June 22, 2023 | 4:09 pm

Table of Contents

As a startup founder, the people you hire can make or break your company’s success, so

hiring great talent is crucial. One way to attract talent is to offer equity compensation,

giving employees an ownership stake in the company.

Not all startups have enough money or cash flow to offer wages as competitive as big

corporations. Instead of a higher salary, startups offer company shares or equity to an

employee as an additional benefit to attract sought-after candidates.

Equity compensation strategy is a win-win situation since the company could hire the talent

they want without spending a lot every month.

For the employees, they can get a partial stake in the business. The potential growth in the

value of the employees' shares can more than makeup for the wage growth over the years.

However, giving equity to your employees comes with caveats that you should consider as a

founder. This guide explains everything you need to know about equity compensation and how

you can start offering this to your future hires.

Startup Founder’s Guide to Equity Compensation

Providing equity compensation is an excellent solution if you’re looking for another way to attract great talent to your startup. Read on to learn what equity compensation is and how to set it up in your company.

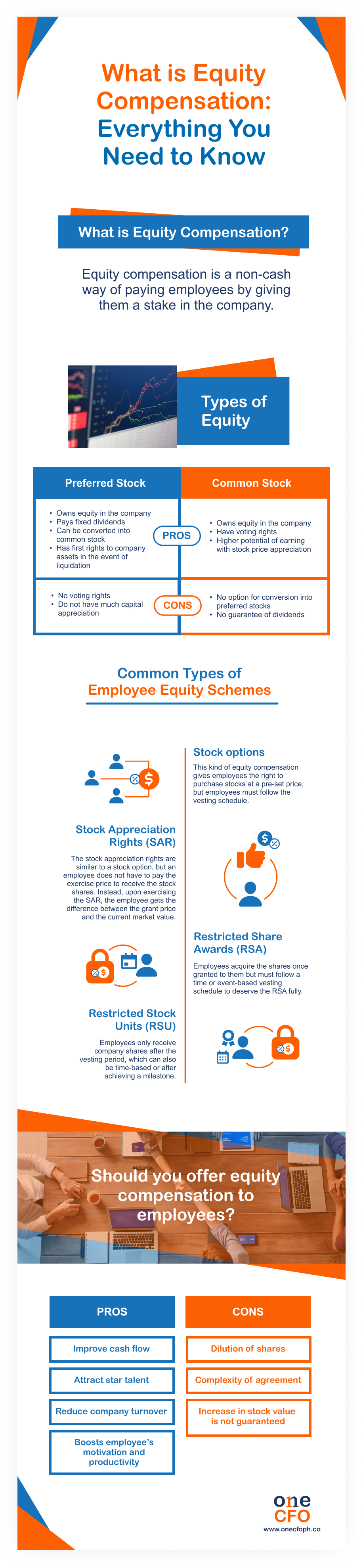

What is equity compensation?

Equity compensation is a non-cash compensation added to an employee’s offer package. Here,

the company gives the employees a portion of the company in the form of shares in exchange

for their service.

Startups typically use this strategy to hire star talents without hurting their cash flow.

Even though the employee might take a pay cut in salary, the equity they get has the

potential to go up in value, making the offer just as attractive.

Equity compensation offers partial company ownership, so employees are motivated and

incentivized to work better. Equity makes them feel a part of the company, and they benefit

directly from its success.

Granting equity compensation also reduces turnover because employees are generally required

to vest or work for a certain period before they can exercise their shares.

What are the types of equity?

Startups can issue two standard classes of stocks: preferred stock and common stock.

Preferred stock

Preferred stock is issued when

raising capital and is typically given to investors and

employees who are part of the company from day one.

This kind of stock is like bonds, as it pays fixed dividends, although the stocks do not

have much capital appreciation.

However, preferred stockholders have no or limited voting rights but can convert their

preferred shares to common stocks.

This kind of stock has superior rights over common stock. For instance, owners of preferred

stocks receive payment first when the company is sold or acquired and can claim the

company’s assets in the event of liquidation.

Common stock

Meanwhile, common stock is usually offered to

employees when the company is in its early or

late stage. Holders of common stocks have voting rights. However, they do not have the

option for conversion to preferred shares.

Those holding common stock have no guarantee of dividends but earn from the potential stock

price appreciation.

