September 19, 2024 | 2:27 pm

Table of Contents

Maintaining a healthy cash flow is crucial for business success and resilience. To improve

business cash flow, entrepreneurs should understand its current state by tracking and

measuring key cash flow KPIs.

Cash flow is simply the movement of money in and out of business. A financially healthy

business typically has a positive cash flow, meaning more money is coming in than going out.

However, measuring additional metrics beyond positive cash flow is essential to truly

understanding the business's financial health.

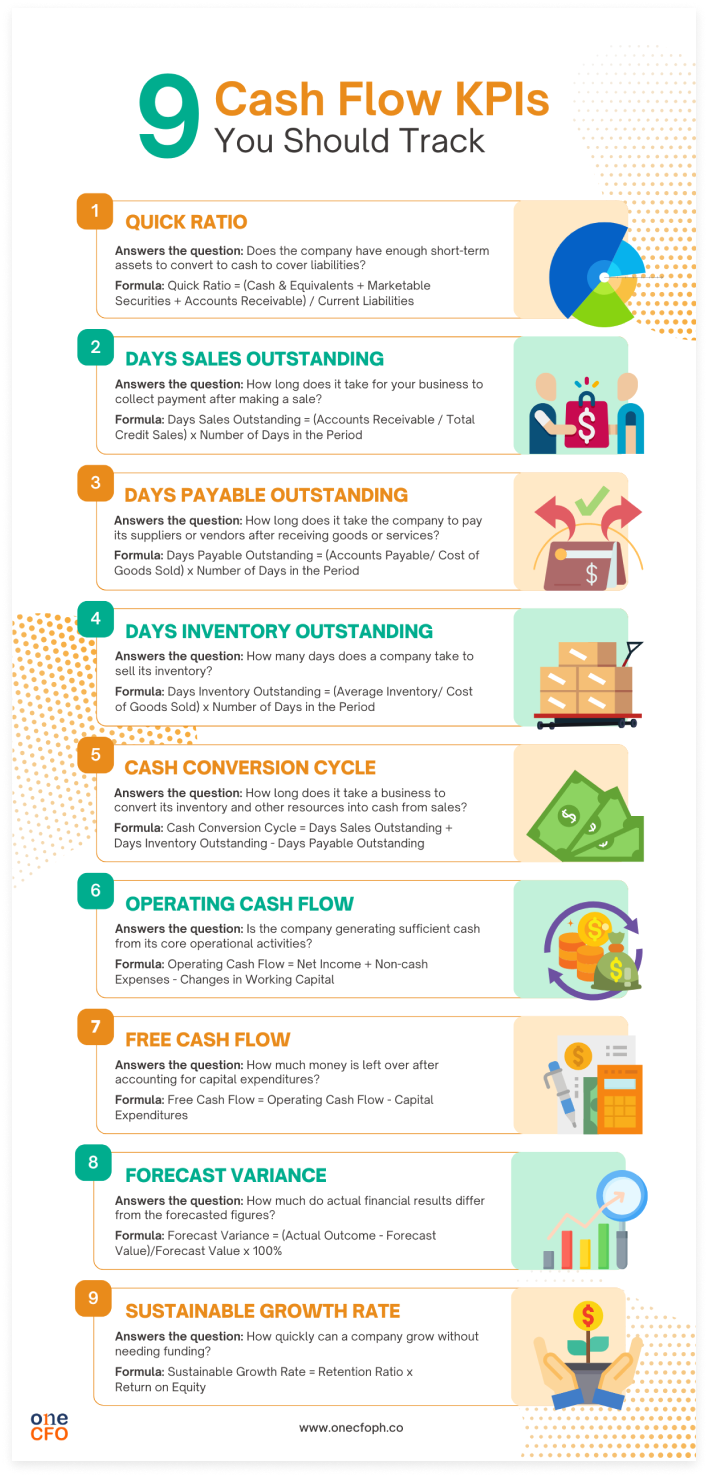

There are many key performance indicators (KPIs) related to cash flow, and tracking them all

can be overwhelming. By focusing on a select few KPIs, you can streamline your efforts and

more effectively strategize to improve and maintain healthy cash flow.

Explore the different cash flow KPIs that truly matter for SMEs, and learn how to utilize

them to improve your business cash flow.

What are cash flow KPIs?

Improving your cash flow and keeping it healthy is

critical to business success - which is

where cash flow KPIs come into play. Cash flow KPIs are specific financial indicators or

metrics that help you evaluate the health of your business cash flow.

Unlike other KPIs that track, sales, customer experience, marketing, or process performance,

cash flow KPIs measure the inflows and outflows of cash in your business to ensure your

business is liquid enough to cover expenses.

