October 23, 2023 | 12:37 am

Efficiency becomes the name of the game when running a small business. Aside from managing

their time well, entrepreneurs should make their business processes, such as managing books

of accounts, more efficient.

Keeping books of accounts is not only a good practice when bookkeeping but also part of

business compliance with the Bureau of Internal Revenue (BIR). But what exactly are books of

accounts, and how do businesses maintain them?

The books of accounts serve as a business’s official record of all its financial

transactions and operations. With these books, a business can get an overview of its cash

flow or how much money comes in and out of the company.

Additionally, recording financial transactions is essential in creating financial statements

and business decisions. Entrepreneurs also use their books to determine how much they owe

the government for taxes.

A business can choose from three types of books of accounts: manual, loose-leaf, and

computerized. Each of these types has its advantages and disadvantages, as well as

requirements for registration. This guide will discuss each type of book of accounts to help

small business owners like you decide which to use best.

Is keeping books of accounts required in the Philippines?

Bookkeeping is necessary for all companies, regardless of type or size. But did you know

that aside from helping you track your financial health, keeping books is also required by

the BIR?

According to Section 232 of the Tax Code:

“232.A. Corporations, Companies, Partnerships or Persons Required to Keep Books of Accounts.

- All corporations, companies, partnerships or persons required by law to pay internal

revenue taxes shall keep and use relevant and appropriate set of bookkeeping records duly

authorized by the Secretary of Finance wherein all transactions and results of operations

are shown and from which all taxes due the Government may readily and accurately be

ascertained and determined any time of the year.”

In other words, the government requires all businesses to register their books and record

all financial transactions. Each financial transaction entry should also have a supporting

document, such as receipts, invoices, vouchers, etc.

As a business owner, it is your job to ensure the accuracy of your books, especially since

they dictate how much taxes you need to pay. Failure to register, maintain, and submit the

business’s books of accounts can result in fines ranging from ₱1,000 to ₱50,000 or even

imprisonment for fraud and tax evasion.

What types of books can I register?

The BIR recognizes three types of books of accounts that businesses can use for their

bookkeeping: manual, loose-leaf, and computerized.

How the business owner registers and maintains their books also depends on the type they

choose, so they should carefully assess which would fit their business’s needs. The company

should also consider whether they prefer manual or automated bookkeeping when

selecting

their books.

In any case, a business’s books of accounts should include a

journal, general ledger, cash

receipts book, and cash disbursement book. However, if the business’s sales exceed

₱3,000,000, they should register for value-added tax (VAT) and add a subsidiary sales

journal and subsidiary purchases journal to their books.

