August 1, 2023 | 6:20 pm

Table of Contents

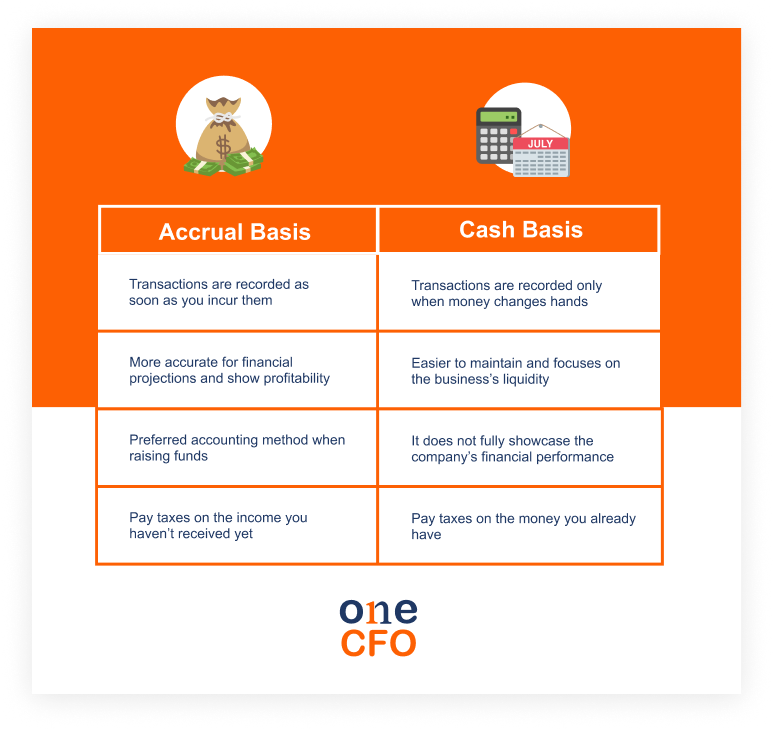

Accounting is part and parcel of running a small business, but owners may need to be more familiar with the different accounting methods. Choosing between the cash and accrual basis is essential as it affects the recording of transactions, management of finances, or paying taxes. But what’s the difference between cash basis and accrual basis accounting? And how do you know which is appropriate for your business? The main difference between accrual basis and cash basis is the timing of when transactions are tracked or recorded.

Each accounting method has advantages and disadvantages, so you need to assess and choose which one your business needs. This guide breakdown the differences between accrual and cash basis and the pros and cons of each method.

What’s the difference between cash basis and accrual basis accounting?

Small businesses must understand the differences between each accounting method as it impacts how financial transactions are recorded and reported. Understanding both ways helps small business owners make informed decisions, comply with accounting standards, and present a clear financial picture.

What is the accrual basis of accounting?

In the accrual basis

accounting method, you record your income and expense as accrued.

There’s no need to wait to receive your money or pay your bills when recording transactions.

For instance, revenue is recognized in the books on services rendered or goods sold, even

though the customer hasn’t paid yet. Likewise, you record your expenses as soon as a bill or

invoice is received, even when not settled.

Since income and expenses are tracked before money changes hands, your books should show

accounts payable and accounts receivable records.

Knowing how much money you will earn and

spend also gives you a more accurate picture of your business’s financial status.

What is the purpose of the accrual basis of accounting?

There are instances when it’s best to use the

accrual basis for your accounting method.

Large businesses with a more complex financial management system mainly use the accrual

basis. On top of cash flow, these businesses need to track their assets, investments, and

liabilities to depict an accurate financial picture.

Big companies also usually deal with financial transactions involving credit and invoicing

at a later date, which the accrual basis correctly tracks.

Small businesses can also use the accrual basis, especially if they have inventory to

account for. It’s also best for companies that make or accept credit card payments to use

the accrual basis since banks can take a few days to reflect these payments on your

account.

What is the cash basis of accounting?

The cash basis method, or cash receipts and disbursements method, is a more simplistic way

of tracking your transactions.

Unlike the accrual basis, the cash basis method lets you record

your transactions once money

changes hands. This method also does not track accounts payable and receivable since you

only record revenue after receiving the money and expense after paying for it.

Who uses cash basis accounting?

Many sole proprietorships and small businesses that are short on staff prefer using the cash

basis because it is easier to maintain. Furthermore, this method is more straightforward

when tracking your transactions.

This method is also excellent for cash-only businesses, like sari-sari stores and vending

machines, since they mostly don’t need to consider credit-related transactions.

What are examples of accrual and cash basis in business?

Your choice of accounting method dramatically affects how you do your business - from

recording transactions, monitoring financial status, building external relationships, and

doing taxes.

