August 24, 2023 | 8:51 pm

Table of Contents

Cash is king, especially in a small business. But even with proper planning, there are times

when companies struggle with cash flow, pushing entrepreneurs to look for ways to bring in

cash quickly.

There are many ways to quickly generate cash and improve cash flow in a small business.

Doing so ensures you can settle the bills, pay employees, stock the inventory, and keep

running the business.

Start streamlining operations by examining current business expenses. Renegotiating terms

with vendors and suppliers and encouraging customers to pay earlier are effective ways to

obtain cash.

Small business owners should also review their pricing and sales strategies and improve them

accordingly to generate more revenue.

In a cash crunch, alternative financing options are also available for small business

owners. These financing options include invoice factoring, business loans, or getting a line

of credit.

This guide explains how a small business can quickly generate cash. Read on and engage these

tips to keep your business free from cash flow worries!

How to generate cash in your small business?

In a perfect world, a small business should always have more money flowing in than out. But

in reality, there are days or months when a company experiences a cash gap or negative cash

flow.

During these times, you must know how to extend cash and keep the lights on for your

business.

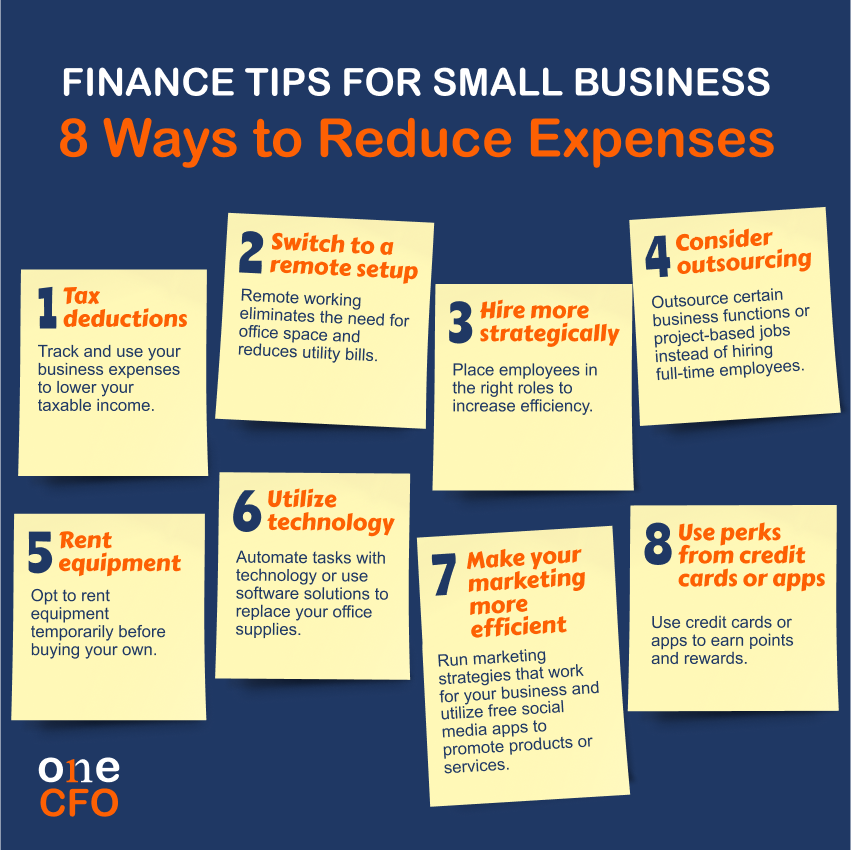

#1 Reduce business expenses

One of the first steps in generating cash is to reevaluate how you spend money in the

business and look for ways to cut costs. Does your company use too many software

subscriptions, paying high utility bills or unnecessary expenses?

Start by looking at and analyzing all the expenses incurred in the business regularly. From

here, you can see areas where you can reduce your costs, even if only temporarily.

Some examples of reducing business expenses are

switching to remote work, utilizing free

marketing tools, and renting instead of buying equipment.

Additionally, outsourcing some business functions, such as finance, can be more

cost-effective for your business. Outsourcing will save you money from hiring a

full-time

employee and ensure you have experts to work on your business.

Read more: 8 Ways to Reduce Small Business Expenses

#2 Maximize credit terms with your suppliers

Many small business owners believe paying their suppliers as early as possible is the best

way to manage their cash flow. While this practice establishes you're a good payer, it can

also cause a "cash hole" in the business, where you take out money for a payable but do not

receive any cash in return from your sales.

Instead of paying in total upfront, maximizing the credit terms with your supplier is

better. If the supplier gives you 30 or even 60 days to settle the invoice, take advantage

of this credit term so you do not have to use available cash immediately.

Entrepreneurs can also request a further extension of terms; however, they need a good

business relationship with the vendor or supplier to get an extension. Alternatively, offer

to pay a downpayment instead if suppliers are hesitant to extend credit terms.

Another option is negotiating prices or asking for bulk discounts. Some suppliers may also

offer more discounts for paying early. In this case, it's best to check your cash flow and

calculate if doing so will be more beneficial to the business.

#3 Collect payments as early as possible

Another way to ensure you have cash in your business is to collect payments as early as

possible, or at least before payables are due. Strategically scheduling when to collect

payments prevents you from needing to acquire loans or debts to cover your bills.

A strategy for collecting early payments is to send the invoice the day you completed your

service or sold your product. It’s also essential to have a regular cadence in sending

invoices, such as resending it 15 or 10 days before it’s due. Periodic reminders help avoid

any payment slipping through the cracks.

It would be best to collect the payment upfront. However, just like how you’d negotiate with

your suppliers, your customers might want to make a deal with their payment terms.

Alternatively, you can ask for a downpayment instead or check the customer’s

creditworthiness if you wish to extend their due dates.

