October 9, 2024 | 11:36 am

Table of Contents

Building a financial model might seem daunting, especially for non-finance entrepreneurs.

However, it is a crucial tool for SMEs and startups to help them understand their financial

situation, anticipate challenges, and identify opportunities.

Financial modeling is a tool that businesses use to forecast future financial performance.

To build a financial model, key assumptions and historical financial data are used to create

scenarios to assess the potential impact of different strategies.

Explore the various ways a financial model can benefit your business. This guide will walk

you through the steps and considerations you should know when building one.

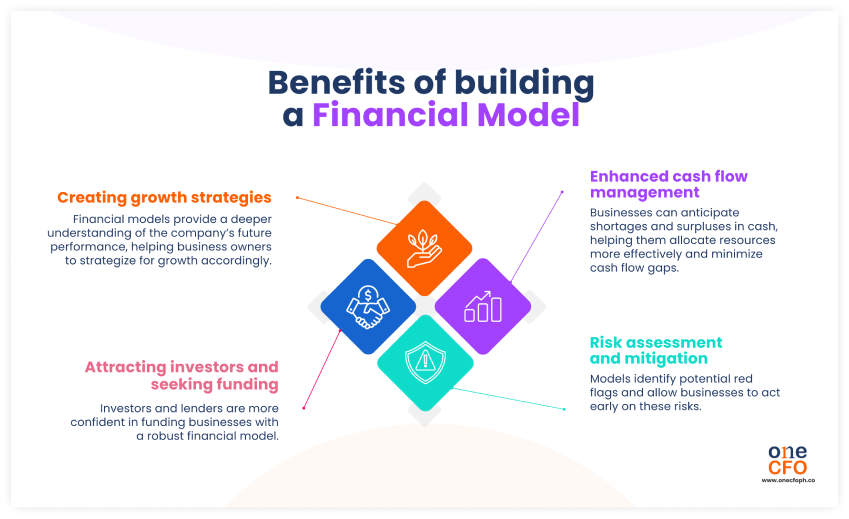

What are the benefits of building a financial model?

Financial modeling isn’t just for large corporations;

it’s also a beneficial tool for SMEs

and startups!

Here are the importance of building a financial model for businesses:

Creating growth strategies

Financial models are a business’s foundation for creating growth strategies. They help

entrepreneurs visualize and understand various business scenarios, such as scaling

operations or changing customer demands, and strategize accordingly.

When building financial models, finance experts test different variables, like sales volume

or price per unit, and create projections crucial for strategizing. Foresight into future

cash flow, profitability, and expenses allows businesses to identify which strategies will

lead to sustainable growth.

Moreover, financial models make tracking progress toward growth targets easier by comparing

your actual data with the model’s projections. Knowing how far or near the actual

performance is from the projection can guide businesses in deciding whether to refine their

strategies or keep the course.

Enhanced cash flow management

Businesses can also build financial models to enhance their cash flow management. With a cash flow model, companies can

anticipate potential cash shortages or surpluses that impact

business operations.

Knowing when you’re approaching a cash dip allows you to be more proactive and avoid any

last-minute borrowing of money. Similarly, anticipating extra cash lets you allocate your

resources more effectively, whether through reinvestment in the business or paying down

existing debts.

Financial models are also valuable when optimizing the timing of your suppliers' payments

and collecting customer receivables. Aligning your inflows and outflows minimizes the risk

of shortages and ensures you can always cover your business obligations.

Attracting investors and securing funding

A robust and well-constructed financial model is essential for attracting investors,

particularly for startups looking for angel investors or venture capitalists.

The first thing investors look for when considering your business is your plan for growth

and profitability, which you can effectively showcase with a financial model.

In addition, a proper financial model instills more confidence in investors. It demonstrates

your deep understanding of the business and shows that you have comprehensive plans to

achieve the company’s goals.

Even SMEs can benefit from financial models when identifying the best type of funding to

target. Financial models project a company’s financial position by factoring in interest

expenses and loan repayment schedules, also known as debt schedules.

