By Maric De Castro

Updated on May 31, 2023 | 11:19 pm

As a small business owner, you must be up-to-date on the tax rules and regulations changes.

Knowing the latest updates on income tax rates ensures that your small business is

compliant, and you can align plans and budgets to address the changes.

The Philippine Government implemented new tax rules at the start of the year and more in the

coming months. Small businesses benefit from lowering income tax rates and reducing the

frequency of filing VAT returns.

However, tax breaks made during the Covid 19 pandemic are expiring in the middle of this

year. Higher tax rates mean added expenses that small business owners have to address.

What are the changes in tax rules in 2023?

Implementing the changes under the Tax Reform for Acceleration and Inclusion (TRAIN) Act

last January 1, 2023, further addresses fixing the tax system's inequity. The changes are

according to Republic Act 10963, which seeks a

simple, fair, and efficient tax system so,

Filipinos enjoy an increase in their disposable income.

On the other hand, the Republic Act 11534, known as the

Corporate Recovery and Tax

Incentives for Enterprises (CREATE) Law, had some adjustments on the tax rates during the

Covid-19 pandemic to aid businesses and the economy in recovery. The tax rates, however,

will revert to their original percentages by July 1, 2023.

Personal Income Tax Rate

Under the TRAIN law, signed on January 1, 2018, Filipinos enjoyed a reduction in the

personal income tax rate. The TRAIN law helps taxpayers enjoy the fruits of their labor

without sacrificing their contribution to the country's development.

It also stipulated a further reduction in tax rates by January 1, 2023. The new personal

income tax rate is from 15% up to 30% for those with taxable

income not exceeding PHP

8,000,000.

According to the Department of Finance, the new tax rate schedule is as follows:

| Range of Annual Taxable Income | Tax Due |

|---|---|

| Not over PHP 250,000 | Exempted from PIT |

| PHP 250,000 and not over PHP 400,000 | 15% of the excess over PHP 250,000 |

| Over PHP 400,000 but not over PHP 800,000 | PHP 22,500 +25% of the excess over 400,000 |

| Over PHP 800,000 but not over PHP 2,000,000 | PHP 102,500 +25% of the excess over 800,000 |

| Over PHP 2,000,000 but not over PHP 8,000,000 | PHP 402,500 +30% of the excess over 2,000,000 |

| Over Php 8,000,000 | PHP 2,202,500 +35% of the excess over 8,000,000 |

The withholding tax on the taxable income is significantly lower compared to the initial

cuts when the TRAIN law was first implemented in 2018. The reduction translates to

increased take-home pay for individuals earning purely compensation income.

Individuals making more than PHP 250,000 and up to PHP 2,000,000 see a further reduction

of 5% in their income tax. While Filipinos with taxable income of more than PHP

2,000,000 but not more than PHP 8,000,000 has a 2% reduction in their tax rate.

However, since the government follows a progressive form of taxation, those

in the

highest income bracket will not have any personal income tax rate reduction. Taxpayers

whose annual income exceeds PHP 8,000,000 continue to have a tax rate of 35%.

VAT returns

Part of the TRAIN law is changes in the Value Added Tax (VAT) regulations.

Under Revenue Regulations 13-2018, starting

January 1, 2023, VAT-registered taxpayers make less frequent

payments and filing of VAT returns.

Instead of a monthly basis, the VAT return requirement is reduced to quarterly payment

and

filing. The government still requires filing VAT returns within 25 days after each

taxable

quarter's close.

However, since this ruling started, many business owners felt quarterly payment was too

heavy on the budget. They prefer the monthly payment as they only need to come up with a

smaller amount. It also does not disrupt the cash flow as much as paying a lump sum every

quarter.

In line with this, the BIR issued the Revenue Memorandum Circular No. 52-2023 last May 10,

2023, allowing the optional monthly filing of the VAT returns using BIR Form No. 2550M.

There will be no deadline for the monthly filing of VAT returns. No penalties also will be

imposed if the VAT-registered taxpayer shifts from monthly to quarterly filing or

vice-versa.

However, taxpayers who opt to file monthly are still required to file the quarterly VAT

return BIR Form No. 2550Q 25 days following the end of the taxable year.

What is CREATE Act?

During the Covid-19 pandemic, then-President Rodrigo Duterte signed RA No. 11534, or the

Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act, to aid local and foreign

businesses from the strain the pandemic has brought about.

The CREATE Act was passed into law on March 26, 2021, with corporate tax reforms tailor-made

to provide monetary relief to companies and make doing business here in the Philippines more

attractive.

According to Section 116 of the Tax Code:

However, effective July 1, 2023, taxpayers exempt from VAT must pay the actual tax rate of

3%.

In addition, the MCIT for corporations (except non-profit proprietary educational

institutions, hospitals, and non-resident foreign corporations) will also revert on July 1,

2023, to its initial 2% rate based on the gross income of such corporations.

