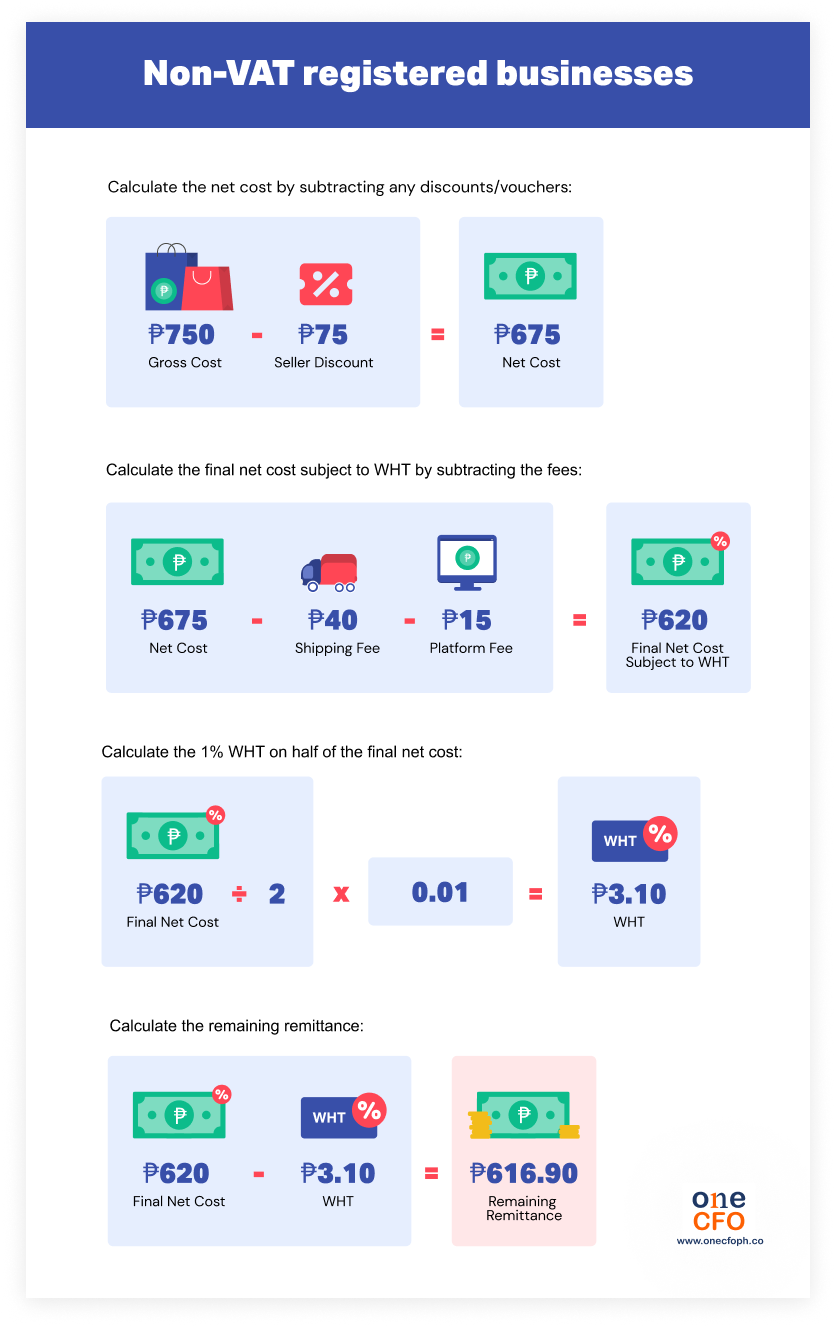

Non-VAT registered businesses

In this example, the marketplace operator or DFSP will withhold ₱3.10 from the business, leaving P616.90 for remittance to the seller.