Businesses gain accurate insights into areas needing improvement by measuring and tracking

cash flow KPIs. This enables them to make more informed decisions about optimizing expenses,

improving payment collection, and better managing cash reserves.

Additionally, financial institutions and investors use finance KPIs to assess the viability

of lending or investing in a business.

What are the most important KPIs for cash flow?

Here are the top KPIs you should measure and track to improve business cash flow:

#1 Quick Ratio

The quick ratio is a liquidity ratio that determines

whether a company is liquid enough to

meet its short-term obligations.

In business terms, liquidity means the ability of a

company to convert its assets into cash.

Lenders or financial institutions use the quick ratio to measure financial fidelity or

trustworthiness and decide whether a company should be approved for a loan.

A quick ratio of 1:1 indicates that the company has enough liquid assets to pay its current

liabilities. The higher it is, the more capacity the business has to pay its short-term

liquidity position.

How is the quick ratio calculated?

How to improve quick ratio?

Some of the ways you can improve your quick ratio are:

#2 Days Sales Outstanding

Days sales outstanding (DSO) is the average time your

business gets paid after a sale.

Low DSO values show that your business collects its receivables quickly, obtaining more cash

for your operations and growth. However, high DSOs indicate that the company waits a long

time to collect its money, causing cash flow issues.

When comparing DSOs, only consider businesses along the same industry or business size, as

every industry may have very different benchmarks.

Formula for Days Sales Outstanding

What is a good DSO ratio?

A good DSO number generally falls below 45 days. This means that, on average, a company

collects payments for its credit sales within 45 days. A rising DSO can indicate issues with

credit management or collection processes.

The acceptable DSO number can vary significantly depending on the industry and specific

business practices.

Larger, more complex businesses may have higher DSOs due to more intricate invoicing and

payment processes. In addition, the terms offered to customers, such as 30- or 60-day terms,

directly impact DSO.

Different industries have different DSOs. It's also important to compare your DSO to

industry benchmarks and track it over time.

How to improve DSO?

The key solution to reducing your DSO involves enhancing your payment collection process, which can be achieved through the following steps:

You can also watch this video to learn more about how to enhance your payment collection strategy and other tips for improving cash flow:

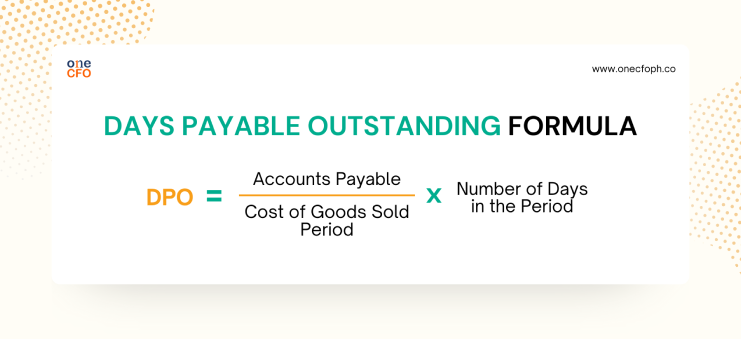

#3 Days Payable Outstanding

Days payable

outstanding (DPO) measure the time it takes for the business to pay its

suppliers or creditors. DPO also shows operational efficiency and resource use by SMEs.

High DPOs suggest that the business retains its cash longer, which is advantageous for SMEs

when making short-term investments. However, excessively high DPO means the company delays

payments too much, potentially straining supplier relationships or missing out on favorable

credit terms.

Conversely, a low DPO could mean the company pays invoices too quickly. In this case,

businesses do not utilize the suppliers' and creditors' payment terms, limiting their cash

flow.

However, in some cases, businesses maintain low DPOs to maximize early payment discounts.

Formula for DPO

How to improve DPO?

Businesses should find the most advantageous timing for making payments by:

#4 Days Inventory Outstanding

Days inventory outstanding (DIO) measures how many

days it takes for a business to sell its

inventory.

You don’t want your inventory to sit idly for long as a business owner. A low DIO simply

means you’re able to sell your inventory quickly, leading to lower holding costs and

improved business liquidity.

However, an excessively low DIO could suggest insufficient inventory to meet demand, leading

to lost sales and customer dissatisfaction.

Meanwhile, a high DIO could mean your sales are slowing down, or you’re overstocking your

goods. Slow-moving inventory negatively impacts your cash flow as it ties up your cash in

these unsold goods and incurs additional storage costs.

How to calculate DIO

How many days of inventory are good?

A good DIO typically falls between 30 and 60 days. This means that, on

average, inventory

sits on the shelves for 30 to 60 days before it’s sold.

