August 28, 2023 | 3:48 pm

Table of Contents

Gross margin is a crucial indicator of a company's financial health, and knowing what

constitutes an excellent gross margin can significantly boost profitability and drive

greater success for SMEs.

You might think, "What's a good gross margin to aim for?" Truth is, there's no

one-size-fits-all answer. The best margin for your business depends on factors like

industry, location, company size, and business goals.

But once you have a target in mind, you can focus on increasing your profitability by

adjusting your pricing, reducing costs, and other strategic measures.

Read on to learn more about gross margin and how you can use it to grow your business

further.

What is gross margin?

Gross margin or gross profit margin is a key profitability metric that shows the portion or

percentage of revenue left after covering all direct costs of selling your product.

Direct costs, also called costs of goods sold (COGS), include all expenses directly tied to

making or acquiring the business's goods or services. Some examples of COGS are raw

materials, labor wages, and manufacturing overhead.

Monitoring gross margin helps entrepreneurs assess their pricing strategies, exercise

control over costs, and more deeply understand their product or service's profitability.

In addition, gross margin alerts entrepreneurs if they overspend on their raw materials,

labor, or other production costs, which could result in a low gross margin.

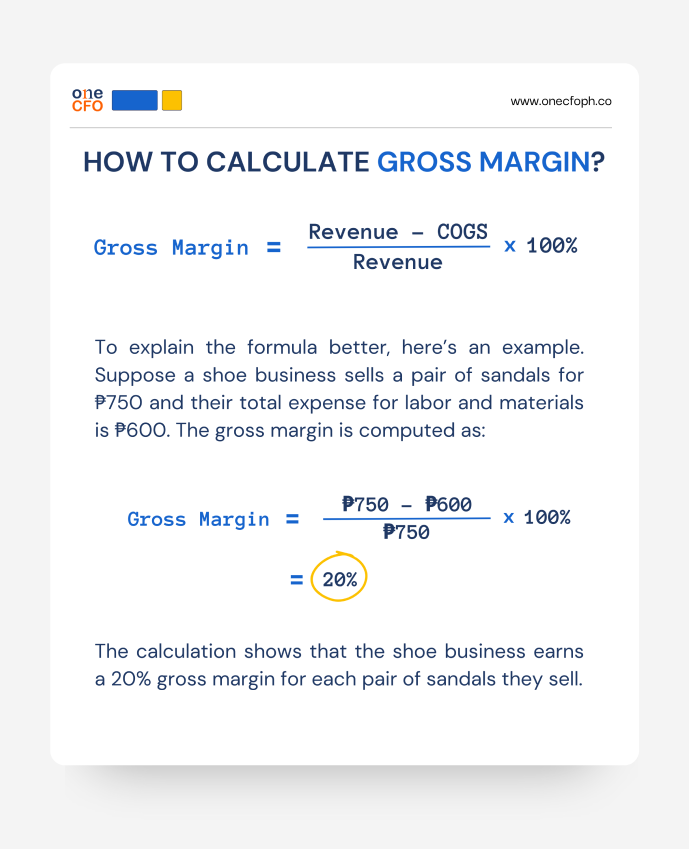

How do you calculate gross margin?

Gross margin is a simple metric to calculate, with the formula as follows:

All the data you need to calculate gross margin should be available from your income statement. It’s also worth noting that the initial portion of the formula, Revenue - COGS, represents the gross profit for that sale.

Are gross margin and gross profit the same thing?

Gross profit represents how much money you keep after subtracting COGS from your revenue or

sales. It represents the total profit a company has earned from its core operations.

On the other hand, gross margin considers the relationship between profit and revenue in

percentage form. Gross margin is often used to compare the profitability of different

companies or industries.

From the example above, we can see that subtracting COGS from the revenue, ₱750-₱600,

results in the gross profit, which is ₱150.

Gross margin reflects the percentage of ₱150 to ₱750, representing how much of the total

revenue is gross profit. In this case, the gross margin is 20%, as shown in the above

calculation.

The above example also shows that gross profit is the actual money you make, while the gross

margin is the percentage of your selling price that is profit.

Gross margin vs. Net margin: What’s the difference?

Gross margin is the most commonly used profitability metric, but small business owners

should also know about net margin. Instead of gross profit,

net margin uses net profit and

expresses it as a percentage of revenue.

When calculating net margin, you compute the net profit first by subtracting the following

expenses from the revenue:

The net profit is divided by the revenue to get the net margin. The complete formula for computing net margin is as follows:

Interpreting gross margin also differs from interpreting net margin. Since gross margin only

considers COGS as the expense, it mainly illustrates the profitability of the business's

core offerings.

On the other hand, net margin is used to assess the company's profitability as a whole. It

is a tool to evaluate a business's efficiency across operational and non-operational

aspects.

Why is tracking gross margin important?