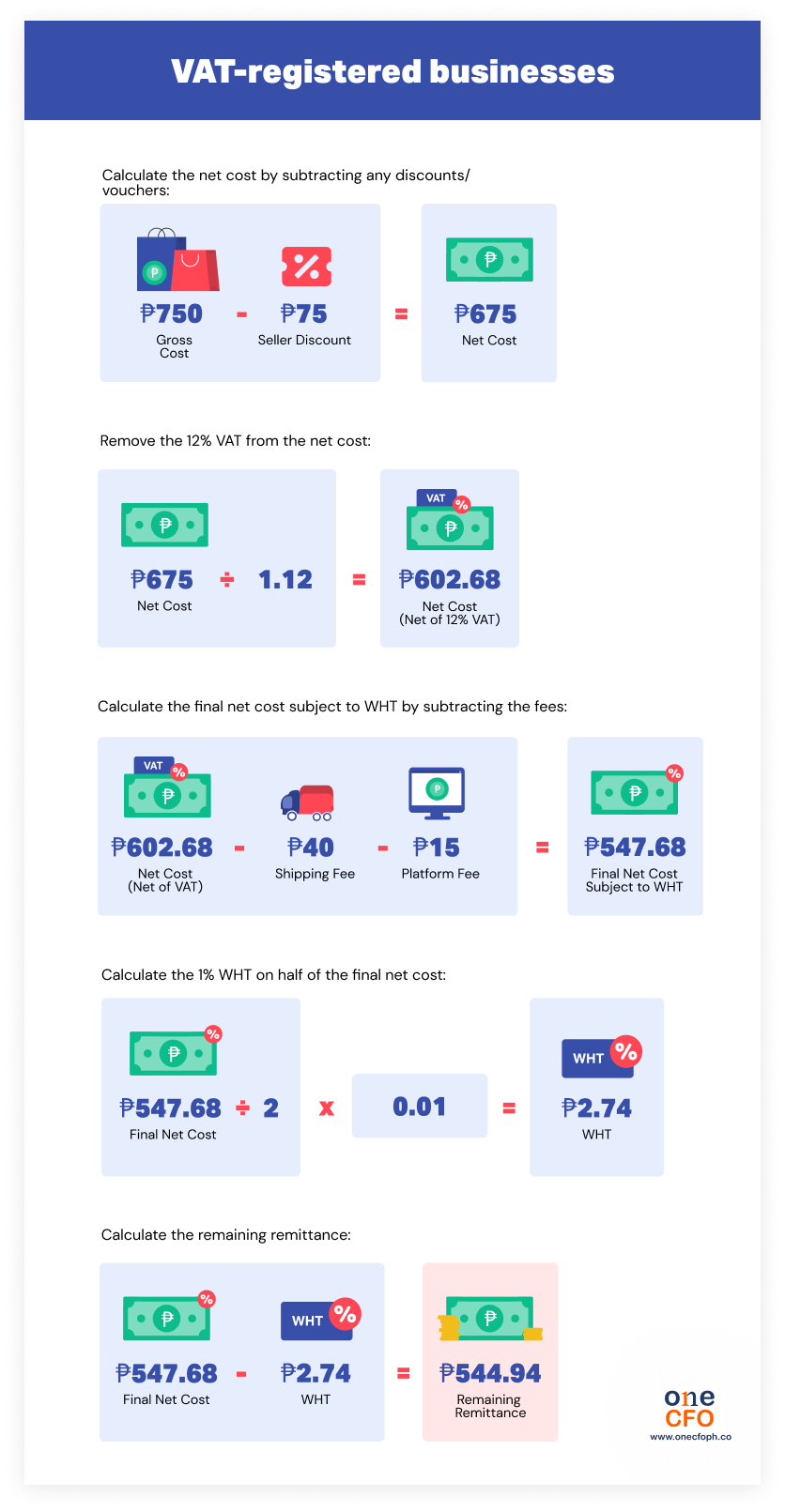

VAT registered businesses

From this example, the marketplace operator or DFSP will withhold ₱2.74 from the business, leaving ₱544.94 for the remittance to the seller, exclusive of VAT.

When is the compliance deadline for online sellers under the withholding tax rule?

After the issuance date of the new RR No. 16-2023, e-marketplace operators and DFSPs have

until July 14, 2024, to adjust and make changes concerning the new tax rule.

These changes include collecting the necessary documents from their partner merchants and

creating internal systems to ensure full compliance with the regulation.

Similarly, online sellers or businesses using digital platforms must comply with the

registration and reporting requirements stated in RR No. 16-2023 before the deadline window

ends.

