November 25, 2024 | 3:27 pm

Table of Contents

Sales invoices and official receipts are crucial for bookkeeping and tax compliance. With

recent changes in invoicing rules, which should your business use to comply with the EOPT

Act?

If you still mainly use official receipts, you might be behind on the latest invoicing

requirements set by the Ease of Paying Taxes (EOPT) Act. According to this act, all

businesses should now use invoices as the primary document to evidence the sales of goods

and services.

Business owners like you might have many questions about the shift from official receipts to

invoices. Do all businesses need to switch to invoices? What happens to your existing

official receipts?

Well, don’t worry! In this article, we’ll explain the key differences between sales invoices

and official receipts and answer all the frequently asked about these new invoicing changes.

What is the EOPT Act?

The Ease of Paying Taxes (EOPT) Act,

signed on January 5, 2024, aims to modernize and

simplify the tax administration in the Philippines, making it more friendly to taxpayers.

The EOPT Act details amendments in our tax system, such as

the reclassification of

businesses, easier filing of tax returns, and simplified value-added tax (VAT) ruling.

Watch this to learn more about the EOPT Law and other recent tax changes in the country:

In addition, the EOPT Act involves significant changes to the invoicing requirements,

pushing businesses to now use invoices instead of official receipts (ORs).

The Bureau of Internal Revenue (BIR) also released the following memoranda—RR 7-2024 and

RR 11-2024—to provide more

clarification on this transition.

What are the differences between an official receipt and an invoice?

Before the EOPT Act took effect on April 27, 2024, companies could use official receipts or

invoices depending on the nature of their business.

Businesses that sell goods and properties should use invoices as their primary document,

while those that sell services or lease properties should use official receipts.

However, the EOPT Act has now amended how to use these documents.

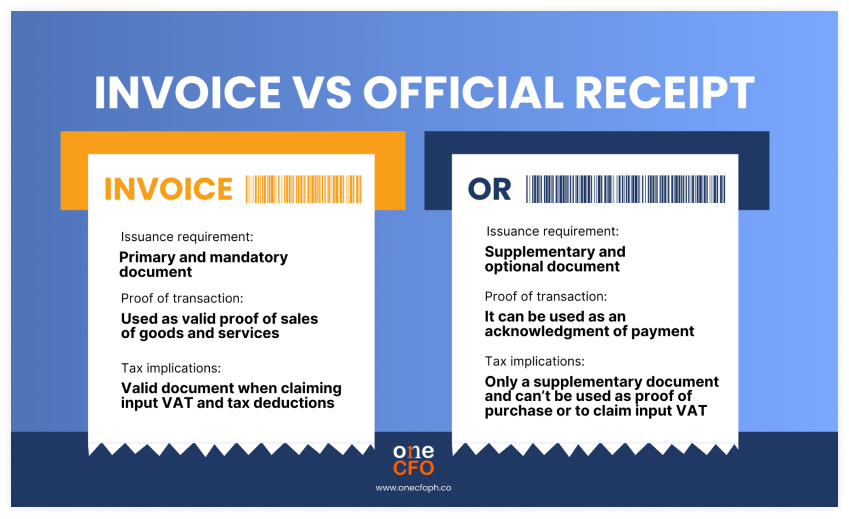

Here are the key differences between official receipts and invoices:

Issuance requirement

According to the EOPT Act, businesses should now issue invoices as the primary document for

selling goods and services.

Also, it’s worth noting that an invoice doesn’t just refer to a sales invoice. Businesses

can add any descriptive name to label their invoices, such as “Cash Invoice,” “Credit

Invoice,” “Service Invoice,” “Billing Invoice,” and more.

On the other hand, official receipts are only secondary and optional. If your business still

decides to use ORs, you must register them to the BIR as a supplementary document to get a

new Authority to Print (ATP).

Proof of transaction

Businesses should now use invoices as proof of their sales, regardless of whether customers

pay in cash or credit. If the customer pays in credit, meaning the business collects the

payment later, business owners should not issue a second invoice upon collection.

Instead, businesses can issue an official receipt as proof or acknowledgment of payment once

the customer settles their outstanding balance.

Tax implications

If you want to take advantage of tax-deductible expenses, remember

that invoices are

considered valid documents for tax deductions.

Moreover, VAT-registered businesses can now use the invoices they receive as input VAT when

buying from other VAT-registered companies.

Meanwhile, official receipts are no longer valid when claiming a tax-deductible expense or

input VAT.