Different industries have different average DIOs. Industries whose products have short shelf

lives or high demand volatility require lower DIOs.

In addition, lead times for replenishing inventory and transportation costs can influence

the length of DIOs. However, insufficient inventory can result in lost sales and customer

satisfaction, and excessive inventory can lead to higher carry costs.

How to improve DIO?

Here are some strategies you can implement to improve your DIO and inventory management:

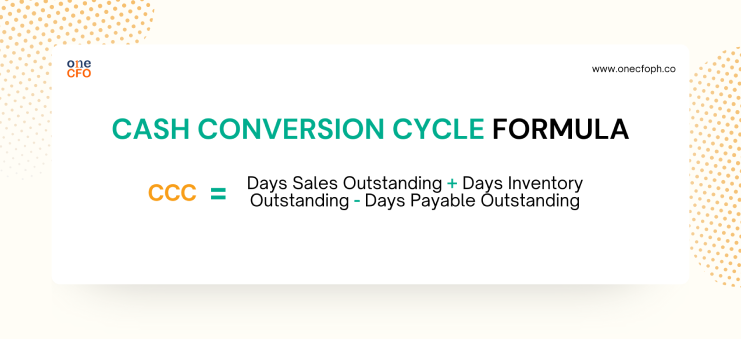

#5 Cash Conversion Cycle

Also known as the net operating cycle, the cash conversion cycle (CCC) shows how efficient a

business is in turning cash into inventory and back into money, which involves the

production or purchasing process, sales, and customer payments.

The shorter the CCC, the less time your cash is tied into inventory, allowing you to invest

for growth.

In contrast, a longer CCC can lead to a negative cash flow, especially when your business

takes so long to sell inventory or collect payments. You can learn more about negative cash

flow and other aspects of cash flow management here:

Formula for Cash Conversion Cycle

By combining these three KPIs, the formula for CCC is:

How to improve CCC?

Apart from the tips in improving DSO, DIO, and DPO, you can lower your CCC by:

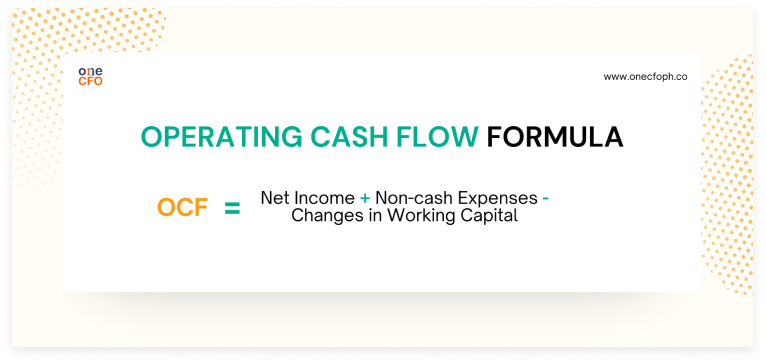

#6 Operating Cash Flow

Operating cash flow (OCF) represents

the total money generated from a business's regular

operations. This KPI is usually found in the first section of a cash flow statement and can

either be positive or negative.

A positive or high OCF signifies that the company can cover its operational expenses and has

the potential to reinvest in its growth. Meanwhile, a negative or low OCF means the business

may struggle to sustain its current operations.

How to calculate Operating Cash Flow

How to improve OCF?

For businesses with low OCF, here are some steps to improve this KPI:

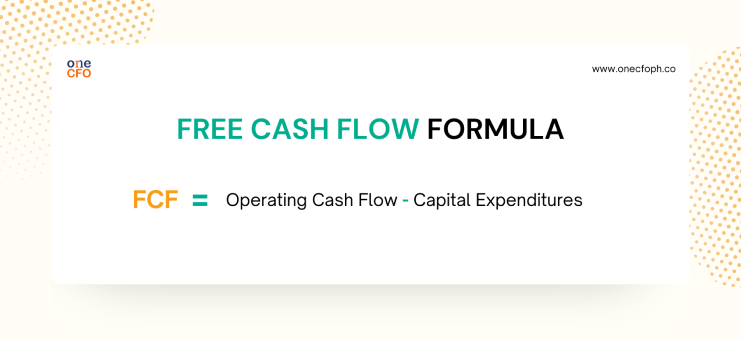

#7 Free Cash Flow

While OCF only accounts for operational expenses (OpEx), which cover the day-to-day costs of

running the business, free cash flow (FCF) considers both

OpEx and capital expenditures

(CapEx).

