June 9, 2023 | 4:09 pm

Table of Contents

Why do people start their businesses? It could be because of freedom, to be their boss, or

to pursue a passion. But business is not just about seeing your idea come to life but also

about making money.

However, being profitable in a business is more challenging than it sounds. Various factors

come into play when it comes to realizing profit.

And once you realize that your business is not making as much money as you think, it’s

essential to step into action and figure out why quickly.

You've come to the right place if you’re wondering why your business is not profitable.

Here, we outlined reasons why your small business is not making enough money and how you can

fix it:

Why isn’t my business making money

There are a lot of factors that can contribute to why your business is not making enough money now. Statistics show that only 10% of SMEs survive after operating for five years. Reasons include a lack of goals, mismanagement of business finances, wrong product or pricing, and issues marketing your business.

Reason #1: Failure to set the right goals

When you start a business, it's easy to say that your goal is to make money. But how will

you exactly achieve it? Reaching this goal won't be easy without a clear and strategic plan.

As an entrepreneur, your business goals should be SMART - specific, measurable,

attainable,

relevant, and time-bound. Setting SMART goals will give you a more concrete plan on how and

when to achieve them and also help you track your overall progress.

If you have no idea how to make a SMART goal, start by asking yourself these questions:

Another thing you should set up throughout your business is your Objectives and Key Results,

or OKRs. While a SMART goal focuses mainly

on an objective, OKRs include an additional layer

of strategic planning for your business, which helps you become more tactical.

When developing your OKR, set a motivational objective that aligns with your business'

vision. Next, put two to three key results describing how you will accomplish your

objective. Like SMART goals, your key results should also be measurable and time-bound.

And since we’re talking about money, you can also set financial or income goals using the

SMART or OKR framework.

For example, your objective could be to break the record in profit for the next quarter.

Your key results or SMART goals could then be:

By setting the right goals, you become more intentional in your business and start seeing the desired results.

Reason #2: Not tracking your profit and cash flow

Another common reason why most business owners don’t make money is that they don’t know how

to manage it in the first place.

Knowing how to manage your finances is a must whether you like math or not. This means

measuring and tracking how much money flows in and out of your business and making sound

decisions.

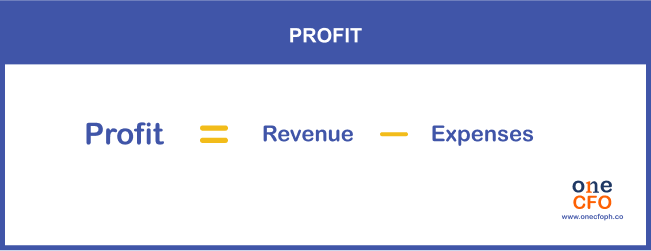

How to compute for profit

One thing you need to measure is your profit. You can compute it using this simple formula:

If you’re not earning any profit in the early stages of your business, don’t panic! Most

small businesses don’t make any profit in the first year since they still need time to

recover their capital, or they reinvest all the money they make.

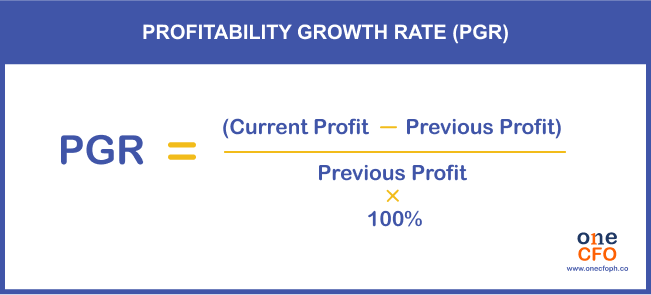

If you want to see how much your business is growing, you can measure your profitability

growth rate (PGR):

By measuring your PGR, you can see how much your company is progressing even when you’re not making profits yet. You can also measure growth using metrics such as revenue, sales, or customers.

Is monitoring cash flow important?

Cash flow is also as important as profit in a business. Your cash flow can be positive or

negative depending on whether or not you have enough money to cover your current expenses.

Knowing how to manage cash flow is essential to keep

your business running. Even though

you’re making a profit, negative cash flow can disrupt your operations, especially if you

cannot pay your suppliers, employees’ salaries, and bills.

An effective way to assess your profit and cash flow is to review your income and cash flow

statements. Need help creating these documents? It is recommended to hire professionals to

help ensure these documents are accurate for your business.

Reason #3: High cost of running a small business

You must look at the business expenses if you have profit and cash flow issues.

Having very high expenses does not only mean you get less profit after you subtract them

from your revenue. It also means you must price your products and services higher, which can

turn away customers.

Given your stage, list down all the things you spend

money on and assess if they’re

essential in your business.

You might already be investing in software subscriptions for big companies while still an

SME. Or you might not need that large office space if you only have five employees or can

still work from home.

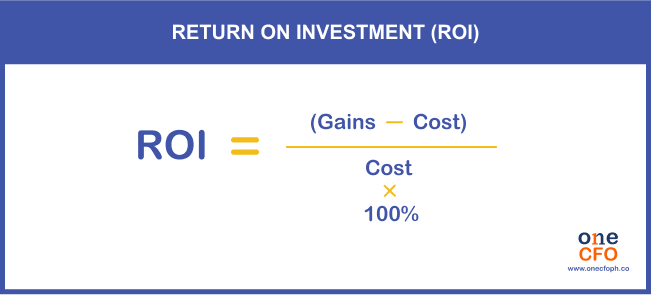

Remember, investing in your business is great if you’re smart about it. A way to do this is

to do a cost-benefit analysis or check your return on investment (ROI), which can be

computed as follows:

Checking your ROI will show you how valuable a particular investment is. From here, you can decide whether it is worth pushing through or if it’s something you can defer and buy later.