The corporate income tax rates and

percentage tax return rate are as

follows:

| Classification | Tax Due |

|---|---|

| Percentage Tax Return (for Non-VAT Taxpayers) | 3% (Effective July 1, 2023) |

| Minimum Corporate Income Tax (MCIT) | 2% (Effective July 1, 2023) |

| Special income Tax for Non-profit Proprietary Education Institution and Hospitals | 10% (Effective July 1, 2023) |

| Domestic small and medium enterprises with taxable income not exceeding PHP 5M and total assets not exceeding PHP 100M (excluding land) | 20% |

| Domestic corporations with taxable income above PHP 5M | 25% |

| Non-resident foreign corporations’ gross income derived from sources within the Philippines | 25% with yearly deduction of 1% to reach 20% in 2027 |

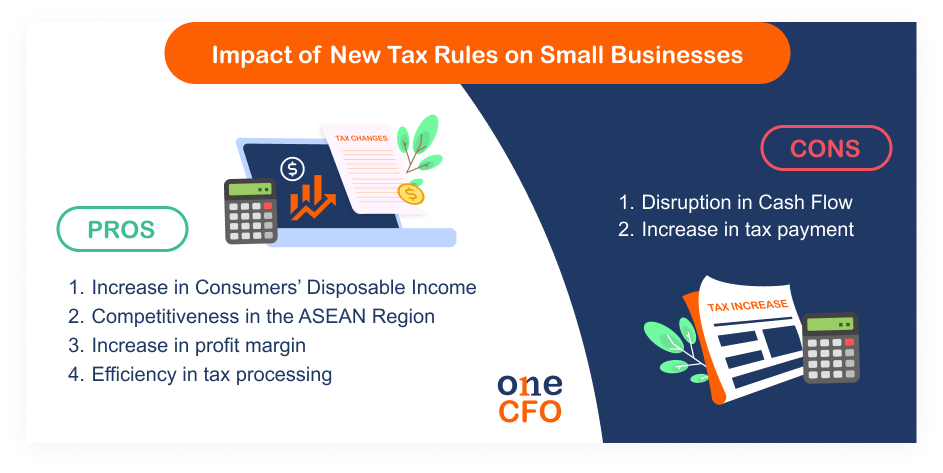

Impact on small businesses

Small and Medium enterprises (SMEs) are essential to the economy. Together with

micro-enterprises, they compose 99.6% of the country’s businesses

providing employment and

boosting the economy.

Your business is categorized as an SME if you have 10 to 199 employees and assets between

PHP 3 million and PHP 100 million. Restaurant owners, entrepreneurs, self-employed workers

or freelancers, contractors, online retailers, tech startups, or anyone who starts a

business are all part of the SME sector.

The TRAIN Law paved the way for income tax cuts, significantly impacting SMEs. They have

seen higher sales turnover, increased demand for goods and services, a broader customer

base, and ease in filing taxes.

However, the changes also negatively affect their budget and taxable income. Tax savings

mean more disposable income, but changes in the VAT ruling and corporate income tax rates

can disrupt cash flows.

Benefits enjoyed by small businesses

The tax system changes are seen to be beneficial to small businesses - they can see an increase in business activity and profitability.

Increase in Consumers’ Disposable Income

Personal income tax cut saw a 5% increase or at least half a

month’s worth of additional pay

for Filipino workers. The tax cut translates to more discretionary income for consumer

spending and savings.

Consumers can increase their budget on necessities and luxuries they cannot afford before

the reduction in taxable income.

A boost in consumer spending translates to businesses having more customers or buyers. As

these customers' consumption increases, business production and sales also jump.

Competitiveness in the ASEAN Region

The Philippines used to have the highest CIT rate in the ASEAN region.

Expansion plans are

difficult for local and foreign companies because they need to pay higher taxes instead of

plowing back into the company funds.

With the adjustments in corporate income tax rates, the cost of doing business in the

Philippines becomes lower and attracts more foreign investors.

Increase in profit margin

Having less stringent tax obligations, small businesses can enjoy increased business income

and more funds for capital investment.

Small business owners can plow the tax savings into buying much-needed equipment, investing

in automation to improve efficiency, and boosting product and cost competitiveness.

Furthermore, they can open new positions and hire more workers to maintain and grow the

business.

Efficiency in tax processing

The latest ruling on VAT returns fosters efficiency in business processes. The quarterly

filing and payment of VAT returns lessen the burden of filing numerous income tax returns

within the taxable year.

Doing VAT return 12 times in a taxable year is time-consuming and burdensome. It also adds

to the paperwork needed to be prepared at a given time to meet the tax requirements.

Now, at four times a year, this allows small business owners enough time to gather VAT

claims’ supporting documents and file them accordingly.

Consequences of the tax rules change on small businesses

Not all of the changes in the TRAIN and CREATE laws benefit businesses. SMEs still need to prepare for tax payments, and business costs too can increase.

Disruption in cash flow

The quarterly amount of VAT returns greatly impacts the cash flow. With the original ruling,

VAT payment is monthly, which is considerable compared to a lump-sum tax payment.

Cash planning is vital to minimize the impact on cash flow. Your cash balance may increase

during the two months VAT payments are not required.

However, this is not disposable cash. Set aside or budget well to avoid non-payment of taxes

due.

Increase in Tax Payment

The lower rates for the Percent Tax Return and MCIT will end on June 30, 2023, and revert to

pre-pandemic rates. Returning to the actual rates will affect businesses whose sales are

exempt from paying VAT.

Instead of savings, affected companies must allocate more in their budget to cover the

increase in tax payments. Many companies recovering from the effects of the Covid-19

pandemic may have difficulty meeting their tax obligations.

Why do small businesses need to be updated on new tax rulings?

Small companies must stay updated on tax rules and regulations changes. Not only will your

business be tax compliant, but you can also readily adjust the business budget for the

fiscal year.

However, understanding the changes and being compliant can be overwhelming to small business

owners. If managing taxes isn't your core strength, you can get expert assistance from

OneCFO PH.

OneCFO PH offers small businesses tech-enabled CFO, bookkeeping, tax, and payroll services.

Our team is up to date on changes in income tax rules and regulations and can readily

propose actions on how to address tax payment and filing best.

Consult now about how

OneCFO PH can

help you with your business’ tax compliance.

Read our disclaimer here.