July 31, 2024 | 11:53 am

Table of Contents

Startup founders juggle a million things, but navigating the complexities of financial

management can be a major hurdle. Here’s where hiring a fractional CFO becomes your secret

weapon.

A fractional Chief Financial Officer (CFO) offers the strategic expertise and financial

acumen of a seasoned expert without the hefty price tag of a full-time hire. This translates

to benefits that can propel your startup towards sustainable growth and financial

stability.

Intrigued by how this works for your startup? Keep reading to discover the 10 key benefits

of hiring a fractional CFO.

What is a fractional CFO?

A Chief Financial Officer (CFO) is a C-level executive primarily responsible for managing a

company's finances. Having one is a big plus for any business.

The CFO role goes beyond processing financial data. CFOs provide strategic guidance in

financial analysis, cash flow management, financial modeling, budgeting, and more.

However, despite the importance of the CFO role, many startups find it a luxury to hire one.

Often, early-stage businesses may find hiring CFOs beyond their current financial

capabilities. There are also instances when their needs don't warrant having a full-time CFO

on staff.

This is where the value of fractional CFOs comes into play.

A fractional CFO performs the duties of a traditional CFO on a part-time or project basis.

These financial experts leverage their knowledge and experience to assist with

decision-making, short and long-term strategies, and business growth.

Hiring a fractional CFO is an innovative solution for startups that need the expertise of a

CFO without breaking the bank or for those requiring temporary financial leadership.

Because of their unique arrangement, fractional CFOs offer startups several key benefits,

including cost-effectiveness, flexible engagement, and access to a broader network and

expertise.

