February 16, 2024 | 3:46 pm

Table of Contents

Are you running a small business? Pay attention to those important financial reports! These

key reports become your secret weapon, helping you understand how well your small business

is doing and where it’s headed.

The data from these financial reports are not just about the past; they’re like the roadmap

for your business’s future. Don't skip out on the valuable insights they offer.

Dive into this guide to learn why each financial report is a big deal and how they can make

a real difference in your small business journey. Your path to financial clarity and success

starts here!

What are the 3 most important financial reports for a small business?

Businesses disclose their financial performance, position, and cash flows through financial

reports throughout a specific period. These reports provide information on how much money a

company has, where it is from, and where it goes.

Here are the three critical financial reports every small business needs:

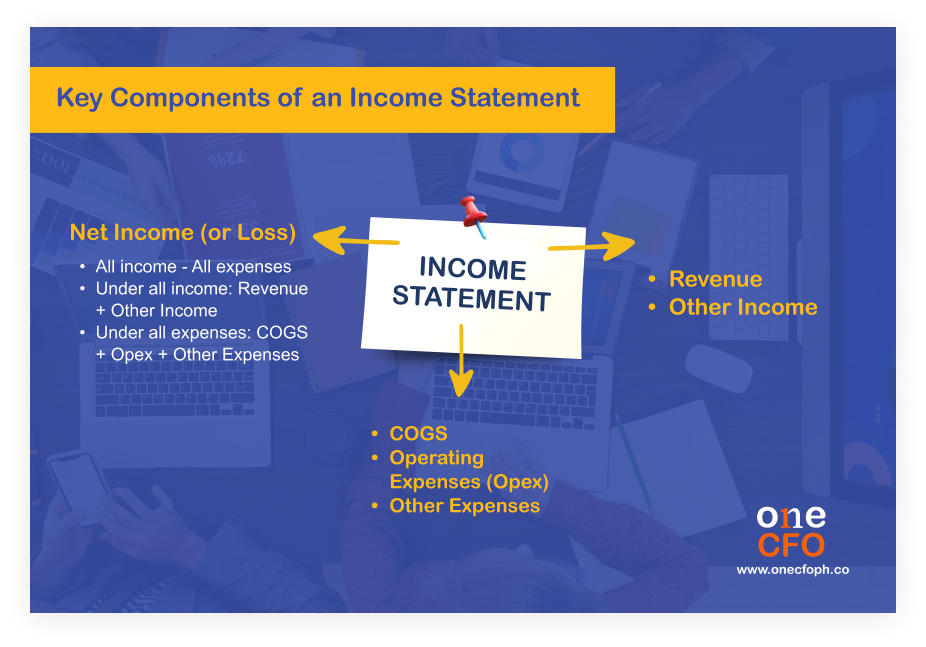

Income statement

The income statement, also called the profit and loss

statement, measures a company's

profitability. This financial report lists the business's sources of revenue, which

typically comes from sales.

Similarly, the income statement summarizes all company expenses, including the cost

of goods

sold (COGS), administrative and marketing fees, taxes, interests, and miscellaneous

expenses.

The end of the income statement shows the net income or bottom line, which comes from

deducting all expenses from the revenue. But, if the business's expenses exceed its revenue,

the income statement will show a net loss.