CapEx is an investment in long-term assets that support future growth and capacity,

including equipment, property, vehicles, and technology upgrades. Meanwhile, OpEx is

typically recurring costs relating to business operations, such as rent, utilities, and

salaries.

FCF shows how much money is left over after settling short-term liabilities from business

operations and spending on properties or equipment. A high or positive FCF means the

business has enough surplus cash for debt repayments, dividend distribution, or growth

reinvestment.

How to calculate Free Cash Flow

How to improve FCF?

Improving your OCF also impacts your FCF positively. But apart from that, some tips for enhancing FCF are:

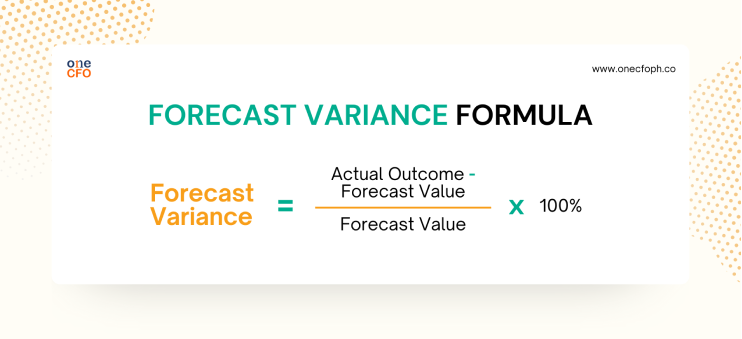

#8 Forecast Variance

Creating cash flow projections or forecasts

helps predict a company’s financial position in

the future. Forecasts can predict cash shortages and surpluses and assist with scenario

planning.

With forecast variance, businesses can

assess the accuracy of their projections by showing

the difference between the forecasted cash flow and the actual outcome.

A high variance indicates a need to reassess the forecasting process and identify

significant cash flow changes to consider moving forward.

On the other hand, the lower the variance, the more reliable the business’s cash projections

are, making them more useful for decision-making, such as preparing annual budgets.

Learn more about how you can prepare your annual budgets here:

How to compute Forecast Variance

How to improve forecast variance?

Tracking forecast variance over time will significantly improve the accuracy of your projections. Here’s how you can lower forecast variance:

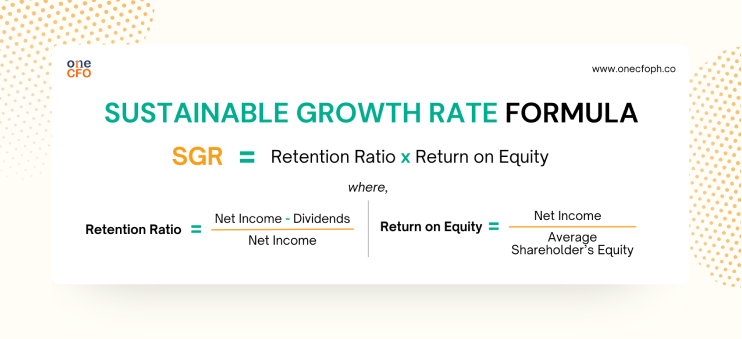

#9 Sustainable Growth Rate

The sustainable growth rate (SGR)

defines how fast a company can grow without additional

debt or external funding.

A high SGR value signifies a combination of maximized sales efforts, a focus on high-margin

products, and proper inventory management.

However, sustaining a high SGR over long periods is challenging. As a company grows, it may

reach a point where profits and retained earnings are no longer enough to expand the

business.

When growth stagnates due to these limitations, the company will need additional funding to

keep growing. Businesses can decide to take on external funding from loans or

investors or

explore new product lines that can generate new revenue streams.

Formula for Sustainable Growth Rate

How to improve SGR?

A high SGR means the company is well-positioned for self-funded growth. Here’s how you can achieve it:

Track the Right Cash Flow KPIs with OneCFO

Just as humans depend on proper blood circulation for health, a business relies on efficient

cash flow management to ensure its operations run smoothly. To achieve a healthy cash flow,

businesses must use the right KPIs that accurately reflect cash flow efficiency.

However, measuring, tracking, and interpreting these KPIs require financial experts, like

CFOs, who possess deep financial knowledge to translate these metrics into informed business

decisions effectively.

Accessing the expertise of a CFO for your business is now within reach through OneCFO.

OneCFO is your trusted partner for growth, providing SMEs and startups with reliable CFO

services at a fraction of the cost! With OneCFO, you can benefit from accurate and

invaluable financial insights designed to optimize your cash flow and drive your business

forward.

Visit us at onecfoph.co or email us at [email protected] to

learn how our premiere

fractional CFO services can help you avoid cash flow challenges.

Read our disclaimer here.