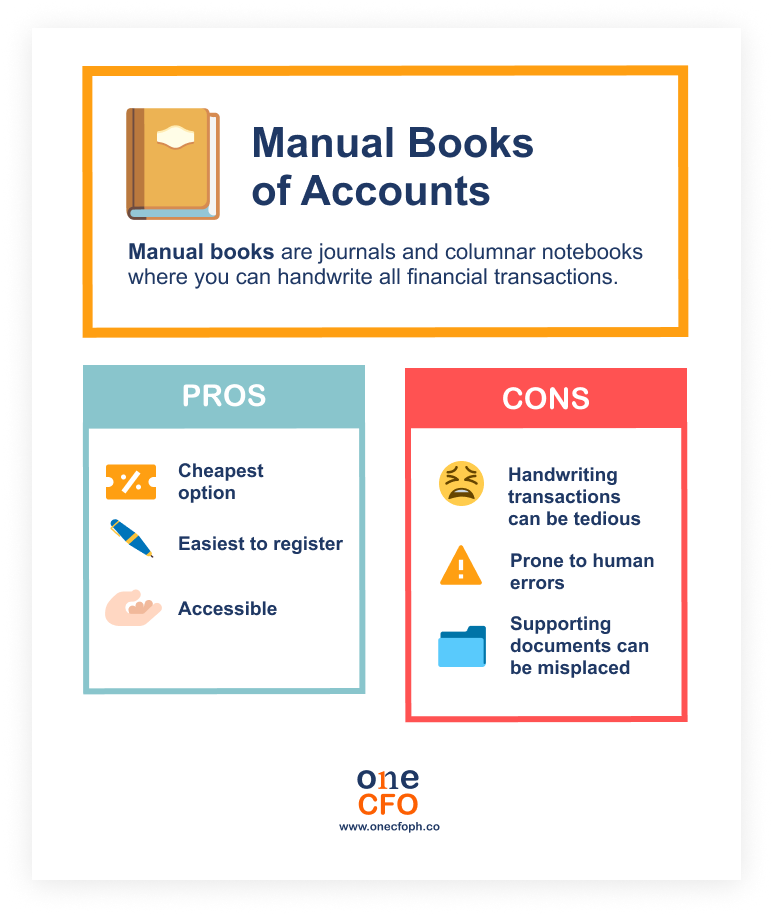

Manual books of accounts

The pre-printed paper journals, ledgers, and columnar notebooks you can buy in bookstores

and office supply stores all refer to traditional or manual books of accounts.

Using manual books does not involve any computer program or software. Instead, the business

owner or bookkeeper records all financial transactions handwritten.

New businesses should register their manual books when they receive their Certificate of Registration (COR)

from the BIR. If they can’t, they can still register their books before

their first quarterly tax payment deadline or annual income tax return, whichever is

earlier.

There is also no need to register new manual books every year. A business owner should only

register new books once they finished or consumed their current books’ pages.

What are the advantages of using manual books?

Manual books are prevalent among freelancers, solopreneurs, and small business owners since

they are the cheapest and most accessible option. These businesses typically have a low

volume of daily transactions, so they don’t worry too much about recording them all

manually.

Aside from being a cheap option, many small business owners prefer using manual books

because they’re the easiest to register with the BIR. No additional permit is needed, and

the business owner must only fill out a form and bring the books to be written and stamped.

What are the disadvantages of using manual books?

Using manual books while business is still slow or early is a good and affordable option.

However, as the business grows and gains traction, handwriting all transactions can become

tedious and time-consuming. Instead of using your time to work on business strategies, you

might spend hours just writing every financial transaction.

Additionally, manual bookkeeping or recording is more prone to human error, affecting the

accuracy of your books. Even a tiny mistake like misplacing a decimal point or writing a

digit wrong will skew your records and might even cause penalties.

Keeping your books as accurate as possible is also crucial in making financial decisions for

the company.

It can also be challenging for businesses to keep supporting documents like receipts when

they use manual books. Since they do everything by hand, they usually don’t create backups

of such documents, increasing the chances of misplacing or losing them.