Here are the ways accrual basis and cash basis are applied in business:

Bookkeeping practices

In business, bookkeeping includes recording all your transactions on a ledger, essential in tracking your financial activities and claiming possible tax deductions. How you track and recognize your revenue and expense mainly depends on the chosen accounting method.

Revenue Recognition

Regarding revenue recognition, the income recording depends on the business's accounting

method. The business recognizes the revenue after selling the goods or rendering the service

on an accrual basis. Meanwhile, the cash basis recognizes revenue only after receiving the

payment.

Suppose you sell clothes online, and a customer purchases a shirt and pays it via cash on

delivery or COD.

If your business uses the accrual basis, record the income in your books as soon as the

customer places the order or once you send the invoice. Meanwhile, if you are using the cash

basis, only recognize the income when the customer pays upon delivery or as soon as the

money reaches your bank account.

Expense Recognition

For expense recognition, the accrual basis tracks the expense when the business receives the

invoice, supply, or service from another merchant. Conversely, a business using the cash

basis only records an expense after they pay for it.

Let’s say you received your wifi bill, due in 20 days, and only decided to settle it on the

due date.

Under the accrual basis method, the amount you must pay is recorded as an expense as soon as

you receive the wifi bill. On the other hand, cash basis method lets you record the payment

only when you settle the bill.

Tip: If you choose the accrual basis, we recommend including the following dates in your

books when recording transactions so you can easily track your money: 1) the date of the

sale of the product or rendered service, 2) the invoice date, 3) the payment date

Financial planning

Proper financial planning, which includes maintaining good bookkeeping practices and choosing the right accounting system, makes the best business decisions.

Between the two methods, the accrual basis allows to create more accurate financial

forecasts and projections.

With the accrual basis, entrepreneurs can better budget their money and evaluate if they

still have enough to make it through the next few months. One can also accurately calculate

profitability and see how the business performs.

On the other hand, the cash method only lets you see how much you have daily. This method

doesn’t show if there’s any income to expect or bills to pay.

The limitation in financial visibility using the cash method can also prevent businesses

from making decisions, especially in cash flow management. Companies

won’t see if they

have

any pending payments, which can lead them to overspend on other things.

Despite this, many small business owners still use the cash basis, especially if they don’t

have an accountant or don’t have a lot of financial moving parts in the business. For

example, small businesses with little to no inventory to account for, don’t offer credit

purchases, or can get by without tracking all their future payables may use the cash basis

accounting method.

Since they don’t have a lot of financing options available, small businesses prioritize

knowing their liquidity, which the cash basis method mainly tracks.

External relations

Expansion plans for the business may lead small business owners to borrow funds or seek

funding from investors. Doing so requires showing them the business's profitability or

overall financial performance.

The accrual basis is the best way to showcase the company's value when forming external

relations. Accrual basis is also the preferred method of most investors since they can

accurately see any future income and liabilities your business has.

Taxes

The choice of accounting

method also affects the tax due from the business.

Since the accrual basis requires the recording of income before the actual payment, the

income tax paid is on the money that still needs to be received. Likewise, small businesses

can take advantage of tax deductions even for unsettled expenses.

On the other hand, in the cash basis method, taxes are based only on the money received.

For example, assume you sent a customer an invoice on December 2023, due on January 2024.

When using the accrual basis method, you must declare the invoice amount as income and pay

income taxes for 2023. However, the cash basis method requires you only to record the

revenue when the customer pays, which could still be in the following year.

Which is better: cash or accrual accounting?

Each accounting method has its advantages and disadvantages. As a business owner, assessing these pros and cons is essential to see which method best fits your business needs.

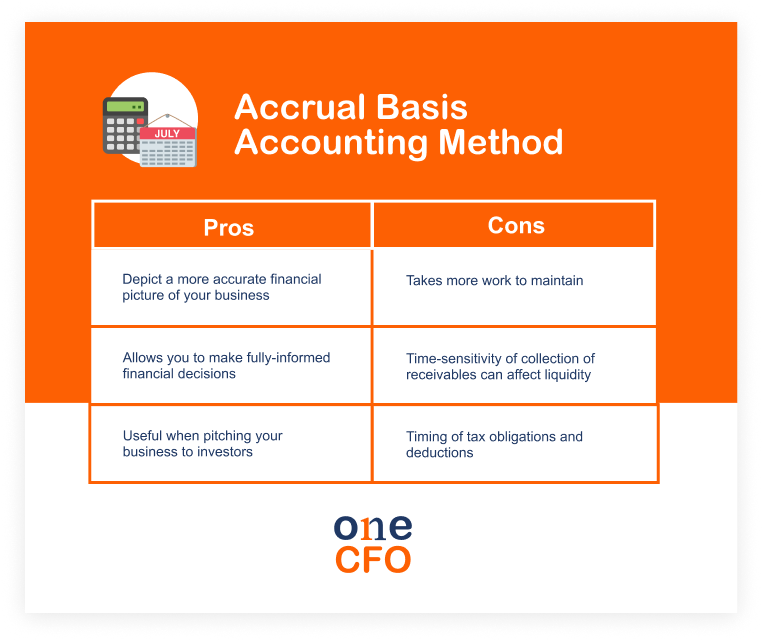

Pros and cons of accrual accounting for your small business

One of the advantages of using the accrual basis is it allows better planning for the long

term and gives an accurate picture of your business’s profitability. This picture also helps

investors assess your company’s financial performance, making it easier to pitch your

business.