Employee equity schemes

The BIR RR No. 13-2022I also defined the most common types of equity-based compensation, which are the following:

Stock options

Offering stock options give employees the

right to purchase stocks at a pre-set price called

the strike price. But, employees must wait to buy the stocks after being hired. They need to

follow the vesting schedule.

Employees should also note that this kind of equity compensation does not require them to

purchase stocks but only gives them the option to do so. The employee, however, could lose

their right to buy if they exercise their option after the expiration date.

Stock appreciation rights

Another type of employee equity scheme is stock appreciation rights (SARs),

wherein

employees are given shares with a set price, vesting period, and expiration date.

This plan behaves like stock options, except employees do not have to pay for the stocks.

They instead receive the amount of the stock price appreciation from the set price. The

employee may receive shares, cash, or both depending on the equity grant agreement.

Restricted share awards (RSAs) are

automatically granted to employees, meaning they no

longer have to purchase stocks.

This type of equity compensation is “restricted” because startups still set limitations,

such as a vesting schedule before employees can sell or transfer their shares.

On the bright side, employees with RSAs immediately enjoy the benefits of being a

shareholder, including voting rights or dividend payouts.

Restricted stock units

Just like RSAs, restricted stock units (RSUs) also

promise the employee a portion of shares

at a future date without them needing to purchase it. The difference, however, is that RSUs

follow a vesting plan which usually includes meeting parameters such as a company milestone

or good job performance.

Employees need to exercise the RSUs before they can get their shares. Once received, the

employees also get voting and dividend rights.

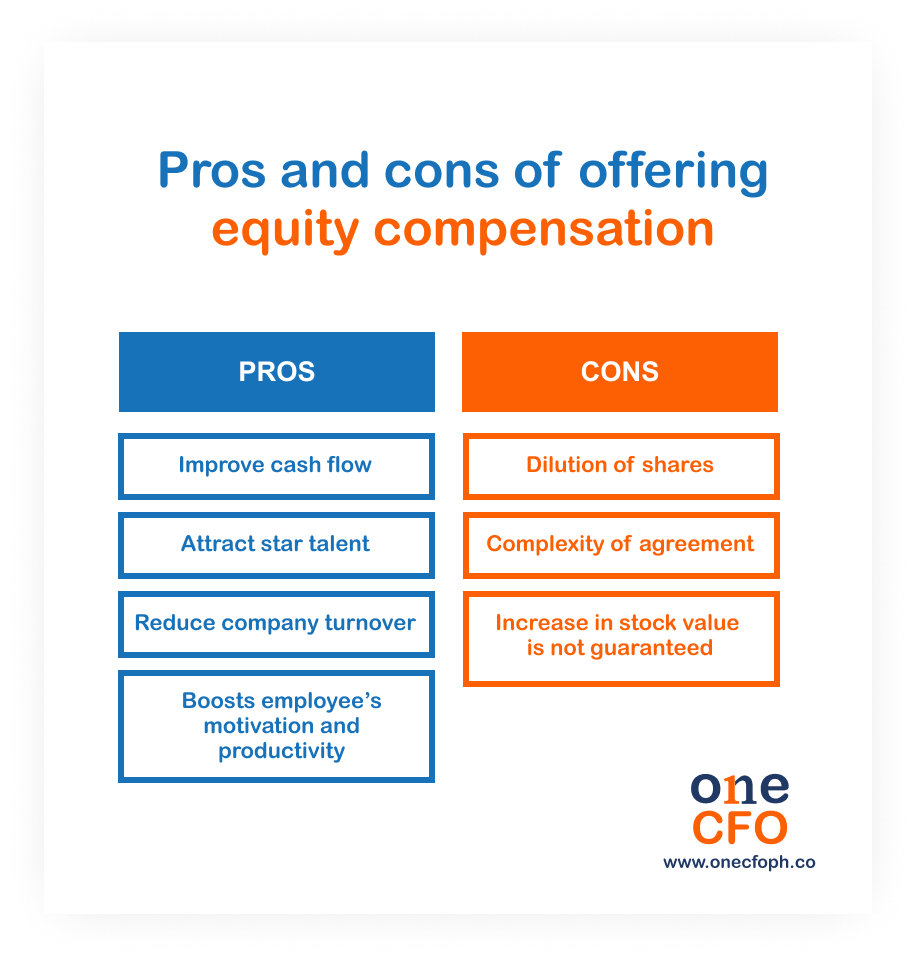

What are the pros and cons of offering equity compensation?