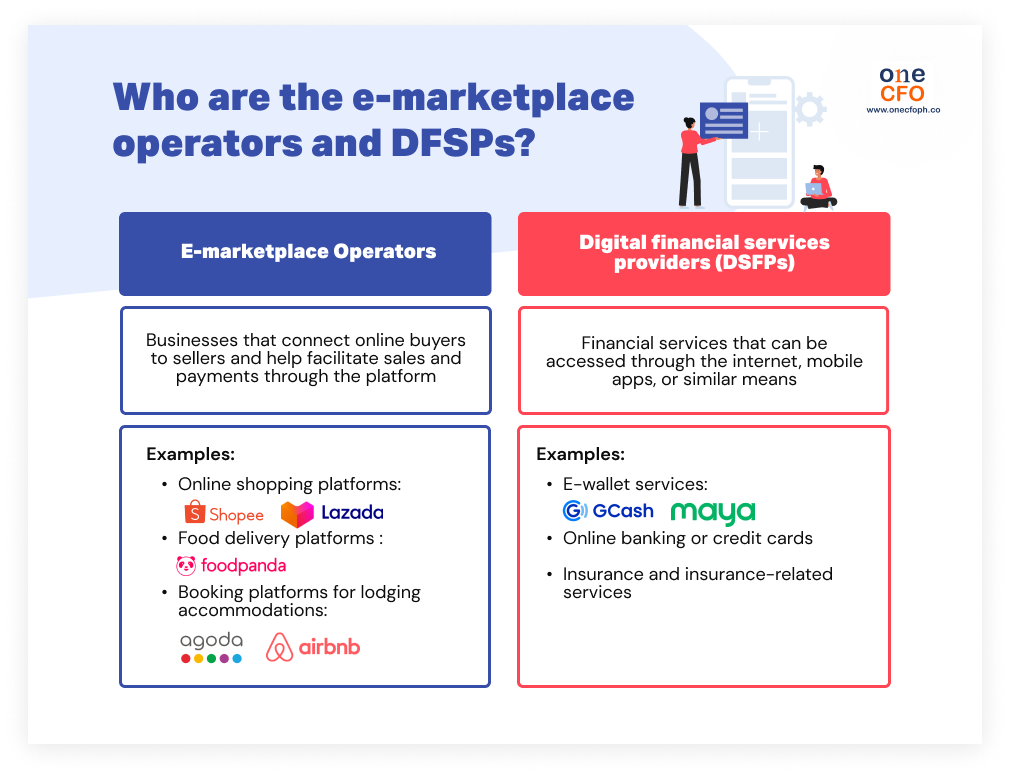

Who are the e-marketplace operators and DFSPs?

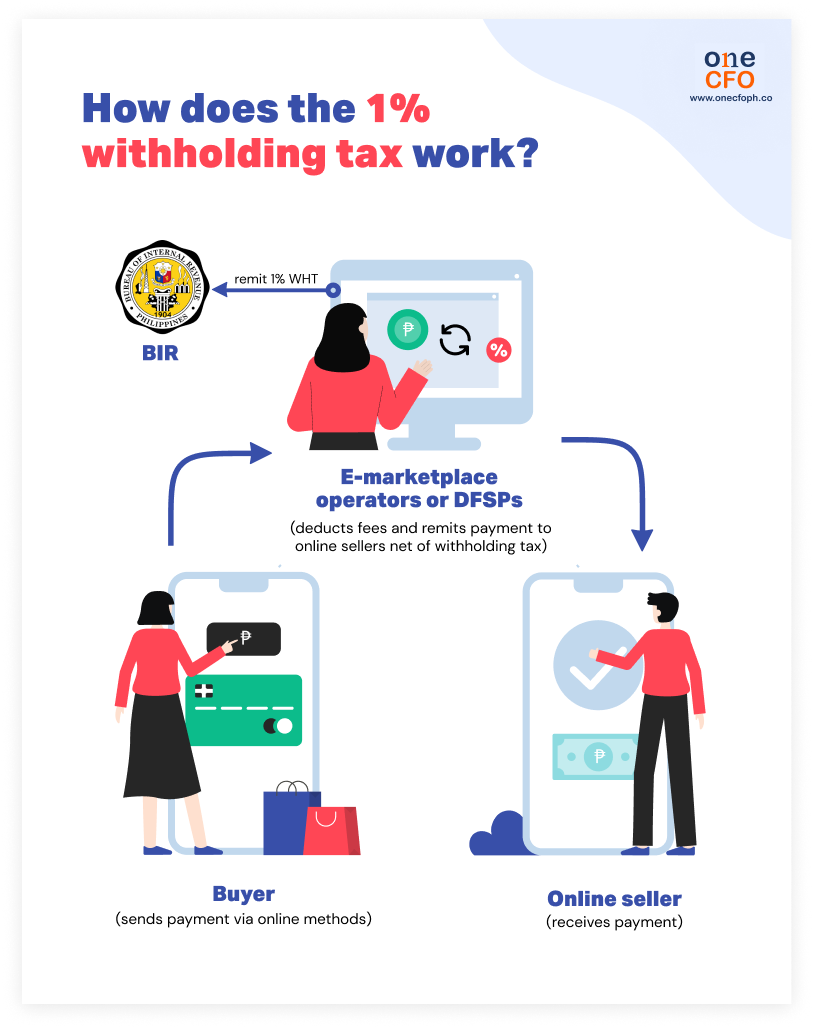

E-marketplace operators and digital financial services providers (DFSPs) must withhold one percent tax on half of the gross remittances. But who are these parties involved?