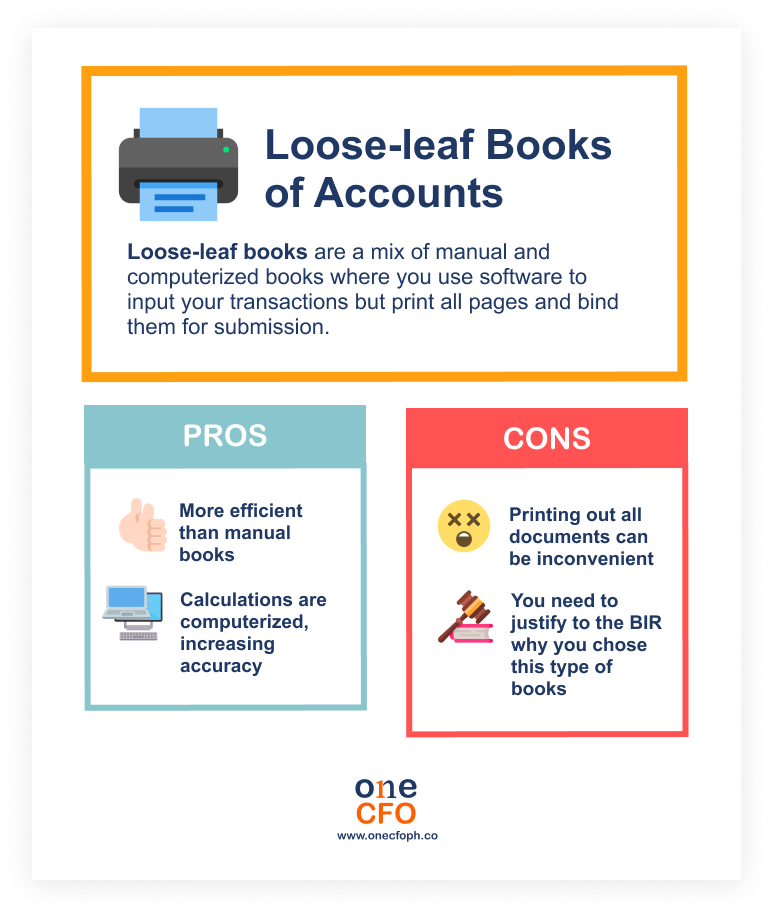

Loose-leaf books of accounts

Using loose-leaf books of accounts combines the aspects of

manual books and computerized

books. Here, the business owner or bookkeeper records the transactions by manually encoding

them on a worksheet or computer software instead of handwriting. They will then print out

the encoded transactions, bind them, and submit them to the BIR for registration.

Choosing loose-leaf books will require you to justify why you prefer this method. There is

also a need to present sample print-outs to the BIR to get a formal permit allowing the

business to use loose-leaf books.

Once a company secures the permit to use loose-leaf books, they will need to submit and

register the bound copies to the BIR, along with the supporting documents, 15 days after the

end of the taxable year or within 15 days from the closure of the business, whichever is

earlier.

What are the advantages of loose-leaf books?

Loose-leaf books are more efficient than manual books since typing in entries on a computer

is much faster than handwriting them.

Additionally, spotting and correcting mistakes is easier because of the computer’s built-in

functions. Some examples of programs businesses can use for their loose-leaf books are

Microsoft Excel, Google Sheets, or even software like Xero.

What are the disadvantages of loose-leaf books?

On the other hand, it can still be cumbersome to consistently print out and bind all the

encoded transactions from the software. Depending on the amount of transactions a business

has, printing them out can easily cost a lot of money.

Using worksheet programs like Excel for your books also means missing out on all the

valuable features of accounting software, such as automated data entry, receipt scanning,

and data security. And if you decide to use accounting software anyway, switching to

computerized books of accounts might already be worth it.