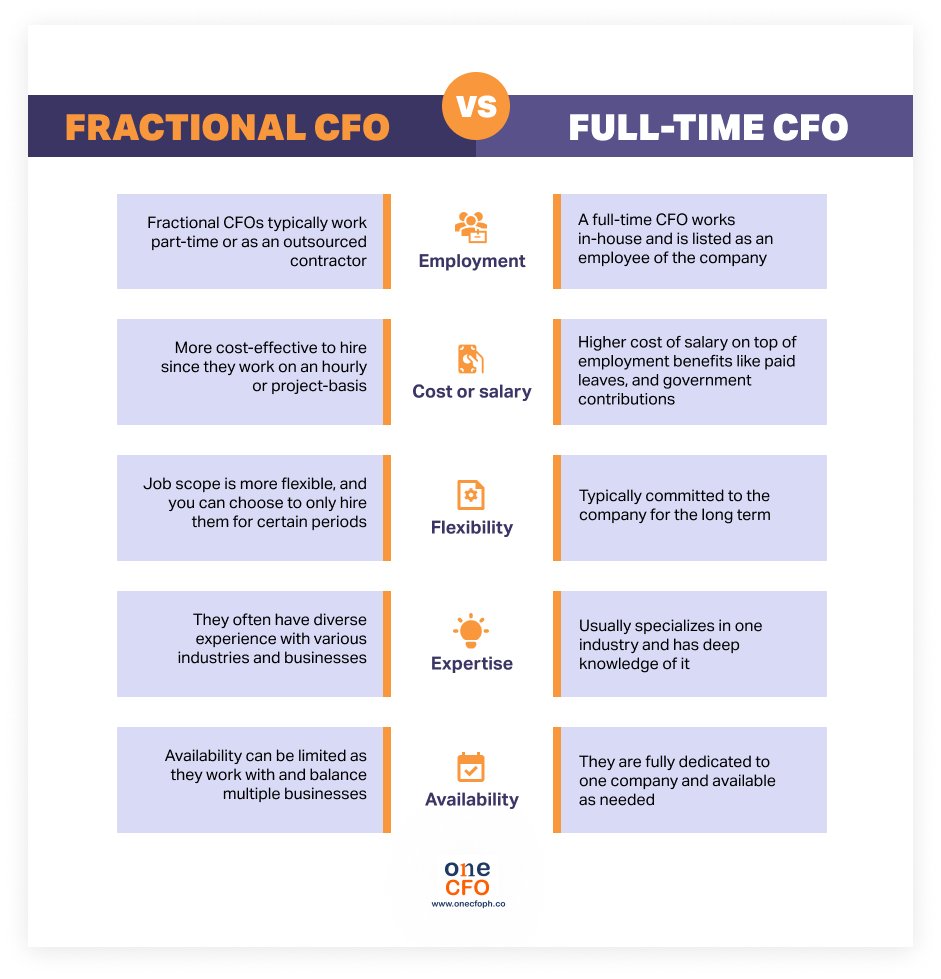

Fractional CFO vs. Full-time CFO: What are the differences?

A fractional CFO is similar to an

in-house or full-time CFO but offers the same services on

a contractual basis and at a fraction of the cost. These experts are known for their

extensive experience working as CFOs with various companies in different industries.

Although fractional and full-time CFOs offer generally the same services, there are some

major differences between the two:

What is a fractional CFO?

Here are some reasons why you need a fractional CFO in your startup:

#1 Enhanced business efficiency

Many founders are knowledgeable about their chosen business, often possessing industry

expertise or being skilled in selling products or services. But, it’s also rare for these

founders to have exceptional skills in business finance, which are crucial for growth.

Juggling multiple funding rounds, managing investor relations, and navigating intricate tax

regulations can quickly become overwhelming.

A fractional CFO frees up the founder’s time to focus on core competencies and excels at

setting up financial systems that enhance business efficiency. Some examples are automating

the company's bookkeeping process and introducing software and tools for accurate

accounting.

These seasoned financial experts can seamlessly integrate themselves into your existing

systems, providing the expertise and bandwidth you need to navigate the complexities with

confidence.

#2 Greater focus on financial health

To build a successful business, you need to grasp your numbers and ensure your finances are

managed effectively. Having a dedicated CFO, even a fractional one, ensures that there’s an

expert who is tracking and improving your business’s financial health.

Fractional CFOs can build financial projections, which

aim to predict potential risks and

devise action plans to mitigate them.

Furthermore, fractional CFOs are exemplary in managing cash flow, ensuring that

the business

consistently has enough to cover its dues and can survive any cash crunch.

Learn what fractional CFO experts have to say about how to

effectively manage your cash

flow:

#3 Strategic decision-making

Bringing a fractional CFO into your business makes decision-making more strategic, as you

can base your choices on accurate financial information. Key decisions, like the right time

to scale, introduce a new product, or make investments, are all better informed with a CFO's

insights.

Using numbers and facts, fractional CFOs keep businesses on track to achieve their

short-term and long-term goals. They contribute to this by tracking KPIs and advising on how

to reach target values.

An example of an essential KPI that fractional CFOs track is monthly recurring revenue

(MRR), which helps businesses understand their predictable revenue. Learn more about MRR

here:

#4 Cost-effective option

Fractional CFOs are an excellent choice, especially for early-stage startups and businesses

that keep business expenses to a minimum but are in need of

high-level financial expertise.

With fractional CFOs, businesses have access to a C-suite-level expert at a more affordable

cost.

Since fractional CFOs typically operate on a part-time or project basis, companies are not

obligated to provide them with the same compensation packages and full benefits as regular

employees.

Furthermore, the expense associated with recruiting and hiring fractional CFOs is notably

lower than hiring one full-time.

In a traditional hiring process for a senior role, companies incur expenses such as job

posting fees, recruitment agency charges, interview-related costs, signing bonuses, and

other administrative expenses - many of which are unnecessary when engaging fractional CFOs.

#5 Flexibility with scope

Another critical advantage of hiring a fractional CFO is the flexibility they offer. Unlike

full-time employees, founders can tailor the scope of service they get from fractional CFOs

depending on their current stage or needs.

This flexibility is particularly beneficial for companies with budget constraints, as

fractional CFO fees can be adjusted based on the scope of work. Fractional CFOs are also

ideal for businesses that require their expertise intermittently or for specific projects.

Engaging a fractional CFO is also a great way to test the waters before committing to a

full-time hire. Since they are outsourced, you have the freedom to decide whether to

re-engage them after the contract ends.

