January 30, 2024 | 1:02 pm

Owning a small business is a dream many have - a chance to build a legacy and call the

shots. However, starting a business entails legal requirements, paving the way for a

successful and legitimate business operation.

The legal requirements and processes in starting a business are essential in establishing

credibility in your venture. Moreover, compliance helps you avoid legal challenges that

could disrupt your operations.

Some legalities every small business owner should know include choosing the proper business

structure, following registration protocols, filing taxes, and being aware of employment

laws.

Know the legal requirements, so you won’t have to navigate the business world in the dark

and avoid legal issues.

What are the legal requirements to start a small business?

Starting a business doesn’t only involve you and your customers but also the government and its regulations. Here are the different legal requirements to know when establishing a small business:

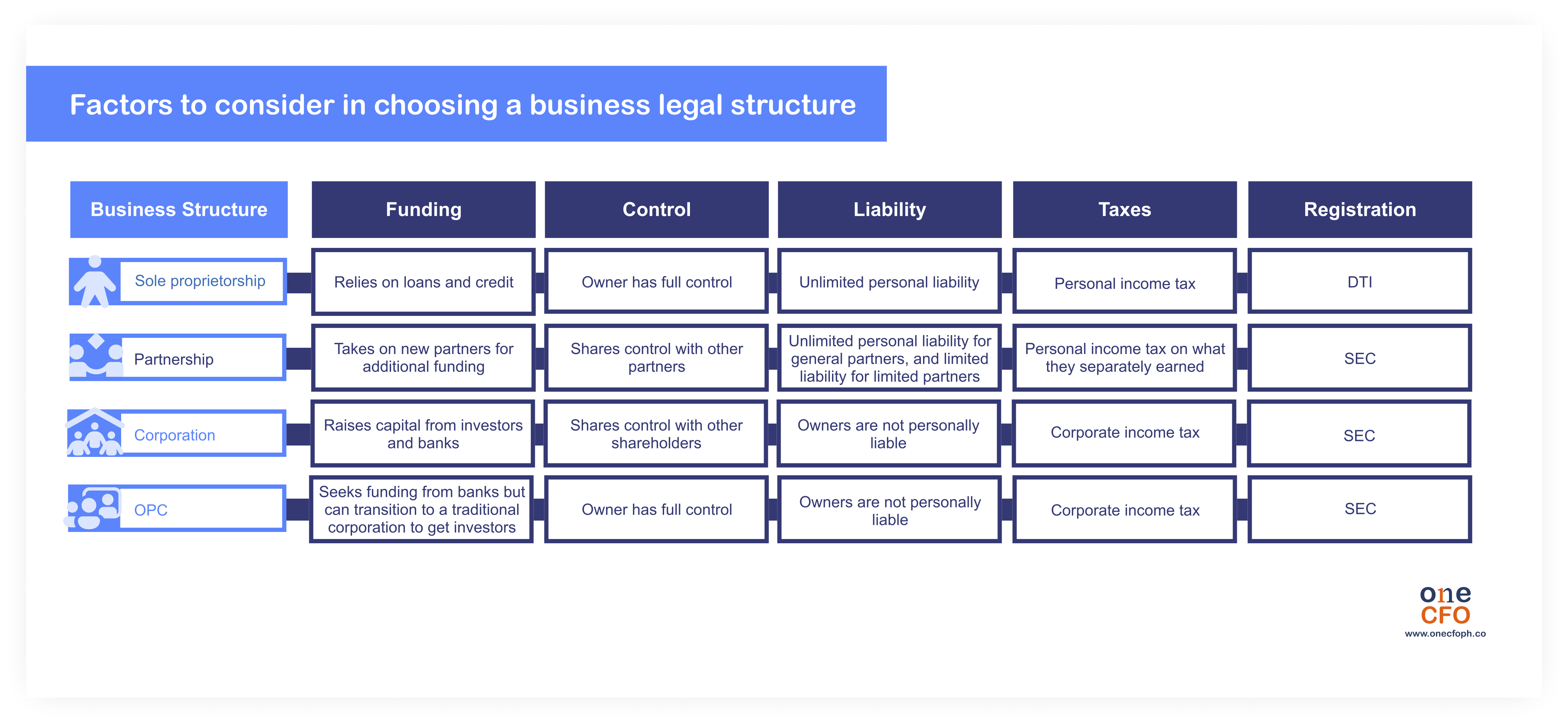

Business Structure

The first legal requirement is choosing the right business structure or entity for your

company. Business structures dictate your business ownership, registration requirements, and

tax obligations, so choose the best fit for your needs.