Reason #4: Lack of understanding of the market

Even the most exciting product or service won’t sell if there’s no market. Not having a

customer base to buy your products can be a big reason you’re not making money.

Before conceptualizing your offering, consider if you are solving a real and relevant

problem. If you are, look for the people with this problem - this is your market.

This can also work vice versa by looking for a specific group you want to serve and

identifying what problems they experience. From here, you can create a product that would

fit their needs.

If you’re in the business already and find that you have a large following and yet not

selling a lot, it might be a sign for you to pivot your products. Study your current

audience and change your product into something they need more.

Another factor you could look into is if your market is too small or too niche to make

enough sales. If this is the case, prioritize selling products or services requiring repeat

purchases. A subscription business model also

works the same way.

Other times, your business area generally pays less than others. For example, a consultancy

firm that caters to SMEs might pay less than those that serve big corporations.

Nevertheless, this doesn’t mean your business is doomed to make little money. You have to be

strategic when it comes to your pricing and also improve the way you gain clients. After

all, there are more small businesses out there than big corporations that you could tap

into.

Reason #5: Targeting wrong customers

If you already have a viable product and still struggling to find customers who can

patronize your business, you may be targeting the wrong customers.

The solution for this is to create your buyer persona, which is a virtual

representation of

what your ideal customer is like.

You can create your buyer persona by interviewing your current customers. Start by finding

out their demographic information and why they bought your product. You can also dive deep

into their motivations and needs to see how to bring them more value.

The data you gathered will show you patterns that describe your ideal customer. Once you

have a buyer persona, you can get your products to the right customers through proper

marketing.

Find out what channels you’re most likely to find your ideal customers and get granular with

your targeting for ads.

Reason #6: Poor pricing strategy

Lowering your prices or being the cheapest in the market is often the go-to-market strategy

of new business owners. After all, people don’t know them yet, so this might entice them to

become new customers.

While this strategy may work at the start, this won’t necessarily sustain your business for

a long time.

Instead of basing your price on your competition, you should consider all the costs of

running your business and the salary you want to make in pricing your offerings.

When we say all costs, we mean everything. Account for any manufacturing or production

costs, shipping costs, marketing expenses, packaging, and other direct costs related to your

offering.

Also, consider all operational expenses you have in the background, such as tool

subscriptions, website maintenance, utility bills, salaries, taxes, and all the unbilled

hours you incur when you manage your accounting, invoices, and the like.

Once you’ve accounted for all your expenses, you

can estimate how much revenue you should

make and base your pricing.

You might find it scary to raise your prices in fear of losing customers. But remember, as

long as you can justify your price with the value you deliver, do not undersell yourself.

If you lose people because you raised your prices, they are not your ideal customer. Learn

how to market your product at the price you want, and you’ll eventually find the right

people willing to pay you what you deserve.

Reason #7: What is your unique selling proposition?

Knowing your unique selling proposition (USP) or competitive advantage is crucial when running a business. Your business will be drowned out without a unique selling proposition, especially in an oversaturated market. If you haven’t figured out your USP, ask yourself the following questions:

Also, remember that your USP doesn’t have to be too complicated. Some examples could be a

unique way of caring for your customers, having the fastest shipping service to small

provinces, or promoting sustainable materials.

It may also be tempting to brand your business as the cheapest one in the market and use it

as your USP. However, this can harm your business if this is your only USP. Being the

cheapest would only attract customers who drop you as soon as a more affordable option pops

out.

Besides your price point, think about another advantage that would make your customers stay

with you even if other businesses offer lower prices than you do.

Once you have your USP, you should center all your marketing efforts around this. Catch the

attention of your target market and show them how you can bring them more value.

Reason #8: Doing many things at the same time

Starting a small business can be overwhelming - you need to think about strategies,

marketing your product, taking care of customers, or operating your store.

On top of that, you should also manage your back-office operations, such as bookkeeping,

payroll, taxes, and legal compliance.

All of these things are important and should be given attention. But if you spread yourself

too thin, you might lose focus, especially on tasks that would bring in revenue.

Doing everything independently limits your bandwidth or the time you can spend running your

business. For example, if you need two hours daily to take care of your books, that means

two hours lost in operating your store.

The bigger your business becomes, the more attention you need to give to revenue-generating

tasks. When this happens, we recommend outsourcing your back-office

operations so you can

focus more on making money.

How to push small business growth

Now that you’ve learned why your business is not making enough money, it’s time to

course-correct and steer your ship to the right path!

As the captain, you should focus more on planning strategically, continuously improving your

product, and growing your business.

Meanwhile, OneCFO will oversee your payroll, bookkeeping,

and taxes and serve as your CFO!

Being your partner, the OneCFO team stays on top of your business’ finance functions while

you work on making more money.

Subscribe to OneCFO

now, and

together, let’s achieve your business vision.

Read our disclaimer here.