Frequently Asked Questions About EOPT Invoicing Changes

Many still need clarification about its implications as businesses adapt to the new EOPT Act. Let’s address some frequently asked questions about the new invoicing changes:

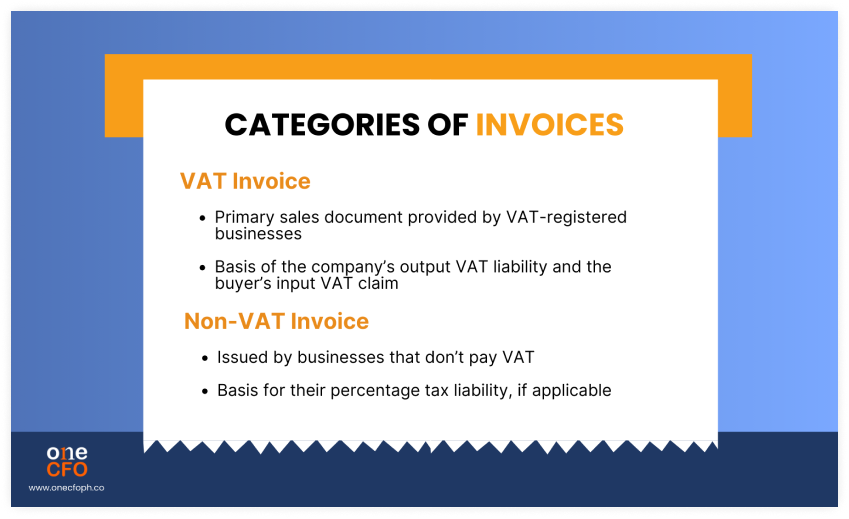

What are the two categories of invoices?

The BIR defines an invoice as a written account evidencing the sales of goods and services issued to customers. There are also two categories of invoices as follows:

If you’re a VAT-registered business selling zero-rated or VAT-exempt products, note that you

can use a single invoice for mixed transactions, including goods/services subject to VAT,

Zero-rate, and VAT-exempt sales.

When doing so, it’s essential to show a breakdown of the amounts for each type of sale:

VATable sales, VAT amount, VAT-exempt sales, and zero-rated sales.

When should you issue an invoice?

The timing of when to issue an invoice depends on whether you’re VAT-registered and the

amount involved in the transaction.

VAT-registered sellers should always invoice all sales transactions, regardless of the

amount.

Meanwhile, non-VAT-registered businesses must issue an invoice when they meet at least one

of these three conditions:

Also, note that the BIR will adjust the ₱500 threshold every three years based on the Consumer Price Index.

What happens to your existing official receipts?

If you still have unused booklets of official receipts in your hand, don’t throw them away!

Even though invoices are now the primary document, you still have two options for utilizing

your unused receipts until they’re fully consumed.

The first option is to use your remaining receipts as supplementary documents for your

business. If you still issue an invoice for the same transaction, you can issue a receipt to

acknowledge your customer’s payment.

If opting for the first option, stamp the OR with the words “THIS DOCUMENT IS NOT VALID FOR

CLAIM OF INPUT TAX.” Doing so reminds buyers that they can’t use ORs to claim input tax.

The second option is to convert unused receipts into invoices, which is very beneficial for

businesses that have yet to print their invoices.

To do this, just strike out the words “Official Receipt” in your OR and stamp it with

“Invoice,” “Sales Invoice,” “Cash Invoice,” or any other variation that includes the word

“Invoice”.

Additionally, you must report the inventory of unused receipts to the BIR to be converted to

invoices.

What about businesses using cash registers or POS machines?

Businesses using cash register machines (CRM) and point-of-sale (POS) machines can simply

replace “Official Receipt” with “Invoice” in their systems without notifying the BIR.

However, these businesses must still submit a notice to the BIR specifying the invoice’s

starting serial number, which should follow the serial number of the last issued OR.

Are online sellers affected by the invoicing regulations?

Similar to the new withholding tax rule, the recent

changes in invoicing regulations are

also applicable to online sellers.

Although online sellers don’t use CRM or POS, they typically rely on e-receipting or

e-invoicing software to issue their sales documentation. Like businesses using CRM and POS,

online sellers can replace “Official Receipt” with “Invoice” in their software.

Additionally, they must report to the BIR the starting serial number of their invoice,

following the same procedure as those with CRM and POS.

What about businesses using computerized accounting or books?

If your business uses a computerized accounting system (CAS) or computerized books of account (CBA),

you should reconfigure your systems and file for a new application to use CAS

or CBA.