Moreover, having visibility on future revenue and expenses depicts a more accurate financial

picture of the company. Knowing your payables and

receivables lets you know if you have

enough money to reinvest or need to catch up on sales. In other words, more visibility helps

you make fully-informed financial decisions for your company.

A disadvantage, however, is that this method can be challenging to maintain. Accrual

accounting involves more complex bookkeeping and accounting processes which may be

challenging for small businesses with limited resources and accounting expertise.

In addition, since the accrual accounting method records revenue and expenses when incurred,

it is crucial to track all accounts payable and receivable. There could be delays in

customer payments or refusal to pay. So constant monitoring of uncollected revenues and

unpaid expenses must be done to ensure timely collection and no short-term liquidity

challenges.

Another disadvantage is the timing of tax obligation. Small businesses may have to pay taxes

on income even if the payment has yet to be received, which disrupts the budget.

If you are a small business owner using the accrual basis, hiring or outsourcing an

accountant to help you manage your financial transactions would be best.

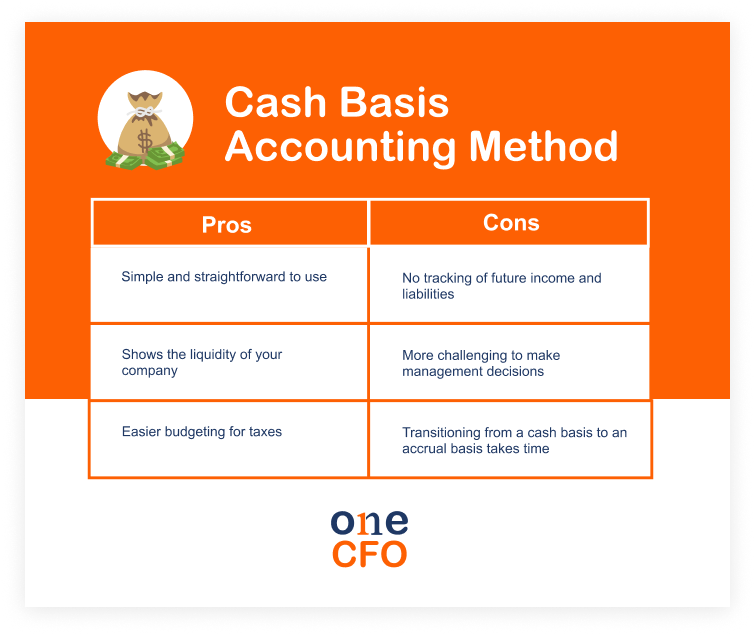

Pros and cons of cash basis for your small business

The most significant advantage of using the cash basis method is its simplicity. In this

method, you only track your money as it comes and goes, making it easier to manage and

maintain.

You can also monitor your liquidity or how much money you have

at a given time, which is

helpful in short-term financial planning in your company.

Making tax payments is also easier since you only pay taxes on the earned income. A tax

strategy automatically deducts taxes from customers' money rather than allotting an extra

budget.

Conversely, the cash basis method must be more accurate since it shows no future income or

liabilities. Making management decisions can be more complicated since you’re unsure if

there’s money coming in or out in the future.

The cash basis method can also be misleading since money in the bank doesn’t necessarily

reflect the available amount for use, especially if you have incoming bills.

Once a small business starts using the cash basis, it can also take time to transition and

switch to the accrual basis method.

Some instances when switching might make sense is when you need to obtain a business loan or

investment and need to show your business’s profitability. Banks and firms might request to

see your receivables and payables before giving you any money.

Another example is when you start working with credit payments or grow your business to a

point where you deal with multiple suppliers and inventories. Using the accrual basis helps

track unpaid invoices and alert you if you’re in the red.

Need help with your accounting system?

Choosing the best accounting method for your business depends on many factors. If you’re

still unsure which one to choose or need help managing your accounting, OneCFO is the one to

call!

OneCFO consists of a team of experts who can help you with financial management. From

bookkeeping, taxes, payroll services, and CFO services, OneCFO will be your partner every

step of the way so you can successfully grow your business.

Visit us at onecfoph.co or contact us at [email protected]

to learn how we can provide you with expert financial insights and services.

Read our disclaimer here.