According to the BIR regulation, e-marketplace operators connect online buyers to sellers, facilitate and conclude sales, process payments through the platform, and provide logistics or post-purchase support. Some of these e-marketplace operators are:

On the other hand, DFSPs refer to financial technology provided by digital service providers accessed through the internet, mobile apps, or similar means. DFSP services include:

What are the obligations of e-marketplace operators and DFSPs?

E-marketplace operators and DFSPs should track seller payments, deduct any necessary fees, and withhold the one percent tax before giving the remaining money to the sellers. The operators and DFSPs then remit the WHT to the BIR.

Sometimes, the buyer uses a certain DFSP to hold their money (Issuer) and sends the payment to a different provider (Acquirer). In this case, the Acquirer should withhold the taxes for the transaction since they remit the money to the seller. For example, if a buyer uses an e-wallet to send payment to the store’s bank account, the bank is liable for collecting the WHT.

What documents do e-marketplace operators and DSFPs need from online sellers?

Apart from withholding taxes, the e-marketplace operators and DFSPs must also secure documents from online sellers, ensuring they’re BIR-registered and confirming if RR No. 16-2023 covers them. These requirements are:

Once a seller is registered with the platform, the operator or DFSP can start collecting WHT when one of the following conditions are met:

Lastly, e-marketplace operators and DFSPs must provide BIR Form 2307 to the sellers as proof of tax withholding.

Are all online sellers required to register in the BIR?

Since the pandemic, more Filipinos have started online businesses through social media

accounts or e-commerce platforms like Shopee or Lazada.

Because online businesses are still relatively new in the Philippines, the government is

strengthening regulations to cover them. Despite this, many online merchants mistakenly

believe they are not required to pay withholding tax or any tax for that matter.

However, just like any traditional brick-and-mortar enterprise, online sellers must still

comply with the legal requirements of running a

business. More importantly, these sellers

still need to pay taxes on their income, just like any other business

owner

Therefore, as an online seller, you must register your business with the BIR and provide a

copy of the COR to the e-marketplace operator or DFSP before using their platform. If

applicable, also submit a certification showing eligibility for tax exemption or a lower tax

rate to avoid paying the WHT.

What other requirements do sellers need to sell online?

Aside from the proof of tax registration, sellers should submit the following to the e-marketplace operators or DSFPs:

It’s crucial to note that the ₱500,000 limit on remittances applies to the same business tax entity, meaning that if you have several

shops under one tax entity or BIR-registered trade

name, these shops will share the same ₱500,000 threshold.

Finally, remember to secure your BIR Form 2307 or withholding tax certificate to claim your

withholding tax credits and lower your remaining tax dues.

Watch this video for more insights on how to minimize tax liability:

Tips to improve online selling experience

In addition to complying with legal obligations, online sellers must ensure a smooth and

secure shopping experience for their customers.

Here are some tips to build trust and a thriving online presence:

Get expert guidance for tax compliance

Imposing the one percent withholding tax on online sellers is a big step toward modern

taxation in the Philippines. This measure not only includes the rapidly growing online

market but also simplifies tax collection through a more streamlined process.

With the continuous growth of the digital and online economy, businesses, e-marketplace

operators, and DFSPs must adapt to regulation changes and ensure compliance.

If you need more guidance on how the new withholding tax rule affects your online business

or want to stay on top of regulation changes, don’t hesitate to ask tax pros like OneCFO for

help!

With OneCFO, you’ll

get access to world-class, CFO-level financial insights perfect for all

your tax planning needs at an affordable cost.

In addition to keeping your business informed about evolving tax regulations, OneCFO’s team

of experts will assist you in developing tailored strategies to seamlessly adapt to these

changes, enabling you to capitalize on potential benefits while maintaining compliance.

Visit us at onecfoph.co or reach out to us at [email protected] to

discover how our outsourced CFO services can

empower your business to adapt and thrive in the face of tax changes.

Read our disclaimer here.