Just like all things, offering equity compensation has its pros and cons. Founders should evaluate these before offering equity as compensation.

Pros

Startups usually have tight cash flow in the first few years of the business, limiting the

salary they can give. Offering equity as additional compensation becomes an attractive

solution to this since the company won’t have to pay cash upfront when issuing shares.

Furthermore, equity ownership in the company encourages high-caliber talent to work for a

startup, even when they might take home a lower salary. Equity compensation helps startups

stay ahead as they compete with bigger companies.

Since employees still need to vest before getting their shares, this encourages them to stay

longer in the company. Reducing employee turnover in this way helps the startup become more

stable as they grow their company.

Aside from the lower turnover, employees are also motivated to work harder since their

efforts directly increase the value of their shares. Employees can feel the impact of their

work, pushing them to be more involved and deliver excellent results.

Cons

A disadvantage of providing employees equity is diluting the company's shares as it

decreases the percentage of shareholders' ownership.

If a startup keeps issuing new shares, more people share the ownership in the company. Once

the stock becomes too diluted, this becomes an issue for the founders and investors.

Issuing equity can also be challenging for the company and the employee, especially if it's

their first time encountering this. To avoid misunderstandings, startups should consult with

equity and cap table management experts.

Like other stocks, the value of a startup's share is also not guaranteed to increase over

time. An employee should evaluate a company's exit strategy to see if accepting

equity will

be worth the risk.

What to consider before offering equity compensation?

Before offering equity compensation to your employees, you should check a few things within your business.

Fair market value

Before you issue shares to your investors, advisors, or employees, you should know your

company valuation or equity worth.

Knowing your company valuation will help you set a fair market value (FMV) price, which

is needed when offering equity.

A commonly-used method in business valuation is the income approach, where you estimate the

value of the business based on its future income.

By knowing how much your current FMV is, you can now set a reasonable price for your shares

before issuing them. The results of this valuation are usually good for 12 months or until

you raise your next round.

Solid business plan

When offering equity compensation, it is also essential to have a solid business plan. This

business plan should show your company's trajectory, including how you plan to grow it and

your exit strategy.

The equity your employees will receive will only have value if you attract venture capital

and plan to go public or sell your company. Even if your business stays afloat, not having

any exit strategy can turn your employees’ equity into nothing.

Careful vetting of employees

Since your employees will become potential shareholders, it is crucial that you carefully

vet them as they undergo your hiring process. Not only will they help drive your company to

success, but they will also have access to confidential information in the business.

As shareholders, these people may also have voting rights and can decide the fate of your

business. Make sure that you conduct background checks for your hires before deciding to

offer them equity compensation.

Equity grant agreement

You should also create a comprehensive equity grant agreement upon issuing shares or stock options to your employees. Some of the things that your employees should know are the following:

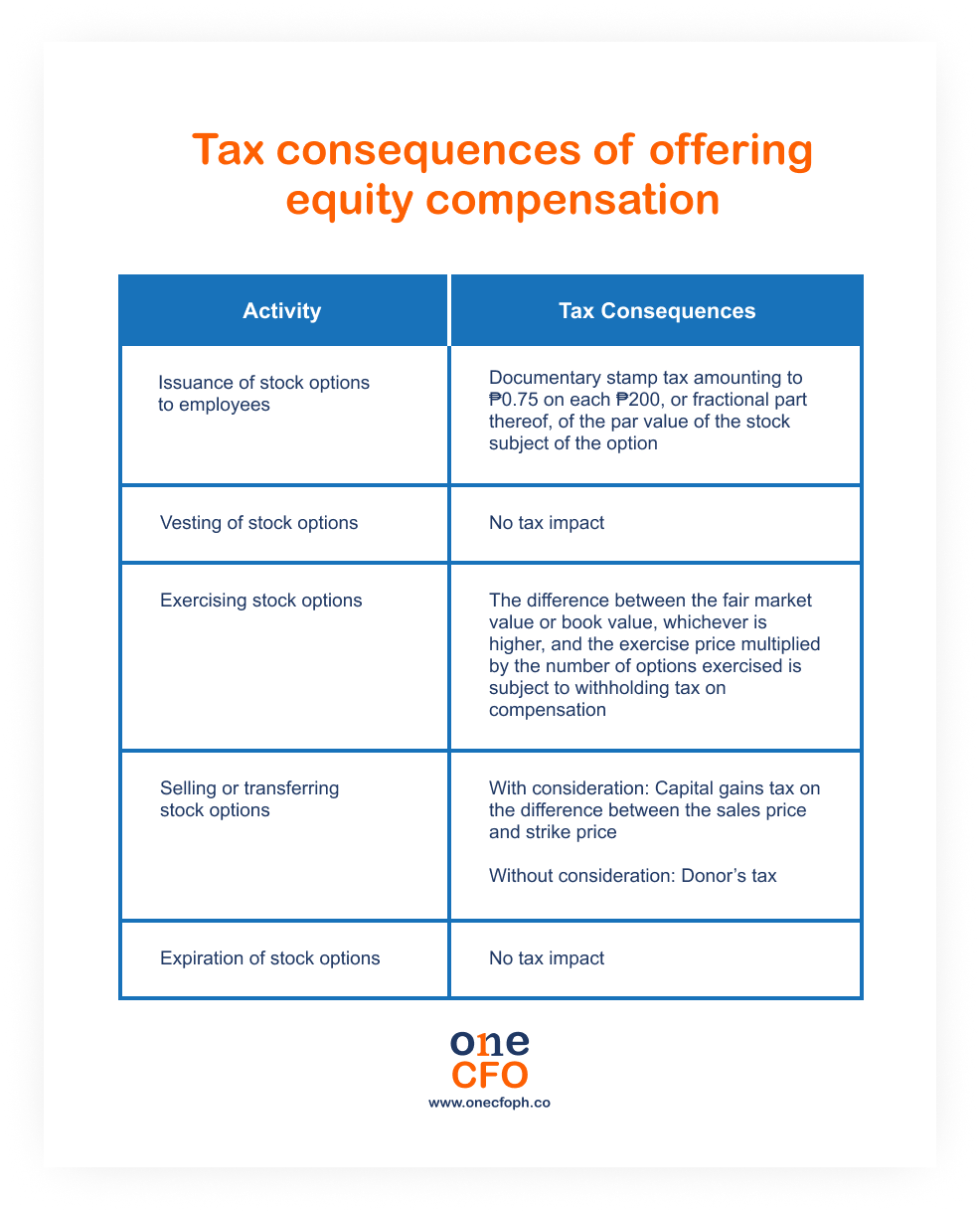

How is equity compensation taxed?

When offering equity compensation, it's essential to identify the potential tax consequences for you and your employee.

Source: BIR RMC No. 143-2022

Issuance of shares or ESOP to your employees is subject to documentary stamp tax, equal to

₱0.75 on each ₱200, or fraction thereof, of the stock's par value.

Employees will also need to shoulder the withholding tax on compensation (WTC)

upon

exercising their options. The payment is regardless of whether they are rank-and-file

employees or in managerial positions, per BIR RR No. 13-2022.

The amount subjected to WTC equals the difference between the FMV or book value, whichever

is higher, and the exercise price multiplied by the number of options exercised.

At the sale or transfer of the equity grant, employees pay the capital gains tax (CGT)

depending if it was made with consideration or not. The difference between the sales and the

strike prices is subject to CGT if the transfer was granted with a price.

On the other hand, transfers made without consideration will be treated as a donation and is

subject to donor's tax.

Employers must also submit BIR forms if exercising the options is done before or after the

implementation of RR No. 13-2022. Additionally, each time you issue equity, or a worker

exercises theirs, you must provide the BIR with a statement under oath.

If your startup is incorporated or headquartered in another country, you may also have

additional tax liabilities based on that country’s tax laws.

How to set up your employee stock ownership plan?

Are you ready to start offering equity to your new hires? Here are some steps you need to follow.

Consider your company's stage

The first step in setting up your employee stock ownership plan (ESOP) is to consider which

stage you will establish. You can set it up before your seed round or wait until the first

investors come in and ask you to create one.

Strategizing when to set up your ESOP is crucial because it dictates how much dilution you,

the investors, and the employees will have as you raise money or issue shares.

You must strike a good balance to keep your employees motivated despite the potential

dilution later on. Investors can also ask you to replenish or top-up your ESOP every

fundraising round for your hiring needs.

Using cap table management software to model different

fundraising and dilution scenarios is

highly recommended to plan for dilution properly. By tweaking your variables, you can see

the equity percentage you need to give up in exchange for the cash you will receive.