Using a debt schedule, the model can show how the company’s debts impact its cash flow and

profitability. This also allows entrepreneurs and lenders to evaluate if the business can

take on additional debt.

Risk assessment and mitigation

Risks are an inherent part of the business world. You can’t have a business without taking

risks! The key to being a successful entrepreneur is knowing how to navigate and mitigate

these risks.

Financial models aid businesses in risk management by helping them prepare for different

outcomes, including worst-case scenarios. Through scenario planning, businesses can simulate

scenarios like market downturns or cash flow shortages and see what

risks these situations

pose and how they impact the business’s finances.

Being proactive in identifying risks allows you to create contingency plans or strategies to

minimize or eliminate these risks.

In addition to scenario planning, financial models' revenue and expense projections act as

early warning systems for your financial performance. By continuously updating your

financial model, you can detect potential shifts in your cash flow or profitability and take

action if necessary.

What are the essential components of a financial model?

A financial model is a tool that simulates or forecasts the company’s financial position

based on various conditions.

To create an accurate and effective financial model, SMEs and startups need to include these

essential components:

Historical Data

One of the main components and foundation of a financial model is historical data.

Historical data gives business owners valuable insights into trends or patterns and helps

them understand what has worked and what hasn’t.

Reliable historical data also ensures that your assumptions are grounded in reality, making

your model more accurate.

Key Assumptions

All financial models require creating assumptions that serve as input variables for your

model. Assumptions are educated estimates of future financial metrics like COGS, operating

expenses, capital expenditure, revenue, etc.

Key assumptions should be realistic and well-researched to create accurate forecasts of your

financial statements. This way, business owners can make more informed decisions using their

model's projections.

Financial Statements

Three financial statements are the cornerstone of financial modeling, providing comprehensive information on a company’s financial health. It consists of:

These three financial statements should be interconnected to provide a holistic view of a

company’s financial performance. Changes in one statement will impact the others.

By projecting future financial statements, one can anticipate potential challenges and

opportunities. This allows you to make proactive decisions and develop contingency plans.

Investors also use this three-statement model to evaluate a company's investment potential.

Supporting Schedules

In addition to the core financial statements, supporting schedules show more detailed

calculations for depreciation, working capital, and debt.

Supporting schedules help provide more clarity by breaking down the elements that influence

your projections. For example, a debt schedule outlines the specifics of your debts, which

helps in projecting how debts impact your cash flow over time.

How to build a financial model?

With proper guidance and understanding, SMEs and startups can start to build a financial model with these simple steps:

Step 1: Calculate your KPIs

The first step in building a financial model is identifying the key performance indicators

(KPIs) you want to track when assessing the business’s financial health.

For example, if your focus is improving your cash flow, calculating cash flow KPIs like

quick ratio, cash conversion cycle, or free cash flow will be beneficial.

Your KPIs serve as benchmarks for your financial performance. Tracking them helps you better

understand how they evolve so you can make more realistic assumptions about your future

financial health.

Step 2: Create your assumptions

Make your assumptions as realistic as possible by relying on historical data, market

research, or industry benchmarks.

For example, a small clothing shop can use assumptions like monthly sales growth and

inventory turnover rate, which is how quickly the shop sells through its inventory. If the

sales go above a certain level, the model might show that the business should order more

stock or introduce new products.

Documenting your key assumptions is also essential so you can easily adjust them when needed

or when more information becomes available.

Step 3: Construct and reconcile your financial statements

The next step is constructing your forecast period’s financial statements: income statement, balance sheet, and cash flow statement. When forecasting these statements, you can choose between these two methods:

If your business or startup has been operating for some time, use your historical financial

data to create these statements.

For early-stage businesses that don’t have financial statements yet, you can rely on market

research and assumptions when constructing your reports.

For businesses that have fallen behind on financial report preparation, you may want to

consider hiring experts to help you get back on track and ensure your financial data are

up-to-date.

Once your financial statements are ready, you should also ensure they’re consistent and

interconnected.