When hiring fractional CFOs, you can choose between getting them on a retainer basis or a

project basis.

Retainers allow fractional CFOs to work with your team on an ongoing or monthly basis,

covering the full job scope of a CFO. On the other hand, project-based CFOs only work on

specific tasks, depending on the startup’s needs.

Watch the video to learn more about outsourced CFO services:

#6 Broad expertise

Fractional CFOs possess theoretical knowledge and bring years of experience working with

multiple businesses across various industries. Their diverse backgrounds enable them to

tackle challenges of varying complexity within a company.

Beyond their extensive expertise, fractional CFOs offer fresh perspectives, innovative

ideas, strategic insights, and best practices in business finance—skills honed through years

of hands-on experience.

As seasoned financial veterans, fractional CFOs require minimal training and supervision.

They can hit the ground running and start making positive changes in the business

immediately.

#7 Extensive network and connections

Because of their diverse experience, fractional CFOs have also built an extensive network,

which can be a big advantage for your business.

With a fractional CFO’s broad connections, they can help you form strategic partnerships

that will lead to various growth opportunities for the company. Some of the people your

fractional CFO can connect you to are:

#8 Increased stakeholder confidence

If there's one thing investors and stakeholders have in common, it's the expectation of

proper and robust financial management from the companies they're connected with. With a

seasoned fractional CFO on your team, you can provide your stakeholders with additional

confidence that the company's finances are in capable hands.

Fractional CFOs ensure transparency and timely reporting, helping investors gain clear

insights into your company's financial health. These accurate reports are particularly

beneficial when seeking outside funding, whether through investments or debt financing.

Having a fractional CFO in your boardroom boosts confidence among your investors as they can

effectively communicate and defend the business’s financials and models.

Lastly, fractional CFOs ensure that founders fully understand the business's current

standing and help develop strategies that would deliver the investors’ expectations.