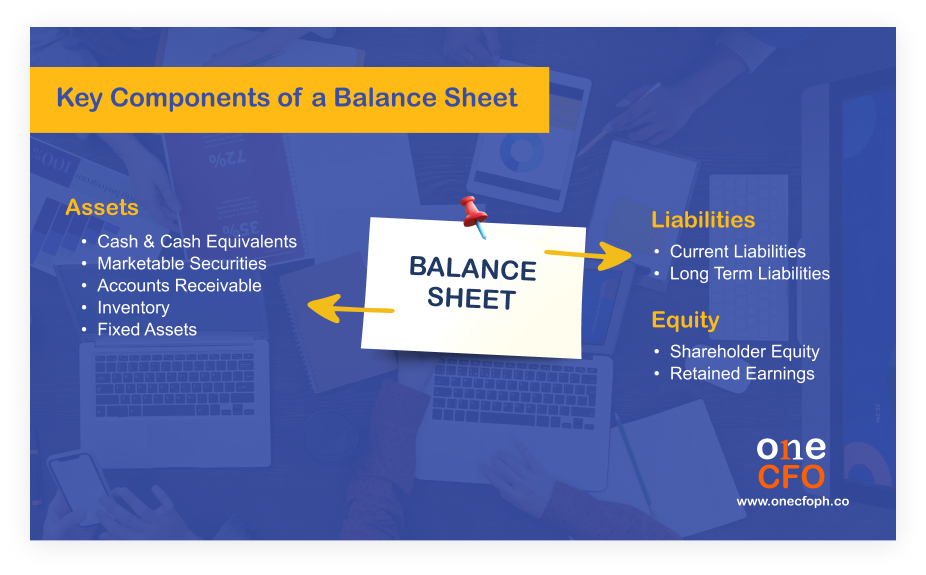

Balance Sheet

Another important financial statement to consider is the balance sheet. A balance sheet showcases the company’s financial position, typically during the end of the reporting period.

What is the purpose of a balance sheet?

Specifically, a balance sheet shows a business’s assets, liabilities, and shareholder’s equity:

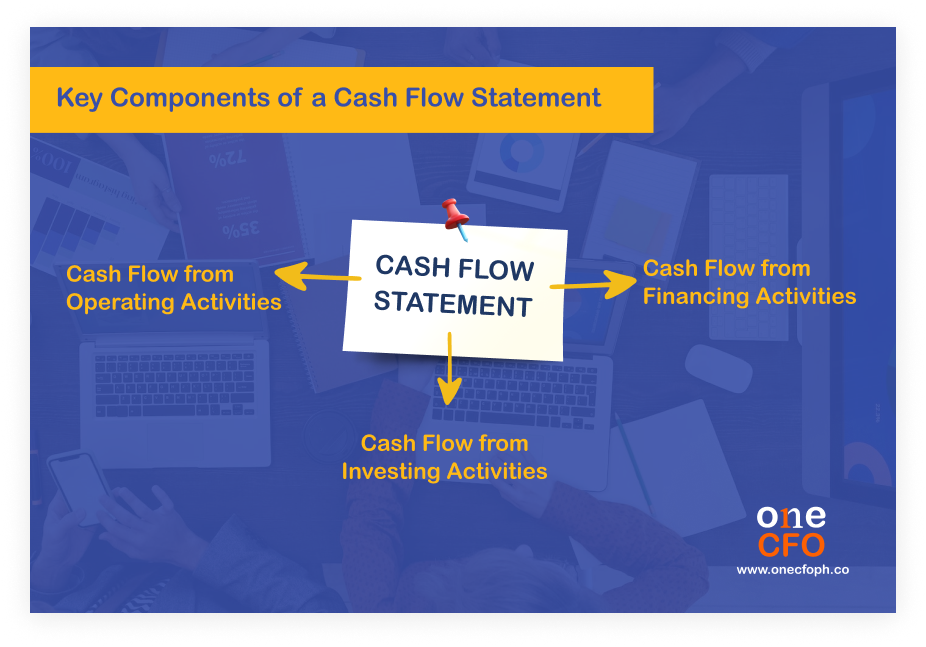

Cash flow statement

As given in the name, a cash flow statement summarizes all cash inflows and outflows the business had in a given period. This financial report represents a company's liquidity and how it manages its cash effectively.

Three components of a cash flow statement

There are three components to a cash flow statement: operating, investing, and financing:

Dive into this video for a deeper understanding of the three components of a cash flow statement:

Why are financial reports important to small businesses?

Beyond being mere guides, financial reports provide owners and stakeholders with

indispensable insights into the financial health of their ventures.

These reports are not just about numbers on paper; they reveal the business's performance,

strengths, and areas for improvement.

Below are the core reasons financial reports play a pivotal role in steering small

businesses to make informed choices, spotting trends, and maintaining sound financial

health.

Decision-making

Financial reports are invaluable tools that enhance the decision-making process. They show

how well the company is doing financially and if it’s making money. With these reports,

businesses can make smart moves for success and growth.

Business owners use income statements to measure profitability. Since this report summarizes

the company’s revenue and expenses, the owners and management can review this to strategize

how to increase their net income or recover from a loss.