Giving discounts or rewards for early payment is another option to encourage customers to

pay early. You can also charge additional late payment fees to prevent customer delinquency.

Automating the business’s payment collection system is also a quick way to collect and

generate cash.

For example, industries like healthcare also need to process payments and claims from

PhilHealth and insurance agencies. Automation platforms like Stash PH streamline hospital

claims and reimbursement processes, improving the hospital’s cash flow and operational

efficiency.

#4 Manage cash flow better

Generating cash is challenging if you don’t know where your money comes from or how it comes in and out of your business.

What is cash flow?

Cash flow refers to the amount of money that flows in

and out of your business at a given

time. Money flows in when your business generates cash through selling goods or services,

earning from investments, or obtaining loans. On the other hand, cash flows out when you

spend money on business expenses like inventory, salaries, and bills.

Knowing the business’s cash movement shows where most of its money comes from and its most

significant expenses. With this information, small business owners can see what part of

their operations they can maximize to generate more revenue and areas where to reduce costs.

It’s essential to keep track of all money inflows and outflows to see if your business

operations are sustainable. Failure to do so is one of the common bookkeeping mistakes that

small business owners should avoid.

What is cash flow management?

A proper cash flow management system is

essential to see how money moves in your business

and ensure you have enough to cover all the business necessities.

Effective cash flow management's foundation relies on understanding the business’s financial

status, which involves employing the best bookkeeping practices and using

accurate financial

information to generate business reports, like profit and loss statements, balance sheets,

and cash flow statements.

Analyzing financial reports helps identify cash gaps and allows small business owners to

mitigate them by finding ways to obtain and generate cash.

Creating financial projections is also

possible when you track your cash flow, helping

businesses see a trend in their income and expenses. Projections show when you have extra

cash or surplus and may experience cash gaps. Having visibility of these points helps small

business owners strategize when to collect payment from customers and when to pay their

vendors.

Knowing when your cash flow is in the red also aids in anticipating future cash needs.

Entrepreneurs can plan if there’s a need to acquire a business loan or open a line of credit

to address any cash deficit.

#5 Utilize online banking functionality

If you haven’t yet, it’s time to open a bank account or activate online banking for your

business. Online banking functionalities are known for processing transactions in real-time,

which helps you get your money faster and avoid check-clearing float.

Comparing online banking with checks, which can take a few business days to clear, the

former is much easier for small businesses. You may need to pay transaction fees averaging

from ₱8 to ₱25 when online banking, but these fees can still be worth it in exchange for the

convenience of using them.

Additionally, having a bank account and actively using it helps establish a good

relationship with your bank and build creditworthiness. Taking out loans or opening lines of

credit becomes easier when you can use your bank activity and statements to prove your

business’ worth.

#6 Consider invoice financing

Invoice financing or invoice discounting is an

alternative financing option where you

leverage your outstanding invoices or receivables to borrow money. With invoice financing, a

third-party company will give you a certain percentage of the invoice amount upfront and

charge interest until customers pay these receivables.

The financing company may also assess the creditworthiness of your customers and use that as

a basis for the interest they will charge.

To help you with cash flow issues, various companies, such as Investree, offer invoice

financing to small and medium-scale companies. An advantage of invoice financing is it

gives you quick and easy access to cash.

What is invoice factoring?

Small business owners tend to interchange invoice financing and invoice factoring. Both

financing options involve leveraging outstanding invoices. However, the role of the

third-party company differs for each.

Invoice factoring works almost the same way as

invoice financing. However, instead of

borrowing against your outstanding invoice, you “sell” your invoices to the third-party

company in exchange for cash.

In invoice factoring, the third-party company now takes over the collection process by

contacting your customers to pay the invoices. Whereas invoice financing allows the business

owner to handle still the payment collection, which helps retain your business relationships

with customers.

#7 Raise your prices

When was the last time you increased your prices?

If you struggle to be profitable, it might be time to raise your prices. Recent events like

COVID-19 caused inflation almost everywhere, including the Philippines. Now, matching your

price with inflation is necessary to keep your business running.

However, increasing prices can push away customers, so finding the balance between staying

profitable and keeping customers happy is essential.

Review all the factors affecting pricing, see what

changed, and what you can adjust:

Read more: Optimize Your Pricing Strategy: 7 Key Factors You Need to Consider

#8 Increase sales

The most direct way a business can bring in cash is to increase sales volume. If you are

struggling to increase your sales, there are strategies you can do to gain more customers.

One strategy is to improve your promotion or marketing tactics. If a strategy has worked for

you before, it’s time to review it and analyze what about that promotion attracted

customers. Ads can also become predictable, so it’s best to switch them up occasionally or

test different ads and see which ones gain more engagement.

Repackaging products as bundles is also an effective way to get customers' attention. Take

an inventory, see what products or services sell out the most, and partner it with a

complementary or slow-moving product. Businesses usually promote bundles as the more

cost-saving option, making them attractive to consumers.

If no marketing tactic is working, it’s time to dig deep and research your target market.

Businesses fail to increase sales by targeting the wrong people or offering the wrong

product to their market. To fix this, you can create a buyer persona for your ideal customer

and curate your products and services to this ideal customer’s needs.

Learn about buyer persona and other ways to improve revenue:

Quickly generate cash and more with CFO services

It can be challenging to balance growing your business while ensuring you remain on top of

your finances, including cash flow management. But no worries because OneCFO is here to help

you.

As your growth partner, OneCFO handles your company's finance functions and is your

business’s CFO! A team of experts will be ready to guide you

with everything finance and

even manage your bookkeeping, taxes, and payroll.

Visit us at onecfoph.co or contact us at [email protected] to

learn how we can help you grow your

business.

Read our disclaimer here.