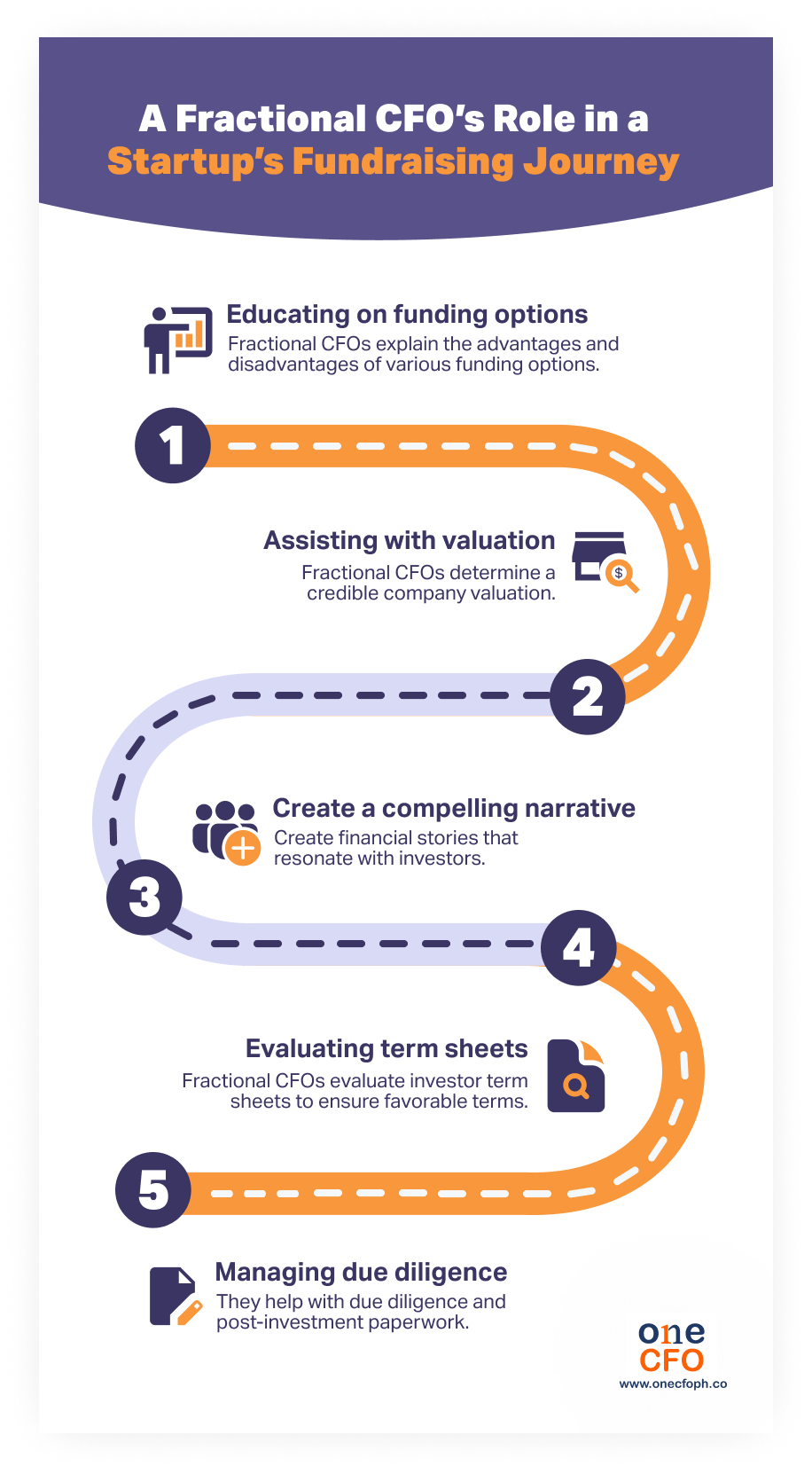

#9 Fundraising assistance

Most businesses require external funding to expand or scale, but the fundraising process can be tedious for founders.

Fractional CFOs help startup founders navigate the complex funding landscape by:

If the company opts for alternative funding sources, such as

loans, fractional CFOs can also

assist by comparing different banks and negotiating loan terms.

Here’s a video on fundraising options for your startup:

#10 Timely updates on industry changes

All businesses must comply with laws and regulations, but keeping up with these changes can

be a burden for founders who are already occupied with growing the business and running

daily operations.

Having a fractional CFO by your side ensures your business remains compliant by tracking

regulation changes and handling compliance

requirements, helping you avoid costly penalties

or, worse, business closures.

The recent EOPT Law highlighted the need for

businesses to stay informed regarding tax

regulation changes. With a fractional CFO, your startup can be confident about remaining

updated about such regulatory shifts and adapting to these changes effectively.

Their broad experience across multiple industries has equipped fractional CFOs with

knowledge about diverse regulatory requirements and industry changes. This expertise allows

them to help your business adopt best practices in your line of business, remain

competitive, and mitigate risks effectively.

When should you hire a fractional CFO

Balancing growth and financial stability can be challenging for startup founders. A

fractional CFO provides the strategic guidance and expertise to help startups achieve their

goals.

In addition, the intricacies and complexities of financial processes can easily overwhelm

any founder or business owner juggling multiple responsibilities. However, hiring full-time

CFOs can also be too heavy on the pocket.

The best solution? Opt for fractional CFO services in the Philippines from trusted experts

like OneCFO!

Engaging OneCFO's fractional CFO service offers the same expertise as a full-time CFO, but

we align our engagement to a startup's specific needs and budget.

OneCFO offers

startups reliable, world-class CFO services, including establishing financial

systems and processes, producing accurate and timely reports, providing valuable insights,

and much more—all at an affordable cost.

Furthermore, if you are looking at rasing capital, OneCFO will set your startup up for

success. Our team of financial experts helps startup founders understand different

fundraising options and provide investor-ready financial models. You will also gain

assistance in creating your pitch deck and evaluating term sheets.

Visit us at onecfoph.co or email us at [email protected] to

learn how we can drive growth

and value in your startup with fractional CFO services.

Read our disclaimer here.