On the other hand, the balance sheet helps small business owners make informed choices about

investments, loans, and other strategic decisions. A well-balanced balance sheet ensures the

business is not overburdened with liabilities and has the necessary resources to support its

ongoing operations and obligations.

Entrepreneurs also need to make decisions for the year ahead. Cash flow statements

greatly

help project future inflows and outflows, which is crucial in proper budgeting and planning.

Attracting investors

When you raise funds or capital from

investors, your business’s financial statements become

vital. Financial statements reveal information about the company’s financial health, which

helps investors decide if they should give you any money.

Investors look at different financial metrics when assessing a company. But some of the most

basic ones they can quickly check from your reports are sales, profit margin, debt, and cash

flow.

Sales and profit margins are two essential metrics from the income statement. Many

businesses think of helpful products, but your sales define if people are willing to spend

for them.

Is your business worth the investment?

Additionally, investors also check if the business makes enough profit and if it can grow to

determine if they can get good returns on their investments.

Debt is also one of the things investors are wary about, especially since it can eat up on

the cash flow.

Businesses with high debt-to-equity ratios based on their

balance sheets

are riskier to

invest in. These companies may have reduced liquidity, as a significant portion of their

cash is committed to servicing debts, limiting their financial flexibility and increasing

susceptibility to financial challenges.

Legal compliance

Financial statements are not only for the benefit of your business but are also requirements

for legal compliance.

The Bureau of Internal Revenue (BIR) requires businesses earning gross sales of more than

₱3,000,000 to submit audited financial statements (AFS) along with the

annual income tax

return (ITR).

According to the Revised Corporation Code, corporations with total assets or liabilities of

₱600,000 or more must submit their AFS to the Securities and Exchange Commission (SEC).

Also, remember that the BIR should stamp the AFS before submitting it to the SEC.

On the other hand, corporations that don’t meet the ₱600k threshold by the SEC should still

submit annual financial statements, accompanied by a duly notarized Treasurer’s or Chief

Financial Officer Certification.

Are financial statements used for tax purposes?

Financial statements become strategic documents, reflecting past financial performance, and

are handy when filing taxes. The net income reported in the income statement forms the

foundation for accurate and compliant tax filings.

Additionally, the detailed breakdown of expenses helps businesses maximize tax deductions,

ensuring efficient financial management and regulatory adherence.

To discover insights on tax deductions and effective strategies for saving on taxes, check

out this video:

Line of credit and loans

For businesses, maintaining accurate and up-to-date financial statements is not just a

compliance requirement; it is a strategic imperative to foster trust with financial partners

and access the capital needed for growth

and operational needs.

Businesses can use their financial statements to see if they can take on more debts.

Comparing the current assets and liabilities and investigating the company’s cash flow will

give insights into how the business can manage its resources and settle its debts

efficiently.

What is the importance of financial statements to the banks?

Financial statements are paramount for banks and financial institutions when assessing the

creditworthiness of businesses seeking loans or lines of credit. These statements serve as a

comprehensive financial snapshot, offering insights into a company’s fiscal health,

stability, and performance over time.

Lenders scrutinize key components such as liquidity, profitability, and solvency to gauge

the business’s ability to meet its financial obligations. A robust set of financial

statements instills confidence in lenders and facilitates transparent and informed

decision-making.

Performance evaluation

Similar to how investors analyze financial statements to determine a company’s investment

potential, businesses can leverage these reports to gauge their growth and performance.

The data provided by the financial reports can be used to monitor how the business is

performing and lay the groundwork for informed decision-making.