Plan your option pool

Before you design your equity compensation packages, you should decide how much of the

company shares to allocate for your ESOP.

Typically, early-stage companies set this to 6% to 10%, but there are rare occasions when it

can go as high as 20%.

Create your ESOP policy

Your ESOP policy will dictate which employees or roles in the company will be entitled to

ESOP. Most startups prioritize giving shares to higher or executive positions or early-stage

employees.

You should also note that the amount of shares to issue differs for all employees, which

generally depends on the importance of the role in the company. It can also be dependent on

the level of seniority of the employees.

As for percentages, they may also vary depending on the value the employee brings to the

business. A founder can opt to give 1% or higher to first hires.

Get your board’s approval

Setting up your ESOP will also need your board's approval, typically consisting of the

founders and investors at the early stages.

You will need a two-thirds vote of the outstanding capital stock in the Philippines to

approve your ESOP.

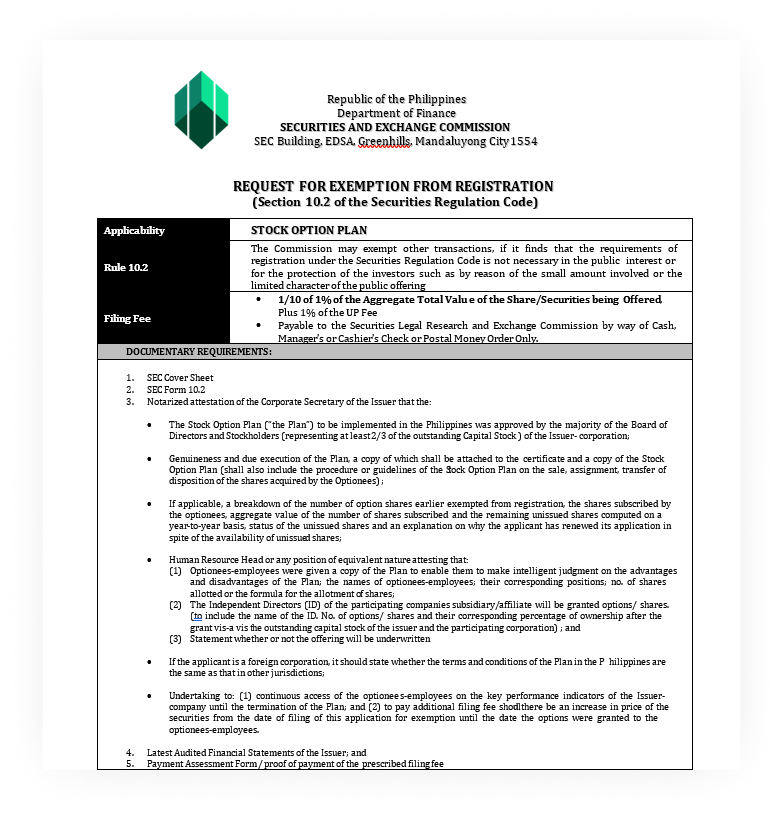

Comply with the SEC

Processing the necessary papers with the Securities Exchange Commission (SEC) is commonly

missed by startups.

Stocks are a type of security, and SEC requires registration of all securities. However,

since ESOP is considered of limited character and generally has a small amount, this is

exempted from registration by the Securities Regulation Code.

All you need to do is to file the SEC Form 10.2 to request for the exemption of the

registration of your ESOP.

Automate your ESOP administration

Setting up and managing ESOP takes a lot of work, especially if you deal with and send

grants to many employees.

Fortunately, you can leverage technology to make this process more cost-efficient. You can

now review and send contracts more efficiently. Your cap table will also be automatically

updated whenever you issue new shares.

Using software will notify your employees of important reminders and help them exercise

their options at the right time.

How to efficiently manage ESOP?

As a startup founder, offering equity compensation is a win for your business and your

employee. However, without the proper ESOP management, things can get complicated quickly.

So how can you make ESOP management more efficient and less costly? Through automation and

managed services!

Founders can automate all things equity using Carta - from cap table management,

ESOP

management, valuations, scenario modeling, and more.

And with its partner, OneCFO, you can ensure that your equity management and structure

changes are all Philippine law and tax-compliant!

Carta’s powerful software and OneCFO’s tech-enabled services and CFO expertise will provide

you with the support you need to set up your startup for success.

Contact OneCFO now

and learn how we can help

your startup.

Read our disclaimer here.