For example, the net income in the income statement should be reflected in the equity

portion of the balance sheet, as well as the operating activities in your cash flow

statement. It’s best to use formulas or software tools to check for

discrepancies and adjust

when needed.

Step 4: Conduct further analyses

Now that the model is almost set up, start analyzing it by testing different scenarios and

stress testing it accordingly.

Conduct a sensitivity analysis to determine

how changes in key inputs and assumptions affect

your financial performance. This test shows how sensitive your model is to variable changes

and which have the most significant influence on your projections.

Similarly, stress test your model to ensure that errors will not occur as the business

continuously updates it.

Stress tests push the model to the

limits by testing all possible values, such as increasing

or decreasing them significantly or even setting them to zero, to see how the model

responds. The goal is to identify potential errors that could affect its performance.

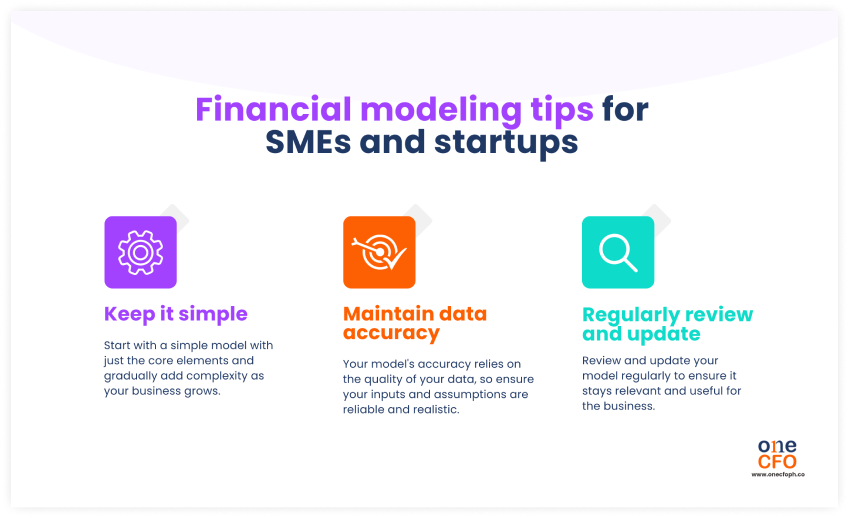

Financial modeling tips for SMEs and startups

Are you ready to build your financial model? Here are some helpful tips to get started:

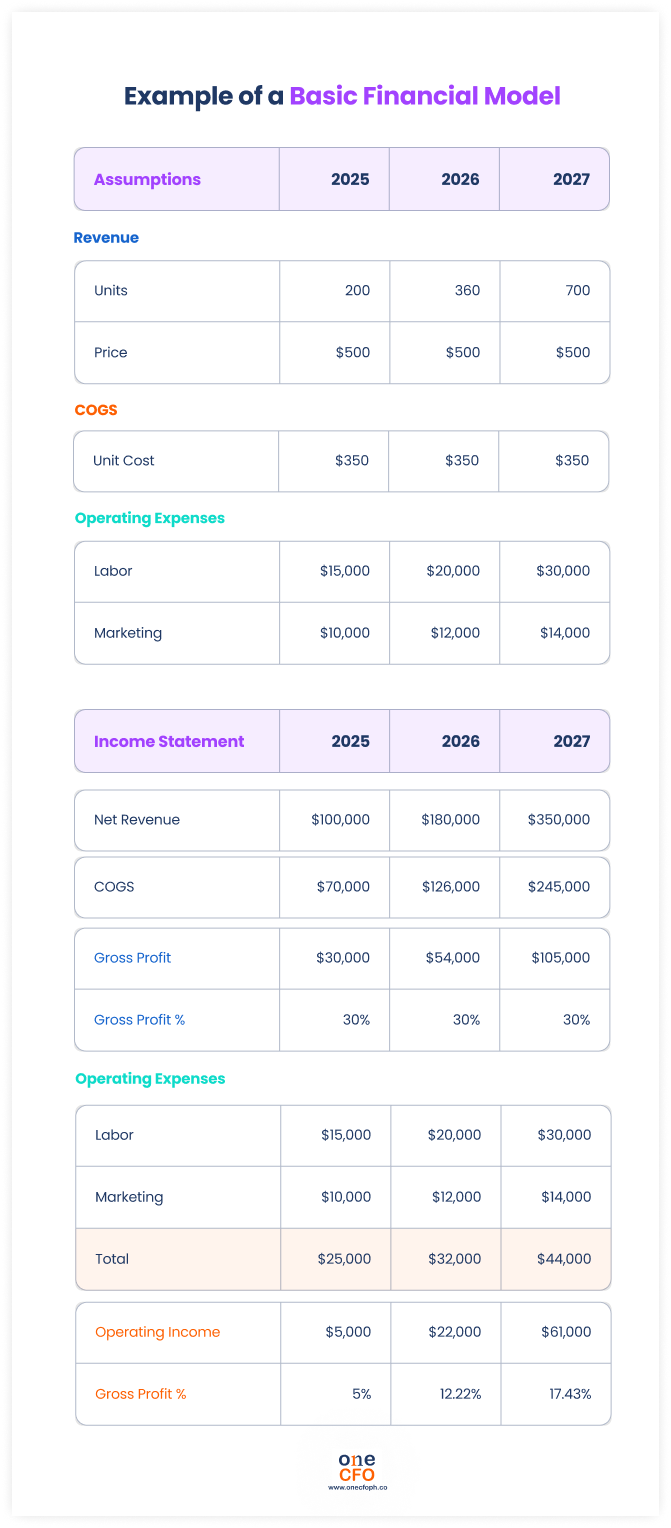

Keep it simple

The first rule of thumb in building financial models is to keep them simple. Start by

creating a basic model with essential elements, such as revenue, expenses, and cash flow.

In the example, you can simply create your assumptions on how many units you’ll sell, the

pricing, unit cost, and your operating expenses. From these assumptions, you can then create

a model projecting your operating income.

A simple financial model is easier to maintain and prevents business owners and finance

teams from being overwhelmed.

As your business needs grow, you can add complexity to your financial model by introducing

more layers and variables.

Maintain data accuracy

Financial models follow the principle “Garbage in, garbage out,” which essentially means

that your model is only as good as the data or inputs used to make it.

Business owners and founders must ensure the accuracy of the financial data fed to the

model. If available, use reliable historical data or ensure your assumptions are realistic.

The more accurate your financial model is, the more valuable it becomes in helping

businesses make informed decisions.

Financial data accuracy starts with proper bookkeeping. Watch this video to learn

bookkeeping best practices:

Regularly review and update

Building a model isn’t a one-time task. After creating it, you should consistently maintain

it through regular reviews and updates.

Furthermore, business and market conditions are rapidly changing, so it's important to

adjust your model and assumptions to reflect these changes. It’s also essential to use your

latest data, such as sales figures, expense reports, and more, to update your model.

A good practice is to review your model and update it monthly or quarterly to maintain

awareness and foresight into your business's long-term direction.

Partner with a fractional CFO for expert financial modeling

Financial modeling is a powerful tool that helps SMEs and startups create growth strategies,

manage their cash flow, fundraise, and mitigate risks.

However, to fully maximize the advantages of a financial model, you’ll need the knowledge

and experience to build it around your business's specifics.

Also, as your business evolves, so do your financial modeling needs. Creating complex models

to address specific challenges can be time-consuming and require expertise.

That’s why partnering with a fractional CFO at OneCFO can be a

game-changer for SMEs and

startups. Running a business or startup is already a handful, so delegating financial

modeling tasks to an expert ensures they are done accurately and correctly.

As your growth partner, OneCFO can take your financial modeling worries off your shoulders

and ensure you can focus on growing your business.

Visit us at onecfoph.co or email us at [email protected] to

discover how our CFO services for small businesses can empower you to make the right

decisions and implement strategies to boost profitability.

Read our disclaimer here.