Gross margin is more than just a number; it reveals the health of your core business

operations and provides invaluable insights for strategic decision-making.

You can cut costs, optimize pricing, and identify growth opportunities by tracking your

gross margin.

Here are the reasons why tracking gross margin is important for business success:

Better measure of operational efficiency

Gross margin reflects an SME’s operational efficiency, allowing owners to evaluate how much

of their revenue is converted to profit.

A high gross margin indicates effective management of production, inventory, and labor

costs. On the other hand, declining margins could mean issues with the supply chain or

inefficiencies in your process.

As an SME with limited resources, it’s crucial to proactively track your margins and ensure

its operations run smoothly.

Optimizes pricing strategy

One of the complex decisions business owners face is setting the right price for their

products. While it’s common to set prices solely based on market competition, it’s essential

to also consider gross margins in your pricing strategy.

You might feel compelled to keep lowering your prices to outperform competitors, but this

could be harming your business’s financial health.

Factoring in gross margin in your pricing ensures you can cover your production costs while

staying profitable. Regularly monitoring your margins lets you know of whether you need to

adjust prices based on market changes, price fluctuations, or shifts in customer demand.

Highlights growth opportunities

Gross margin indicates whether you’re ready to grow or invest more in your business.

If you plan to hire more people or open a new branch, it’s essential to evaluate your gross

margins to determine whether you can support such growth.

A low gross margin shows that most of your revenue goes to cover operating and

administrative costs, leaving you little money to scale your company.

On the other hand, a consistently high gross margin is a good sign for you to invest back in

the business and further boost your profitability.

What’s a good gross margin for SMEs?

Defining a good gross margin for small businesses can be tricky since many factors influence

this metric. For instance, a 10% gross margin might be fantastic for some businesses but

considered too low for others.

Here are some factors that determine a good gross margin for your specific business:

To determine the best margin for your business, connect with and learn from other entrepreneurs in your industry through networking in trade associations or conferences. Similarly, consulting SME experts and finance professionals can give you more insights into what gross margin to set.

How can gross margins be improved to boost profitability?

Improving your gross margin involves pricing your offering properly and reducing expenses

with every sale to boost profitability.

Here are some tips for SMEs:

Adjust your pricing strategy

A common strategy for pricing products or services is "cost-plus", which involves setting a

specific gross margin and adding it to your costs to determine the final price.

For example, if each product costs ₱10 to produce and you want a 50% margin, you would price

your product at ₱15.

Apart from cost-plus pricing, other factors to consider when setting a

price include your

market positioning, the economy's state, or competitors' presence.

When adjusting your pricing, be strategic and ensure the change is justified, especially

since increasing prices risks driving customers away.

Learn more about proper pricing by watching this video:

Reduce direct costs

Another effective method for increasing gross margins is to reduce business expenses or

direct costs. A simple way to do this is to review your current expenses and find ways to

eliminate or lower each.

For example, you can reassess your packaging and see if you can downsize your boxes, use

simpler designs, or switch any printed manuals to an online QR code.

You can also decrease expenses by negotiating with suppliers and agreeing on more favorable

terms. For example, you could ask for lower prices when bulk buying materials or request

discounts for early payments.

Ramp up your sales

Once you have addressed the other profitability issues concerning price and costs, you can

now improve profitability by increasing your sales. One way to ramp up your sales is to

leverage upselling and cross-selling in your strategy.

Upselling means encouraging customers to purchase a more expensive version of the product

they’re considering.

For example, laptop stores could train their salespeople to upsell high-end models whenever

someone is buying a basic one. Since customers often lean towards cheaper products,

salespeople can persuade them by highlighting the benefits of the higher-end version and

justifying the additional cost.

Educating customers on the superior features, better performance, and long-term value of the

pricier model can make the higher price more appealing and reasonable.

What is cross-selling?

On the other hand, cross-selling involves recommending complementary products that the

customer might find useful, thereby increasing their overall transaction value.

For example, if a customer buys a laptop, you might recommend a laptop sleeve, a wireless

mouse, or a keyboard.

Offering bundles at a discounted price can also be effective as long as you maintain good

profitability on all the items. This approach not only enhances the customer’s experience

but also boosts your sales.

Boost your bottom line through gross margin optimization

As the saying goes, “You can’t improve what you don’t measure.”

One effective way SMEs can boost their profitability is to regularly calculate, track, and

improve their gross margin. Achieving the right gross margin ensures you cover all costs and

have sufficient funds for growth.

If you're at a loss on what gross margin to target or how to increase it, don't worry—OneCFO

is here to help!

Our team of highly skilled finance experts is ready to help entrepreneurs like you elevate

their business. Working with OneCFO, world-class financial insights and advice are at your

fingertips, guiding you to set optimal profit margins and develop strategies to achieve

them.

Visit us at onecfoph.co or email us at [email protected] to

learn how we can help SMEs

manage and enhance their profitability.

Read our disclaimer here.