In the Philippines, there are four types of business structures to choose from:

Sole proprietorship

This business entity is the most common in the Philippines since it’s simple to set up.

There is only one owner in sole proprietorships, making it the go-to option for

many

micro-business owners and solopreneurs.

Sole proprietors enjoy complete business ownership and usually take all the profit.

However, they also bear unlimited liability to the business, which means the

government or

financial institutions can seize their assets in case of unpaid debts or losses.

Partnership

A partnership is a good option if you want to share the

ownership and responsibilities with

another person or more.

One kind of partnership is called a general partnership, where all partners share equal

responsibilities and profits but have unlimited liability to the business.

On the other hand, you can establish a limited partnership, where there’s at least one

general partner and one or more limited partners. General partners keep more profits but

bear more liability. Meanwhile, limited partners make less profit and are only liable for

the amount of their investment.

Corporation

A corporation is a business entity

with two or more incorporators or shareholders. The

total, though, should be at most 15 persons.

Even though a corporation is complex to set up, many businesses still choose this entity

because of its limited liability protection to the shareholders and their assets.

Incorporating the business also allows owners to raise funds from investors by giving out

shares or portions of the company’s equity.

One-person corporation

Another business structure option is the one-person corporation (OPC),

combining the best

features of a sole proprietorship and corporation.

An OPC is a corporation with a single stockholder who wholly owns the business and has

limited liability.

However, registering an OPC can be a complex task for solopreneurs compared to registering

as a sole proprietor. For one, a requirement for OPC is to submit Articles of Incorporation.

Moreover, according to the Revised Corporation Code,

professionals and financial

institutions cannot register as OPCs.

Learn more about the legal business structure options in this video:

Business registration

After choosing a business entity, it’s time to register your business, which also comes with

the necessary fees.

Sole proprietorships should register their unique business name with the Department of Trade

and Industry (DTI), valid for five years.

On the other hand, partnerships and corporations are to register with the Securities and

Exchange Commission.

The SEC’s legal requirements may vary depending on the registered business entity type -

stock corporation, non-stock corporation, or partnership. But in general, one needs to

submit articles of incorporation, by-laws, treasurer’s affidavit, and proof of deposit of

the paid-up capital.

Business permits

After the business registration, businesses should process licenses and permits required by

the local government unit (LGU). The usual permits that LGU looks for in businesses are

barangay clearance and a Mayor’s permit, also known as a business permit.

The requirements for acquiring a barangay clearance depend on the local barangay your

business is registered. Similarly, businesses should get their mayor’s permit from the city

or municipal hall where the company operates.

Do note that business permits must be renewed on or before the 20th of January each year.

Other necessary permits depending on the nature of your business

Depending on the nature of the business, entrepreneurs may need to process additional

permits to follow local regulations. These permits are usually related to zoning, land use,

health, and safety regulations.

Some examples of additional permits you may need are:

There are also industry-specific permits you may need depending on the business. For

example, food-related companies must register and comply with the Food and

Drug Administration (FDA).

Additionally, the Department of Tourism must certify tourism-related establishments

before

getting permits from the LGU.

For a complete list of requirements, it’s best to research and consult with your LGU or

consultants who can help with your business registration.

What is the BIR Certificate of Registration

In the Philippines, the Certificate of Registration, also known as BIR Form

2303, is a vital

document that grants legal permission to run your business.

Business owners should register their business with the BIR to get a Tax

Identification

Number (TIN) and have the BIR stamp their books of account.

If the business owner has an existing TIN from being an employee, they need to update its

status to proceed with the registration.

To ease the cost of business registration, as of January 22, 2024, the BIR has ceased the

collection of the annual registration fee of P500 in compliance with the Ease of Paying Taxes Act, or the

Republic Act No. 11976.

Taxes

As always, paying taxes is part of the legal requirements of starting and running a business. Here are the usual business taxes you should note as a business owner:

Income tax

The income tax a business pays also depends on its business structure.

When filing for personal income tax, sole

proprietors can choose between these two options:

The partners in partnerships are also liable for personal income tax on the money they earn

from the company.

Conversely, corporations are liable for their graduated tax rates of up to 25%.

Corporations

can take advantage of tax deductions and save more money

to lower their tax liability.