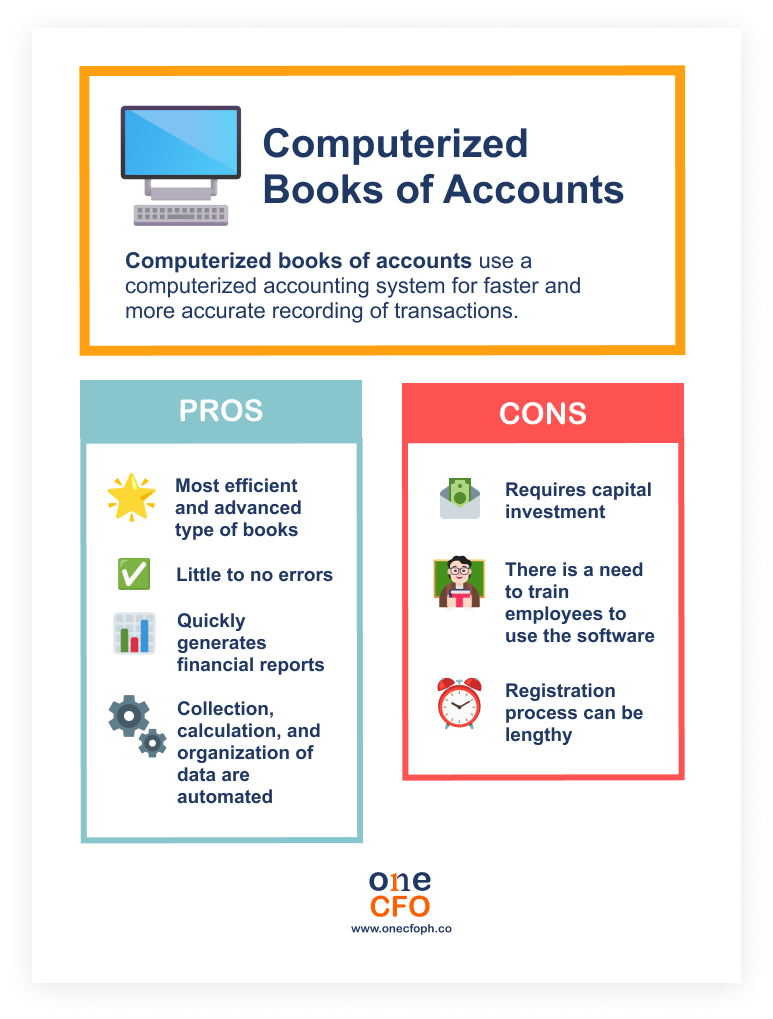

Computerized books of accounts

You should use computerized books of accounts or

computerized accounting systems (CAS) to

automate bookkeeping. Computerized books are the most advanced and efficient bookkeeping

method available to businesses.

Here, the company can hire an IT expert to build or customize an

accounting software fit for

their needs. However, readily available accounting software is more convenient if your

business does not require such complex customizations.

When acquiring the permit to use computerized books, the BIR ensures that your CAS can

process data accurately and follows tax regulations, which includes conducting a series of

tests on the software.

While businesses are generally free to choose what type of books they will use, the BIR

sometimes requires big companies or large taxpayers to use computerized books for more

accurate bookkeeping.

Businesses should register their computerized books by submitting soft copies of their

records in CD-R or DVD-R format every year within 30 days from the end of the taxable year

or within 30 days from the closure of business operations, whichever is earlier.

What are the advantages of computerized books?

Automating your bookkeeping with computerized books increases efficiency and productivity in your business. Accounting software already has built-in functions meant to collect, organize, and sync data across different systems, making it more convenient to access accurate financial data.

How computerized books improves business efficiency

Computerized books are perfect for growing businesses since there is no need to record all transactions manually. Businesses can enjoy the benefits of faster generation of financial reports, significantly reduced human errors, and easy categorization of all transactions.

Most software also uses the cloud to store and backup your data, so there’s no

need to worry

about missing files or storing your receipts.

Switching to a computerized system is also considered an investment in the company. Although

you need to shell out money to purchase or build the software, the company will get its

money back by becoming more efficient in business operations.

Instead of assigning an employee or yourself to finish repetitive tasks, you can automate

these. You and your employees can focus on strategy-making for the company and business

activities that will earn you more money.

What are the disadvantages of computerized books?

As mentioned, using computerized books requires capital investment on the company’s end. The

amount of money they need will depend on the complexity of the software they’ll use.

Aside from monetary investment, the company needs time to train its employees to use the

software accurately. The good news is that businesses can outsource their accounting or

bookkeeping function to trusted providers, so they won’t need to train their staff or

purchase the software themselves.

Registering computerized books can also take the longest because the BIR will request

additional requirements and will

test your software to see if it can perform the functions

needed to comply with the Tax Code. However, you can quickly mitigate this by using standard

accounting software available in the market since the BIR is already familiar with such

systems.

Become more efficient with computerized bookkeeping

Choosing what books of accounts to use will affect the efficiency of your operations in the

business. Among the three types, new companies or those with a low volume of transactions

can initially use manual books, especially when money is tight.

But as your business increases sales and expands its customer base, switching to

computerized bookkeeping allows you to keep the growth momentum, not get pulled behind by

manual processes, and continuously improve business efficiency.

Even when just starting, a business can automate its bookkeeping instantly as long as they

have an ample budget.

Another great option is outsourcing your bookkeeping to experts like OneCFO! OneCFO is your

outsourced finance department, handling your business taxes, bookkeeping, payroll, and more.

Visit us at onecfoph.co or contact us at [email protected] to

learn how we can help you with

your bookkeeping needs.

Read our disclaimer here.