Filing a new application involves surrendering your current Acknowledgement Certificate (AC)

or Permit to Use (PTU) and applying for a new one.

The BIR has set the deadline to December 31, 2024, to give you enough time to update your

systems. You may also request an extension through your Revenue District Office (RDO) if

needed.

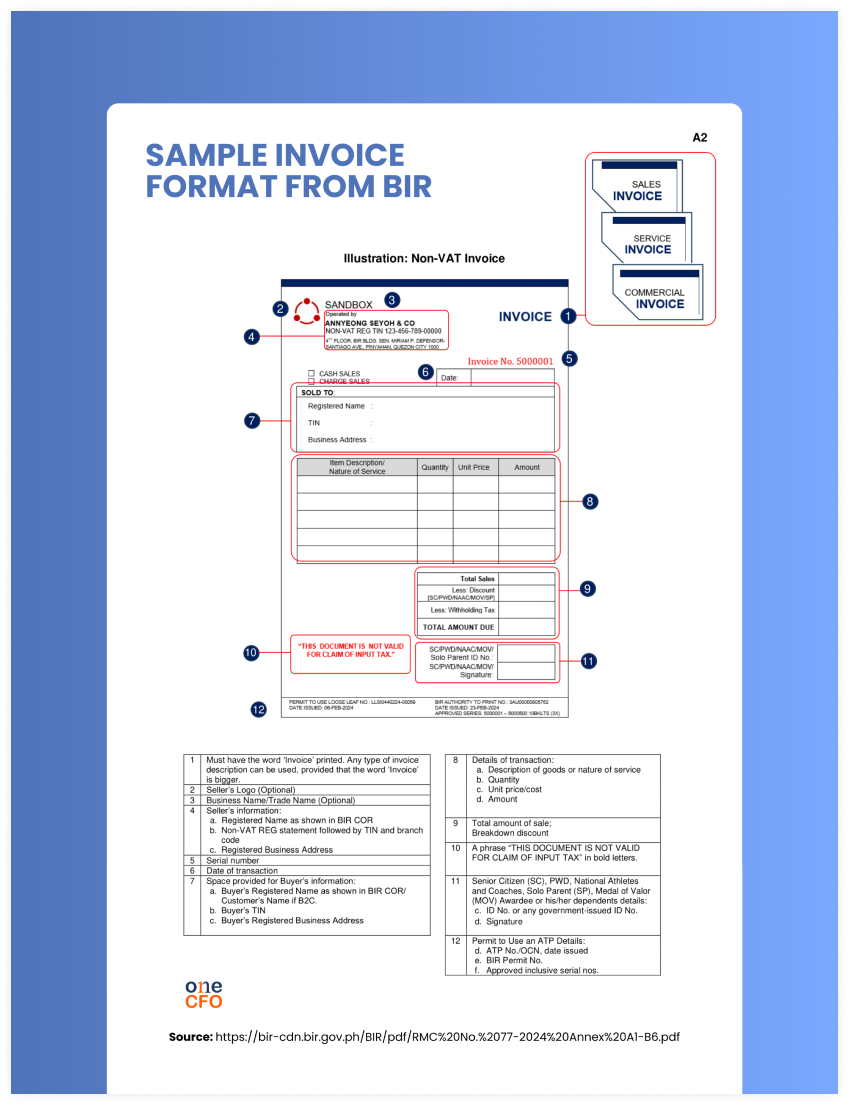

What should be the format of an invoice?

Now that invoices are the primary document for proof of sales, businesses should secure an Authority To Print (ATP) from the BIR before going to an Accredited Printer to print their invoices.

Here are the following information to include in your invoice format:

What are the consequences of non-compliance?

Non-compliance with the new invoicing regulations set by the EOPT Act, such as non-issuance

of invoices, failing to stamp an OR, and the like, is subject to a penalty of ₱1,000 to

₱50,000.

In addition, non-compliant business owners may be imprisoned for two to four years.

Stay compliant with the new invoicing regulations

Navigating BIR’s new invoicing rules is crucial to remaining compliant with the EOPT Act and

avoiding costly penalties. After educating yourself on these regulations, it’s time to make

the necessary adjustments to your documentation and systems.

And if you need more help complying with the recent tax changes, OneCFO is here to help!

Our team of professionals has the expertise you need to ensure your business meets all the

new invoicing and other tax requirements! Not only is OneCFO your partner for growth, but

we’re also your trusted resource for managing tax compliance.

Visit us at onecfoph.co or email us at [email protected] to

learn how we can support your

business through all regulation changes.

Read our disclaimer here.