Click the play button to get insights on how to take advantage of tax deductions for your

small business:

Value-added tax

Businesses with gross sales or receipts of more than ₱3,000,000 must register for

value-added tax

(VAT). The VAT rate is 12% of the gross sales, which businesses can file

quarterly or monthly to the BIR.

It’s also important to remember that businesses opting for monthly VAT payments should

submit their quarterly VAT return form within 25 days after the closing of each taxable

quarter.

Payroll tax

If the business has salaried employees, the company must withhold payroll taxes from their

staff. Withholding taxes for employment purposes means employers automatically collect

employees' income taxes from their salaries and remit them to the government.

The amount of payroll taxes to withhold is also based on the graduated tax rates given by

the BIR.

Local government tax

Aside from the national taxes you pay, the LGU might also collect local taxes from your

company.

Real property tax (RPT) is a local

tax corporations should pay on lands, buildings, and

machinery they own or use. The real property tax rate is 1% of the property’s assessed value

for provinces and 2% for cities and municipalities within the Metro Manila area.

Corporations can also pay RPT annually on or before January 31 or quarterly.

Another local tax all businesses need to pay is local business tax (LBT). The amount

of LBT

to pay depends on the locality.

Like RPT, businesses can pay the LBT annually on or before January 20 or every quarter.

Business contracts

Any business, as long as there’s a trade of goods or services for a fee, needs legal

business contracts. A business contract is a promise or set of promises that are enforceable

by the law.

The main goal of a business contract is to protect all the parties involved and ensure that

everyone will follow through on the agreement.

Some of the most common business contracts are the following:

Supply agreement

When dealing with suppliers, a business needs a supply agreement to set the terms and

conditions of their relationship. This contract outlines necessary details like payment

terms, delivery schedules, pricing, product quality, etc.

A contract agreeable to the business and suppliers can foster a better partnership as the

business grows.

General employment contract

A general employment contract between the employer and employee or a labor union is legal.

Similar to the supply agreement, this contract defines the rights and responsibilities of

each party, including the salary terms, contract duration, general duties, benefits, and

more.

Some companies also include a non-compete clause in the employment contract, which

prohibits

the employee from joining a competitor’s company after the employment ends.

Non-disclosure agreement

Businesses use a non-disclosure agreement (NDA) to protect sensitive information or trade secrets. This contract establishes confidentiality between the parties and prohibits them from disclosing unauthorized or sensitive information.

Intellectual property

Aside from registering a business name, companies can also trademark their business name,

logos, slogans, and other assets at the Intellectual Property Office (IPO).

The primary purpose of a trademark is to provide exclusive rights to the business and

prevent others from copying or using their assets without permission.

The trademark process can take six to 18 months since the IPO must examine the application

and publish it to its e-gazette. If no one opposes the trademark application after

publishing it, the IPO will give the applicant their Certificate of Registration.

Applying for a trademark also comes with its fees. While this is not a requirement,

trademarks can be investments as you establish the business and build its unique identity.

Employment laws

When hiring employees, businesses must be aware of the Labor Code mandated by the

Department

of Labor and Employment (DOLE). Studying the Labor Code or consulting an expert in labor

laws helps the business stay compliant and avoid legal issues with its employees.

The Labor Code outlines all necessary provisions in hiring and terminating employees, their

working conditions, and benefits.

What are the mandatory employee benefits?

The Labor Code highlights the mandatory benefits companies should

provide, including Social

Security System (SSS), PhilHealth, Pag-IBIG Fund, and 13th-month pay.

SSS, PhilHealth, and Pag-IBIG are government-owned and controlled corporations providing

employees with social security, healthcare, and housing program benefits. All businesses

need to register with these government agencies and remit the employees' monthly

contributions and the company's share for their employee's benefit.

The 13th-month pay is another mandatory

benefit, where companies give employees an extra

month's worth of income by Christmas Eve or in bi-annual installments.

Employers must also submit a compliance report to DOLE by mid-January to prove they gave the

mandatory bonus.

Take the leap and start a small business legally

Starting a small business can be fulfilling, but you must navigate legal hoops before

establishing one. Complying with the different legal requirements helps your company avoid

future issues and create a safe environment for your employees and customers.

If you need advice or assistance starting your small business, OneCFO will guide you!

The team of finance experts at OneCFO can help business owners like you decide what’s best

for your business financially - such as choosing the right structure, maximizing tax

benefits, and more.

Visit us at

onecfoph.co or

contact us at [email protected] to learn how we can help with

your small business registration.

Read our disclaimer here.