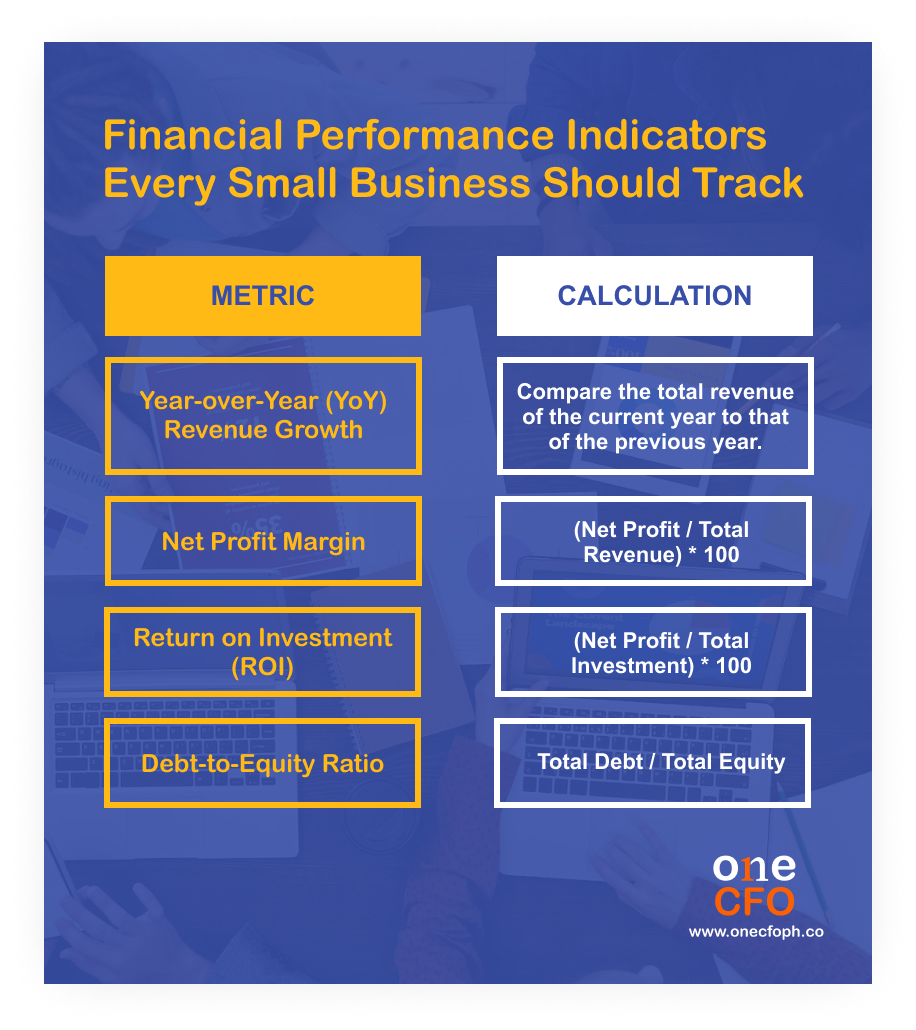

4 KPIs to gauge small business performance

Identifying key performance indicators (KPIs) to

guide small businesses is crucial. These

metrics, extracted from the financial reports, show the business's performance, stability,

and potential.

The KPIs you monitor may be dependent on the nature of your business and performance

criteria, but here are the basics:

Transparency and accountability

Clear and comprehensive financial statements go beyond mere documentation. They play a

pivotal role in fostering transparency within the business and among external

stakeholders.

By meticulously reporting financial information, a company showcases its integrity, a

cornerstone in establishing and maintaining strong business connections.

Moreover, a company with complete financial reports shows it has nothing to hide, building

trust with its partners, investors, and employees.

Why is accountability important in financial management?

Financial statements go beyond numbers, serving as a critical tool in fostering

accountability within a business.

These statements offer a detailed insight into how a company manages its resources, handles

outstanding debts, allocates funds for current expenses, and plans for future investments.

In essence, financial statements serve as a tangible representation of the company’s

commitment to responsible financial management. This assures stakeholders of its dedication

to sound business practices and creates trust and belief in how the company manages its

money.

Unleash growth with strategic financial reporting

Financial reports, including income statements, balance sheets, and cash flow statements,

are indispensable tools for small businesses. They guide decision-making, assess

performance, and play a pivotal role in establishing connections that propel business

growth.

Recognizing the significance of these reports, entrusting finance experts like OneCFO is a

strategic business move!

OneCFO serves as your

all-in-one CFO, bookkeeping, and tax assistant. With our team of

finance and accounting professionals, we ensure that all your financial reports are

accurate, insightful, and consistently prepared on time.

Explore the possibilities with OneCFO by visiting us at onecfoph.co or

contacting us at [email protected]

Let’s elevate your financial reporting, setting the stage for your business success.

Read our disclaimer here.